[ad_1]

Welcome to Startups Weekly, this week’s spotlight on startup news and trends by Senior Reporter and co-host of Equity Natasha Maskerenhas To receive this in your inbox, subscribe over here.

In the year By the end of 2022, some entrepreneurs, some citing Elon Musk, told me they were bringing in-person work cultures to boost productivity and, in some cases, help loyalty in the coming year. One founder told me that they weren’t worried about losing talent over drinks and fancy snacks — because the in-person people weren’t really mission-driven when they started.

Some founders are clearly set on a return, while others are confused. There’s the argument—sometimes from venture capitalists who want to see their portfolio companies succeed—that a physical presence boosts productivity and ultimately helps the bottom line. And there’s also the counter-argument that telecommuting allows for more inclusive and broad employment, which may help, well, the mainstream.

And if 2023 isn’t the year of the finish line, I don’t know what else will be. Cruise Consulting, an accounting firm for startups, mines the financials of more than 750 companies, including more than $300 million in quarterly revenue and more than $750 million in quarterly expenses. I spoke to Haley Jones, who heads financial planning and analysis for Cruz Consulting, about the findings — and who thinks the results will add some weight to the debate.

To read more about the findings, read my TC+ column “Data Hints About the Value of Startup Offices.” In the rest of this newsletter, we’ll talk about disruptive organizations, Salesforce spinouts, and Artifact. As always, you can follow me Twitter Or Instagram.

The wrinkles

On paper, it looks like venture funding is back. The rush of new funds feels to me and, more importantly, to founder VCs getting back to work and ready to write more and more checks. But one could argue that new VC fund announcement days, like the phrase “oversubscribed,” mean little in practice.

Here’s why this is important: There are a number of reasons why not all dry powder is as absorbent as we think. While new fund announcements are certainly exciting, the fund may already be partially invested and investors need to make capital calls before writing those checks. The focus is less on new money coming into the venture space and more on why this VC firm is announcing their funding now, sooner rather than later. What is the argument that shows that you are now playing abuse? I think it’s more complicated than “business as usual”.

Image Credits: Getty Images/dane_mark/DigitalVision

Salesforce, Sales Fund

Firsthand Alliance, led by solo investor Simon Chan, is a venture firm looking to leverage Salesforce. Here’s how: The company, which closed a $25 million initial investment round, received investments from 21 Salesforce-acquired founders, and Chan himself built a company that he says is Einstein’s foundation for AI initiatives across Salesforce’s businesses.

With the support of alumni and mentors, the organization hopes to help early-stage enterprise startups find additional support and, of course, new capital.

Here’s why it’s important: Mafia funds can be exclusive, both LPs are invited to the table and which companies receive funding. In a statement to TechCrunch, he said the company’s investment scope “extends the Salesforce app ecosystem” and founders don’t need to be Salesforce alumni to be considered. Now, 35% of Firsthand Alliance’s portfolio is founded or co-founded by women, and 50% of its portfolio is co-founded or co-founded by people of color.

Amazing. And, well, they’re having a great time considering the stresses of being laid off and motherhood as we speak. Maybe it’s time to take advantage of the changes on the old stomping grounds?

Image Credits: Bryce Durbin / TechCrunch

follow up

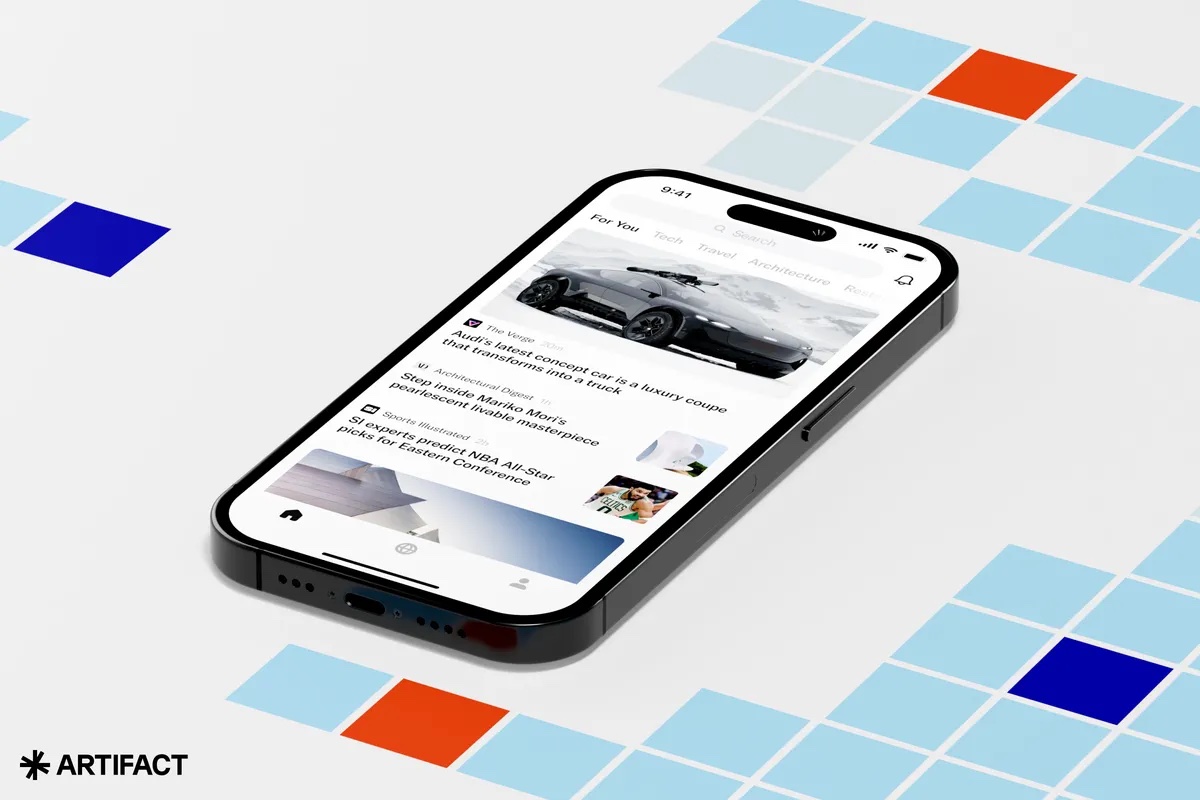

Nothing like a good comeback story to follow, am I right? The founders of Instagram are back with a new social app, looking to make news consumption easier and smarter. The startup, Artifact, is accepting people on its waiting list as we speak.

Here’s why it’s important: Artifact is looking at a controversial business because it has to do with news consumption, surveillance, algorithms and innocent, gullible consumers. If you’re raising your eyebrows at all the issues that can arise from this company, you’re not alone. About the news and why we hope for justice.

Image Credits: Artifact screenshot via Verge (Opens in a new window)

etc. etc.

Featured on TechCrunch.

Car-sharing SPAC Getaround lays off 10% of employees

Car-sharing platform Getaround gets cancellation notice from NYSE

There are still robotics jobs out there (if you know where to look).

Apple stock occasionally declines in earnings

The Coinbase Asset Recovery Tool just saved my bacon.

Featured on TechCrunch+.

Pitch Deck Teardown: Laoshi’s $570K Angel Deck

Dear Sophie: What H-1B and other immigration changes can we expect this year?

Which open source startups rock in 2022?

What do recent changes to state taxes mean for US SaaS startups?

Why invest in Ukrainian startups today?

It was one of those weeks filled with inspiring conversations with experienced and fresh entrepreneurs that reminded me of what the big world of tech is all about. Even with the obstacles facing technologies from every direction, it’s refreshing to see how the promise of an idea can push beyond reality.

With this heartfelt note, always,

N

[ad_2]

Source link