Will Ross and William Steenbergen, AI researchers who worked on climate and atmospheric modeling and simulation at Stanford, began collaborating on wildfire modeling and hurricane modeling initiatives for the insurance industry, respectively. Ross says they were surprised to learn how much of a gap the data is between what insurers are being told to do and what carriers are actually doing. After studying the problem, Steenbergen and Ross launched Federaton to provide a data visualization for selecting insurers and pricing risks.

Now Federato is raising new capital to grow the business. Emergence Capital led a $15 million Series A round in the company, which recently closed with participation from investors including Caffeine Capital and Pear. A portion of the cash will go toward expanding headcount, Ross told TechCrunch in an email, from Federato’s current 23 employees to 50 by the end of the year.

The way Ross sees it, the insurance industry faces three major challenges today: the rise of climate-related natural disasters; “uncertainty” in insurance risks, including government-sponsored cyber attacks and ransomware; and in an environment where premium inflation is the subject of lawsuits against insurers. With “warfare exclusion” clauses common in cyber policies and recent rulings related to the opioid crisis, commercial trucking and asbestos hazards have raised questions about corporations, they have pointed to Russia’s support for cyberattacks on U.S. businesses. It should be allowed to transfer risks.

“Many insurers come to Federato looking for a tool to help create operational efficiencies, something that’s part of a unified platform workflow is great,” said Ross. “The reality is that they complete the purchase because they understand the value of a hands-on approach to portfolio management that provides invaluable insights into managing portfolio risk, balancing and growing their book of business.”

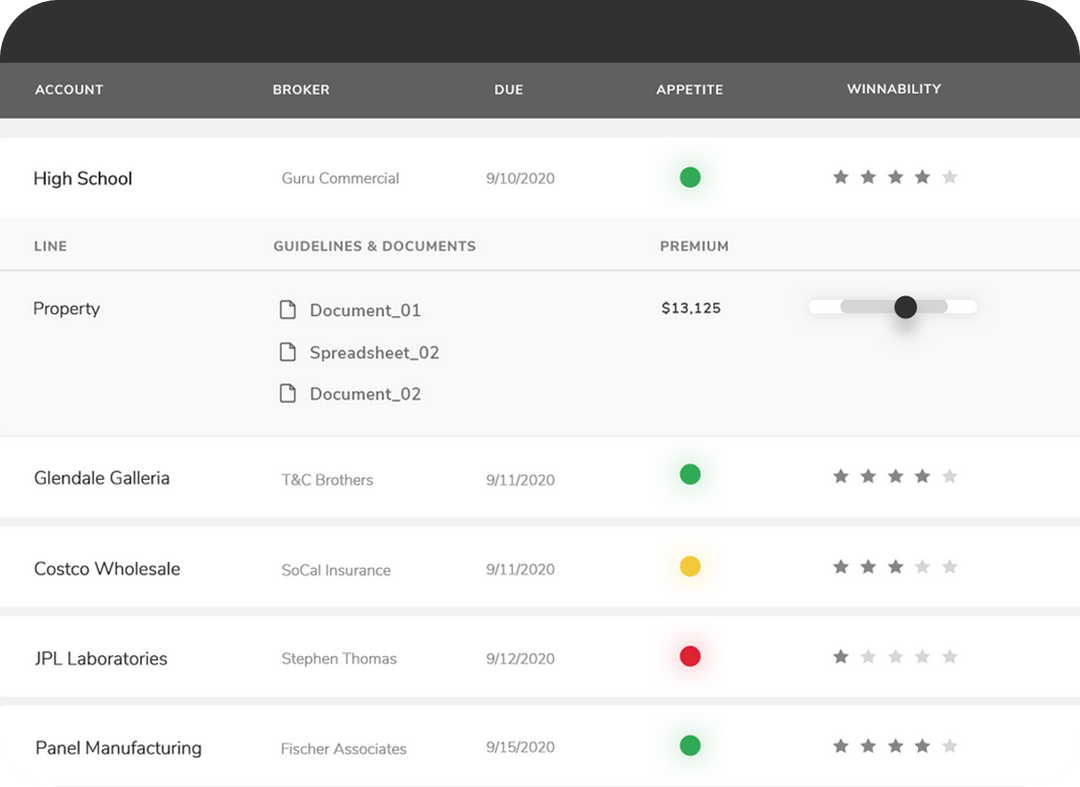

Using the platform, customers – primarily insurers – can visually track risk and manage policy portfolios, using workflows such as risk data hunting and targeted workflows to generate risk data and underwriting guidance.

Image Credits: Federal

Federato says it uses machine learning to create a common framework for portfolio management to ensure it adapts to each firm’s constraints. The platform uses a “mathematical representation” of systematic patterns to identify trends, Ross says, then fine-tune as needed.

“[T]The beauty of Federato’s approach is that all customer contracts are clear that it does not share or collect proprietary customer information,” explained Ross. “[Any] Meta-learning that occurs based on very high-level usage data still allows for some level of development, but customers know that their customer data and loss experiences aren’t being shared.

Ross positioned Federato as an alternative to in-house service providers like Accenture and EY, as well as legacy providers like FirstBest and Pegasystems. The startup declined to say how many clients it currently has, but identified names including Insuret, QBE North America and Propeller Bonds.

Ross said the Fed could break even on cash flow in the second half of this year.

“The property and casualty insurance industry is in a unique situation because inflation and high interest rates have actually increased property and casualty reserves over the past six months, while other industries are suffering,” Ross said. “That dynamic, coupled with a heightened focus on talent (the Great Recession) and digital tools and workflows (on remote work) accelerated Federato’s growth…processes — and still does.”