[ad_1]

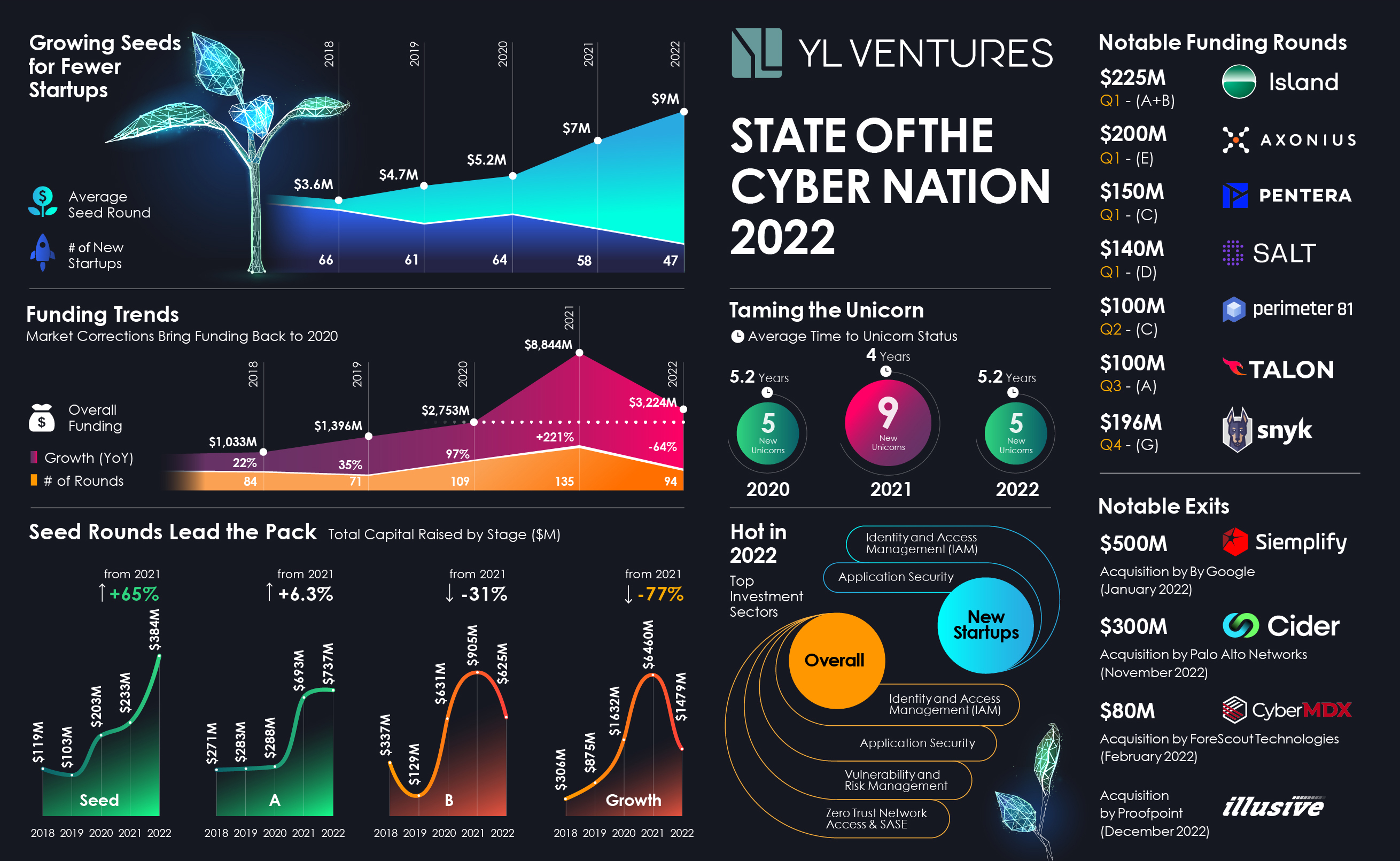

Huge reviews And the 2021 funding provided some optimism for the state of Israel’s cybersecurity industry in 2022, leading to a sense of security in Q1 of the new year. As other sectors rode the market tide for the year, capital continued to flow freely into cybersecurity, bolstering confidence in the technology’s enduring resilience, resilience against market volatility and imperviousness to shocks. failure.

After closing the book on 2022 this week, it’s safe to say that optimism was somewhat misplaced. In hindsight, 2021 could be classified as an oddity that sent the industry into a tailspin, with prices outpacing actual earnings and subsidies at an unhealthy pace that many have warned against. The results of this cycle are evident in the analysis of 2022 funding and M&A data for Israel’s cybersecurity ecosystem.

Image Credits: YL Ventures (Opens in a new window)

In the year Total funding for Israeli cybersecurity startups in 2022 dropped by a staggering 64%, from $8.84 billion in 2021 to $3.22 billion this year, and funding rounds dropped from 135 to 94 in 2021. (over 109 funding rounds), 2021 appears to be a blip on the radar, and the industry is picking up where it left off in 2020.

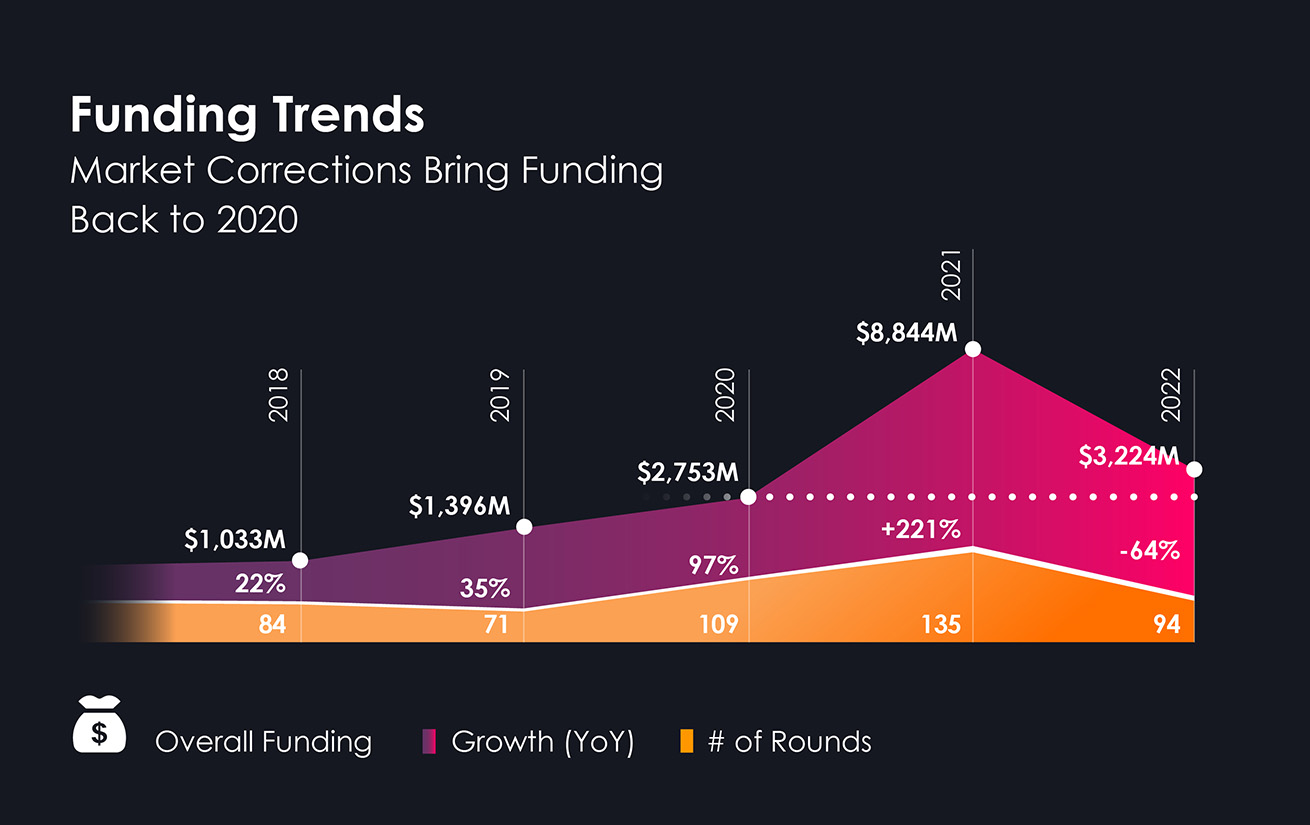

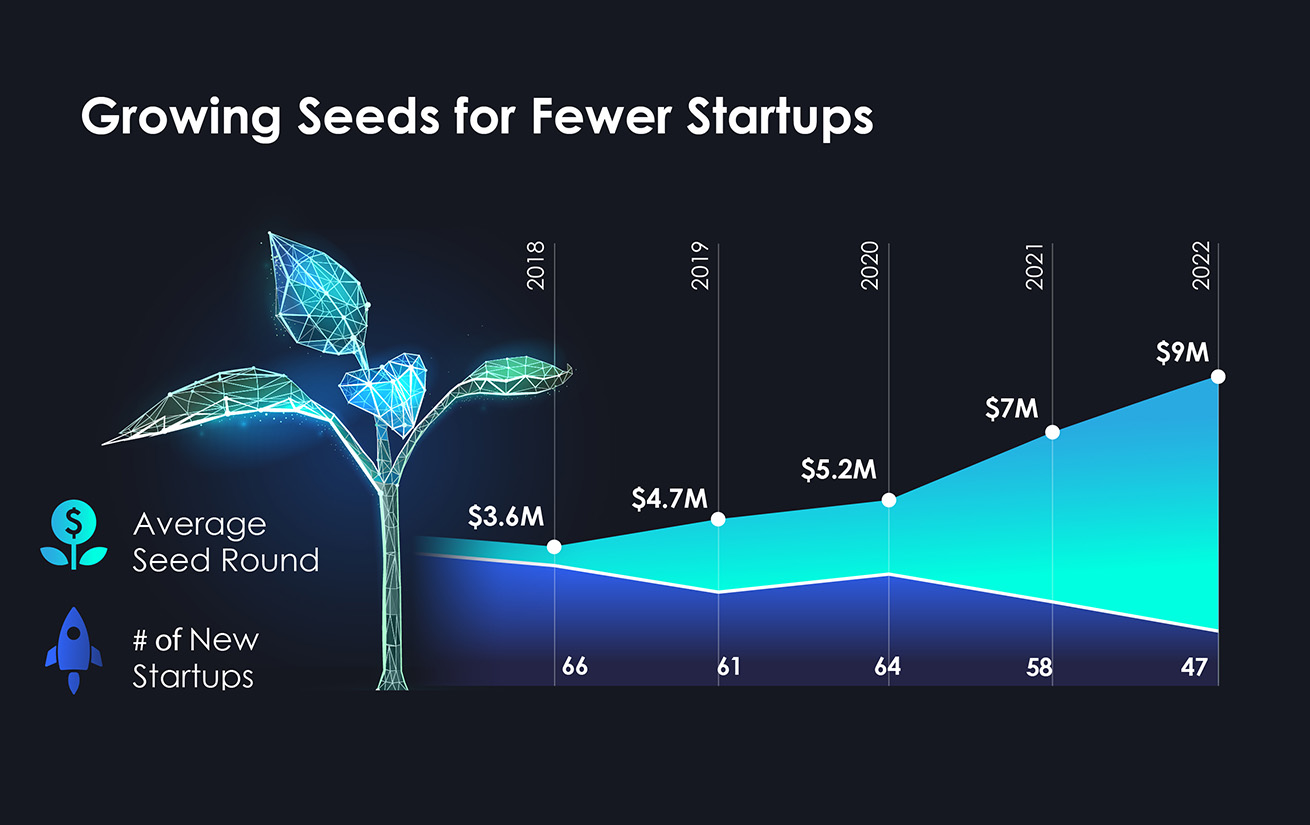

Much of the capital that has flowed into Israel’s cybersecurity industry has gone directly into early-stage startup seed.

The first step is to get the money

Our data indicates that most of it is capital. He did This year, the cybersecurity stream flowed directly into a very special place: the seed round of an early-stage cybersecurity startup. The average 2022 seed round broke the 2021 record ($7 million), reaching a whopping $9 million. Overall, seed funding grew 65 percent this year, from $233 million in 2021 to $384 million in 2022.

This impressive amount of capital committed to the early stages of the company’s construction demonstrates the continued confidence investors have in the cybersecurity industry’s ability to innovate and develop solutions to the ever-changing threats.

Image Credits: YL Ventures (Opens in a new window)

Additionally, it suggests that it will be difficult to raise Series A rounds this year, as investor round times are growing in light of the economic crisis. While Series A rounds have remained almost unchanged since 2021 (30 rounds last year and 24 rounds in 2022), investors have chosen to support startup rounds that have grown sustainably and cautiously since the introduction.

Image Credits: YL Ventures (Opens in a new window)

“Since the cost of building a company has not decreased, investors will see that seed financing has a clear starting point,” said Iren Reznikov, Director of Corporate Development and Ventures at Sentinel One. “They know that building a company from the ground up and making sure it gets to the Series A round at a very mature stage costs money while hitting all the criteria. At the same time, investors expect their founding teams to set clear goals for getting to Series A, and they strive to get the product to market early by engaging with their customers quickly.”

This confidence is shared by cybersecurity founders, who believe that despite this year’s market volatility, it is still possible to build something meaningful for enterprise protection and business continuity. “Early-stage startups are very ready to respond to the dynamic demand created by lack of budget,” says Slavik Markovic, co-founder and CEO of Deskop, which builds a service in the authentication space for app developers.

“A tight economy is often accompanied by fraud and cyber attacks. With user adoption and conversion becoming more critical in this market, businesses are looking for solutions that reduce friction for their end customers to prevent any fake sources. The founding teams of early-stage companies focused on solving these problems will continue to attract investor interest.

The return of the cyber veterans

[ad_2]

Source link