[ad_1]

andresr/E+ via Getty Images

Will 2023 be the year Hong Kong stocks shine?

It has certainly not been an easy time in China and Hong Kong over the past few years.

There seems to be a problem The next one.

However, every dog has its own day. We revisit BlackRock’s iShares MSCI Hong Kong ETF ().NYSEARCA: EWH) to see if next year will be a better year.

The share price has followed the general market decline this year but we have seen further improvement in early November this year.

EWH vs. SPY as of December 22, 2022 (SA)

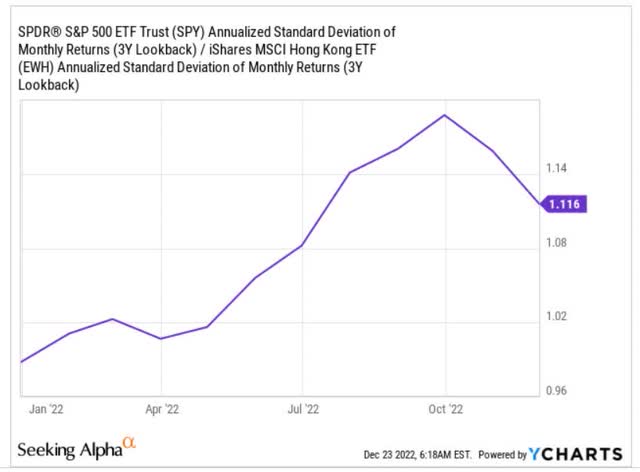

The 3-year equity beta is 0.52 and the standard deviation over that period was 24.1%. Standard deviation measures how scattered returns are around the mean. A higher standard deviation indicates that returns are spread over a larger range of values and are thus more volatile. For comparison, SPY has a slightly lower standard deviation of 20.8%.

EWH and SPY difference in standard deviation (YCharts)

The 12-month yield as of November 30 was 2.95%.

Let’s take a look at the top 10 companies on the list and check if there have been any changes to it over the past year.

EWH’s Top 10 Holdings (BlackRock)

Comparing this top ten list to last year’s top ten in October, there are some changes. Sun Hung Kai Properties (OTCPK:SUHJF) moved from 5th to 3rd.

Tektronic, which was 3rd, took over 5th place. Another company to make the list is CK Hutchison ( OTCPK:CKHUY ), which was ranked 7th last year. These increases and decreases are very similar to the assessment of the future business prospects of these 3 companies.

Two companies that were in the top 10 but didn’t make the list are HK China Gas and China Light & Power. Both are in a difficult business environment with rising energy prices and restrictions on how much of this they can pass on to their customers. HK China Gas has forecast a 16% drop in profits in 2021 and a further 21% drop in FY2022.

The story at CLP is even worse. In the year Revenue in 2021 is down 26 percent and losses in Australia are expected to hit a record loss of HKD 4.8 billion in 2022.

Back to the top 10 came Galaxy Entertainment (OTCPK: GXYEF) are in the gaming industry in Macau and BOC Hong Kong, which is the Hong Kong Commercial Bank of China.

Update on the Hong Kong economy

This year was the year inflation finally reared its ugly head.

Many investors and some economists knew it was coming, despite Mr. Powell’s long attempts to convince the world that it was all a temporary phenomenon. In my opinion, the Federal Reserve always gets things wrong.

When they finally start to act, we have to understand that the currency is tied to the strong US dollar, so it has a big impact on Hong Kong. And it became great.

The US dollar index rose as much as 18% in November this year but has since fallen to 8.5%.

This index is a basket of six currencies against the US dollar. They are Euro, GBP, Yen, Canadian Dollar, Swedish Krona and Swiss Franc.

US Dollar Index 1 Year Chart (TradingView)

Hong Kong imports most of its consumer goods. A strong dollar has helped a lot in curbing inflation.

According to the Hong Kong government, as of November 11, 2022, the core CPI for 2022 has been revised to 1.8%.

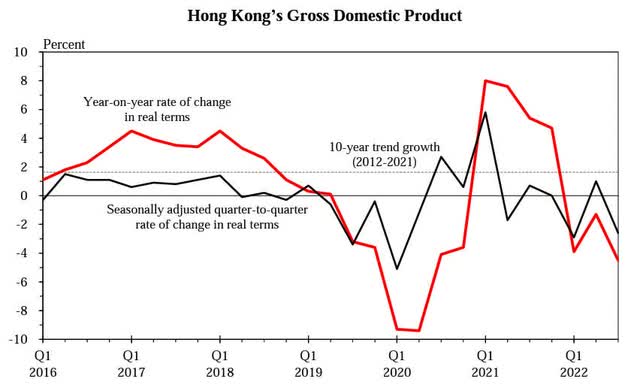

This is revised down to -3.2% for real GDP growth in 2022, taking into account the positive results in the first 3 quarters of the year and the weakened short-term outlook.

Hong Kong GDP updated 11 November 2022 (Hong Kong Government)

The relationship between Hong Kong and the Greater Bay Area

As of Dec. 21, the number of overseas visitors to Hong Kong has increased by 25 percent since travel restrictions were eased a week ago.

But tourism experts warn the sector still has a long road to recovery.

Figures released by the Immigration Department on Wednesday showed 20,400 overseas visitors arrived between December 14 and 20, the first full week since travel restrictions were eased. This number does not include the all-important migrants traveling to and from mainland China.

To put things in context, Hong Kong attracted 65.1 million visitors an average of 1.2 million per week in 2018.

80% of these were people from the mainland.

That is why it is so important that the land border between China and Hong Kong resume the free movement of people.

People arriving in Hong Kong still need to take a PCR test on arrival and another PCR on the third day of arrival. The good news is that there are no quarantine requirements. People can freely go to restaurants and bars.

Hong Kong’s chief executive John Lee Ka-chiu gave the Christmas present he had been asking for by announcing on Christmas Eve that the long-awaited re-opening of the border with the mainland could be achieved. The green light from Beijing.

This will be a positive boost to the economy.

Summary

We believe that Beijing has finally realized that if they continue to lock people down, the negative impact they will have on the economy and society as a whole is huge. Eventually, they seem to realize that even China will have to learn to live with Covid-19. Same goes for Hong Kong.

This will help start the economy in 2023. In the middle of the year, it helps both consumers and businesses.

The next risk for the thesis is the international feel of doing business and living in Hong Kong.

Some international companies, talent and funds themselves have flocked to Singapore.

Whether Hong Kong can reverse this trend remains to be seen. There is room for both Singapore and Hong Kong to thrive together. Hong Kong’s physical location and the fact that it is an integral part of China should be important.

EWH is still a good proxy for the Hong Kong stock market.

Editor’s Note: This article discusses one or more securities that are not traded on a major US exchange. Please be aware of the risks associated with these stocks.

[ad_2]

Source link