It’s demo day season. This morning kicked off VC Firm 500 Global’s Fall 2022 Showcase Day, where more than a dozen startups pitched their best to prospective investors — and customers. Participants ran the gamut from fintech and sustainability to edtech and developer tools, and several stood out from the rest of the pack.

The event comes weeks after Y Combinator held its twice-yearly demo day, the first since returning jobs in person. 500 Global, formerly known as Under 500 Startups, has an accelerator comparable to YC. Both outfits support early-stage founders with advice in exchange for money and equity. YC has supported more than 3,500 founders, while 500 Global has supported more than 2,800 founders, according to their respective websites. Unlike YC, 500 Global has geographically-specific accelerator programs like TechStars, which focuses on locations such as Aichi, Japan, Cambodia and Alberta, Canada.

That said, today’s 500 Global debut dates back to 2010 and comes from its flagship program, which includes companies from around the world. All companies go through a four-month program but start at different times, with the Global 500 having somewhat of a new enrollment strategy. Let’s take a look at some of the team’s moonshots and finish with notes from Clayton Bryan, Partner and Head of the 500 Global Accelerator Fund.

Moon shots

For example, there’s Taiwan-based Rosetta.ai, an ecommerce startup whose AI allows customers to search for products — particularly apparel and cosmetics — using specific attributes. Rosetta’s AI algorithm detects which features (e.g. sleeveless, ripped, microbe) and triggers if the buyer appears to be abandoning the cart.

Image Credits: Rosetta.ai

It’s early days for Rosetta. But in the year Founded in 2016, the company has raised $2.4 million in capital to date, and Shu says it has clients including Uemura, in which L’Oreal holds a majority stake. The method will continue to win customers over rivals such as Lilly AI.

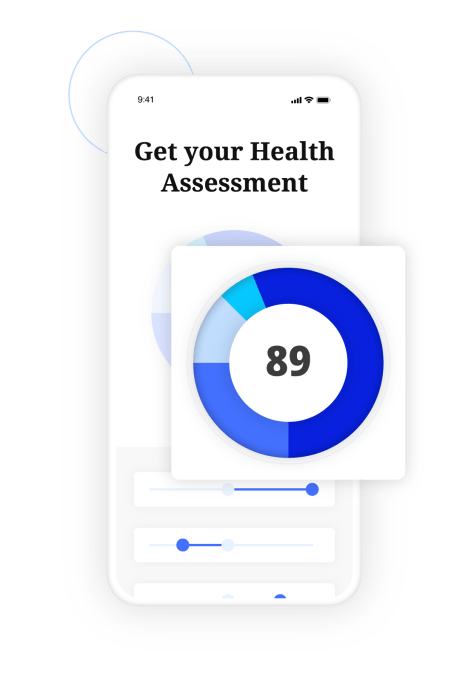

Elsewhere on the demo day, Lydia.ai passed on its health assessment service to insurance carriers. Designed to eliminate lengthy medical exams and forms, Lydia lets insurance plan applicants answer a few questions about their health — such as whether they have chronic illnesses, recent hospitalizations, and more — on their smartphones. The platform then generates an abstract health score without sensitive medical details that insurers use for risk management and underwriting.

Image Credits: Lydia

Lydia is not the first to try this. Health tech startup Fedo also generates algorithmic health scores, which indicate a person’s susceptibility to diseases and propensity to seek treatment. The lack of transparency in Lydia’s approach raises questions, such as whether the algorithms capture demographic disparities and historical biases in health care. But if the startup is true to its mission — guaranteeing the next billion people — it might be worth watching, especially with the capital behind it (~$13 million).

One of the most unique startups Demo Say has featured is Betastore, a provider of traditional “informal” retail outlets in Africa. Informal retailers are unlicensed and unregistered retailers who do not report to tax agencies, usually operating outside markets and shops. Betastore serves as a marketplace for non-formal retailers for products like dish soap, laundry detergent and all-purpose cleaners at wholesale prices and delivery to retailers (within 48 hours).

Image Credits: Beta Store

Beta Store customers can order products via chat, text message or WhatsApp. On the back end, the platform provides manufacturers with sales analytics, which BetaStore notes can be used to make “informed” decisions to increase shipments.

BetaStore seems to be off to a strong start. In the year Founded in 2020, the Nigeria-based startup claims to have distributed more than 140,000 items and fulfilled more than 20,000 orders to retail customers in Nigeria, Ivory Coast and Senegal. Betastore recently started offering financing to retailers and plans to start buying now, paying for the product in the coming months.

A year after the rebrand

Minutes after demo day ended, Brian spoke to TechCrunch about 500 Global and how it’s growing in an increasingly changing (and competitive) market.

“It was very sad, but the silver lining was in 2010. We have repeatedly told our companies that 2021 is an amazing year for venture capital fundraising. $290 billion in dry powder now. The accelerator’s top advice was to start fundraising early, prepare the company more before going to market, and be smart about managing costs. The advice these days is that beginners should prepare for at least 18 months of running.

It’s been almost a year since 500 Global rebranded as one of the 500 startups, a move Bryan said was intended to accelerate the organization and transform it into more of a venture firm. It is more than a definition; Previous group participants returned to 500 for continued funding, during Series A but not until Series D.

“Historically we have had no option, but now we are going for a multi-faceted strategy and working on a platform fund later,” he said. “We have interest with our founding community, we also have a demand within our partner community that they want to find more vulnerable companies.

“We are very proud of our speed,” he added. This is a key opportunity… but it has helped us open up other opportunities that we are now exploring with great interest as a firm interest.

If the 500 changes its investment prowess, size or focus — just as YC is set for failure — Brian says there’s more to come.

“We’re not immune to changes in our ecosystem, we know what other funds are doing and what other programs are doing,” he said. “Our program has been going strong for the last 10 years. But at the same time, we can’t rest on our hands, and we have to make sure we have binding terms of agreement.”