There’s no way to sugarcoat it: this year has been a sad one for wind turbine manufacturers. The renewable energy businesses of all three major Western players — Vestas (VWDRY -3.90%), Siemens Gessa (GCT 0.81%)And General Electric (G -1.47%) — They are going to lose money by 2022.

There is clear evidence that this is underway and investors should look for a gradual improvement in the sector’s fortunes in 2023.

Not the year you expected.

The guidance given by these three wind energy companies at the start of their relative fiscal years (Siemens Gesa’s fiscal year ended in late September) shows just how difficult a year it has been compared to their recent results and outlook.

Siemens Gamesa lost money in its 2022 financial year, and Vestas is on track to do the same – but both are forecast to turn a profit at the start of their financial year. Meanwhile, GE Renewable Energy is expected to lose $2 billion, instead of the $600 million loss it had at the midpoint of the start of the year.

|

Company |

Original full-year 2022 view |

Latest Outlook/Results |

|---|---|---|

|

Vestas |

€15 billion to €16.5 billion in revenue, adjusted EBT margin 0%-4% |

Estimated revenue EUR 14.5 billion to EUR 15.5 billion, adjusted EBIT margin negative 5% |

|

GE Renewable Energy |

Single digit low percentage revenue growth, $500 million to $700 million loss |

It suffered a loss of $2 billion. |

|

Siemens Gessa |

€9.5 billion to €10 billion in revenue, adjusted EBT margin 1%-4% |

Actual revenue was €9.8 billion, with an adjusted EBT margin of negative 5.9 percent. |

Data source: Company presentations. EBIT=earnings before interest and taxes.

What happened in 2022?

The industry was hit by a perfect storm this year. Rising raw material prices, rising transportation costs and supply chain disruptions and spare parts shortages have added pressure as all three continue to operate in a very favorable environment with orders booked years ago. Throw in rising interest rates and their negative impact on financing costs, and it’s no wonder conditions are so dire.

As a result, all three have announced layoffs, with GE Renewable Energy eliminating 20 percent of US offshore wind power. Siemens Gamesa has changed its management and operating model, and has a turnaround strategy in place. Meanwhile, Scott Strzyk, who was largely responsible for the turnaround at GE Power, is now accused of turning GE Renewable Energy around.

Rotation plans

The turnaround plans at arch-rivals Siemens Gamesa and GE Renewable Energy have much in common. Both are committed to cutting costs and competing in their core geographies, where they can generate profitable orders.

All of this points to improved pricing discipline. In short, wind farms have to get used to paying higher prices for wind turbines. GE, Siemens Gamesa and Vestas seek to “scramble” reserved orders at relatively low prices while waiting for new orders at higher prices.

The good news is that’s what’s happening. GE management has observed that order value has improved. The average selling price of Siemens Gamesa offshore order intake in 2022 was €820,000 per MWh and €650,000 per MWh in 2021.

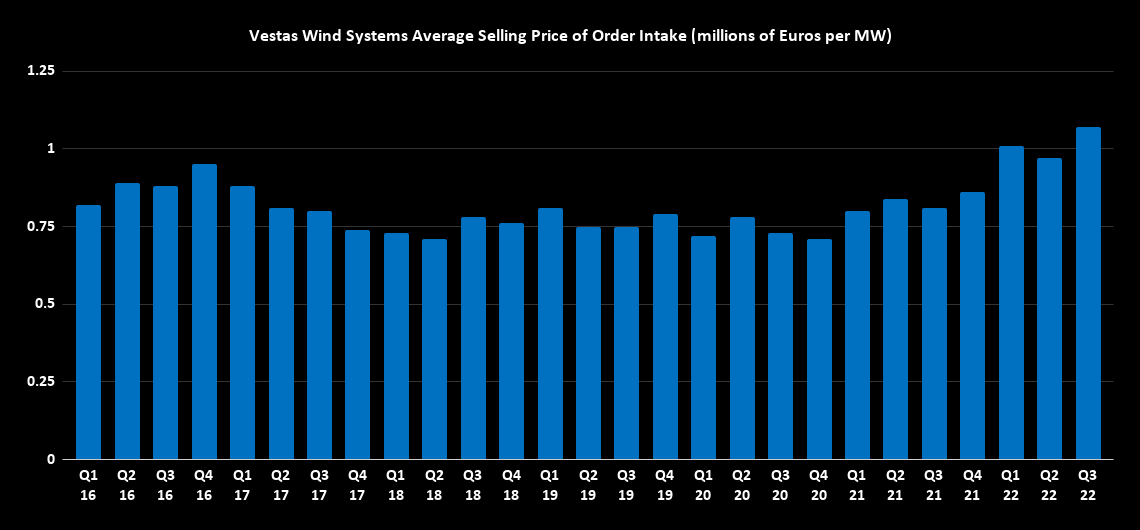

The data from industry leader Vestas also reflects the improvement in pricing across the industry. As you can see below, there has been a significant improvement in the cost of new orders at Vestas, which speaks well in the industry. All three companies are trying to improve prices, and the data from Vestas is a sign of potential improvement for GE Renewable Energy.

Data Source: Vestas Presentations.

Has GE turned the corner on renewable energy?

There is no quick fix for GE’s most troubled business. However, the improvement in prices in the industry and the optimism among buyers generated by the Depreciation Act — which extended tax credits for wind farms — suggest that the decline is firmly in place.

So, don’t be surprised if GE Renewable Energy goes down before the end of next year and all three of these companies come out better than 2023.

Lee Samaha has no position in the said shares. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.