MF3d

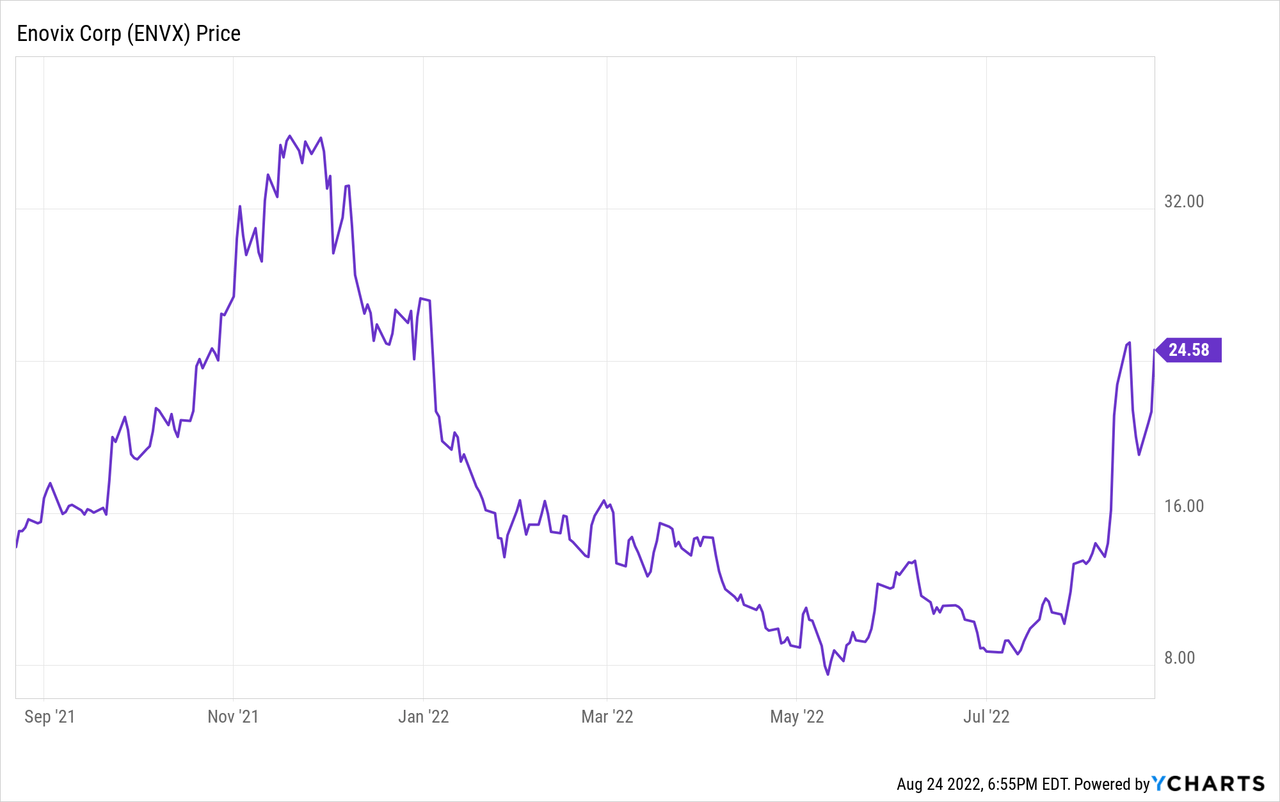

Inovix (NASDAQ:ENVX) positively spooked the bulls by upending the bearish stock market trend of the past few weeks. The Fremont-based company surged 240% from an all-time low following the publication of its fiscal 2022 second quarter. Results and a positive research note from Loop Capital. The note made him extremely clever. $100 price targetIt means more space to share.

Behind the renewed bullishness is the company’s new generation of advanced silicon-anode lithium-ion batteries. Enovix has developed a proprietary 3D cell architecture that is more energy efficient than current battery technologies and addresses several issues, including battery swelling. While the battery has been under development for several OEMs and Innovix shareholders such as Intel ( INTC ) and QUALCOMM ( QCOM ) for years, the company has only just begun to recognize revenues from its Fab-1 facility.

Common shares are currently trading at $24.61. Realized revenues are growing exponentially when sales begin. Inovix has announced that it is working with the US military to develop wearable battery cells for soldiers. It is also working with Apple ( AAPL ) on technology capabilities. So its batteries could appear in select Apple products as early as 2024. As the company is the parent of Facebook, it can be seen building the next generation of AR glasses and VR headsets on the META platform. Also testing Inovix batteries.

When stocks heat up, earnings start coming in

The company reported second quarter fiscal 2022 revenue of $5.1 million, topping the consensus estimate of $4.78 million. For some context, Enovix has guided for full-year revenue of $11 million in 2022, when it goes public in 2021 via a blank check firm. That said, most revenue comes from a customer’s service revenue after achieving certain milestones. Battery cells have made a significant contribution since they started shipping.

Adjusted EBITDA was negative at $18 million, compared to $11.7 million in the prior quarter, with negative free cash flow at $24.6 million. However, this equates to $385 million in cash and cash equivalents at the end of the quarter. This provides sufficient runway to reach management’s expected cash flow by 2025. It also allows the company to fully realize its revenue stream, which reached $1.5 billion in the quarter. Overall, Inovix sees a cash burn of no less than $160 million in fiscal 2022, half of which is for capital expenditures.

The company expects revenue to be $6 million to $8 million for fiscal 2022 due to a recent focus on streamlining operations at Fab-1. Guiding Enovix to revenue of $176 million in fiscal 2023 and $410 million in fiscal 2024, the company is seeing significant growth over the next few quarters as it ramps up production from its Fab-1 facility. Enovix expects to enter the EV space starting in 2025 when it completes its Fab-3 facility that year.

More than a year after becoming a public company and fifteen years since its founding, Inovix is at the stage of fully realizing the opportunities created by bringing advanced battery technology to the electronics and EV markets. Loop Capital’s $80 billion market cap target by the end of the decade has eased sentiment of a crash and kept the stock fresh even as the broader market weakened. As the macro backdrop is still characterized by considerable uncertainty, I would advise caution about buying at these levels. Higher-than-expected interest rate hikes, an official recession and a further yield curve shift are distinct possibilities ahead, and now it seems headed for a major energy crisis and inflation.

Making the batteries of the future

Enovix is developing batteries that have 27% to 110% higher energy density and are dramatically less likely to burn out than standard market technologies. The company has a client pipeline that includes several blue-chip tech companies and stands to realize revenue from electronics ranging from laptops to smartwatches to VR headsets.

While the current run could pull back when sentiment is cautious, the overall long-term direction looks bright. The $1.5 billion in revenue is a strong indication of the company’s ability to build a future that will impact the growth of multiple industries. But I only recommend the stock as a buy on a partial recovery from current levels.