You know what it is Where great pain =sum()Does it not shine? Financial reporting, planning and analysis. I often go on (And on and on) because startups don’t really get their financials and operational plans in their startup pitches, so… I’m not going to lie, I chose Austrian startup Helu.io, which closed 9.8 million euros in July, thinking it’s just one company to focus on. On FP&A (that’s “financial planning and analysis,” for those uninitiated in financial lingo) he shows the rest of us how it should be done.

We’re looking for more unique pitches to break down, so if you’d like to submit your own, here’s how to do that.

Slides on this floor

Helu noted that revenue and unit economic data were removed when the ship was imported.

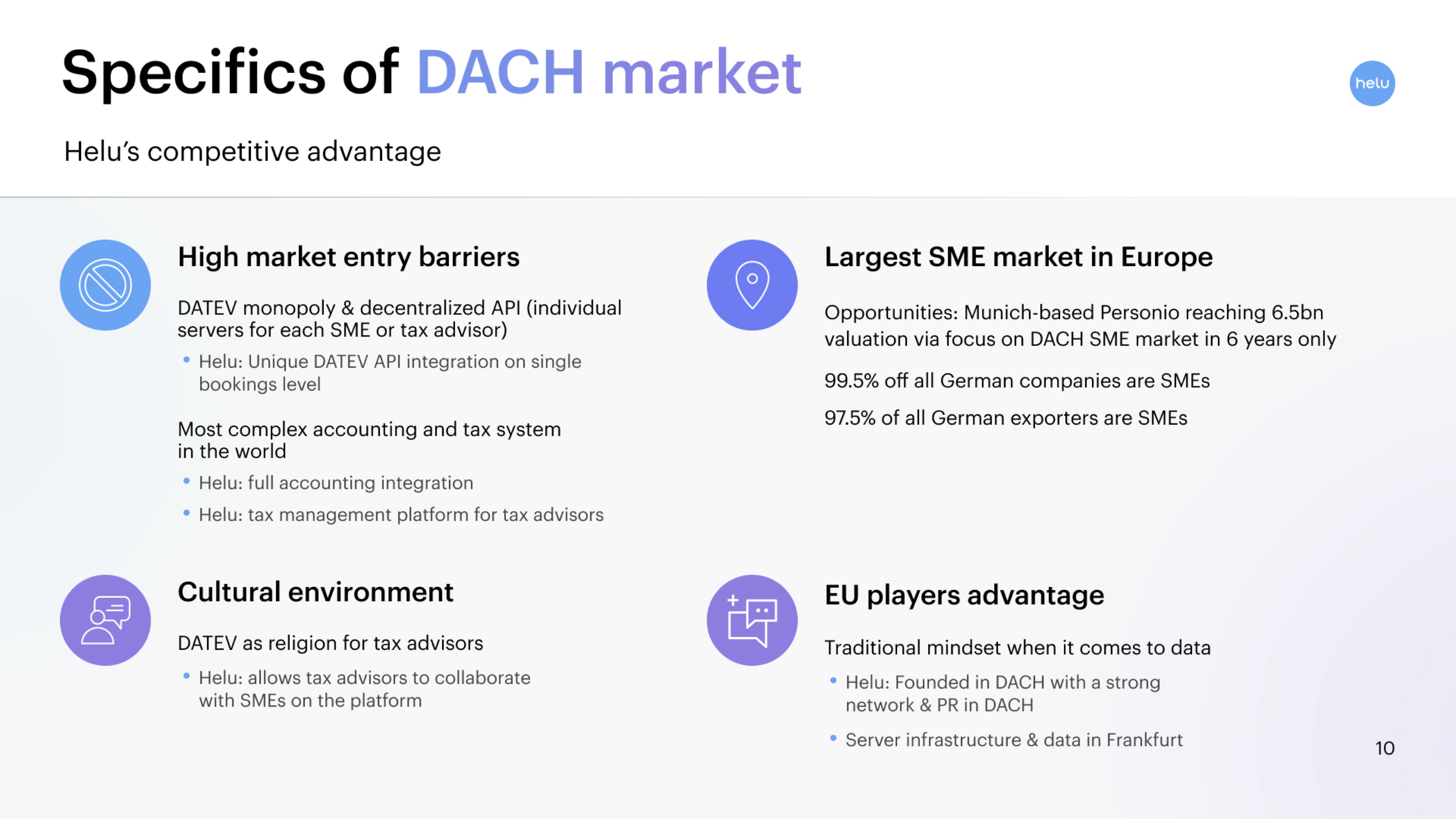

In a world where I’ve seen pre-production, revenue companies harbor wild dreams of global market dominance, Slide 10 comes as a pretty bulwark.

Also worth noting (I had to google it because I’ll be honest and I’m going to save you all a google search or two) is that what “DACH” means is shown on the slides below. D is Deutschland – that’s easy. A is for Osterreich (Austria) and CH is for … Switzerland. DACH is a term used in some form for a group of countries in Europe that have German as Sprahraum – in other words, where German is predominantly spoken.

- Cover slide

- “Helu is for CFOs, Personio is for HR” – Market opportunity slide

- “The pain of the CFO is Excel” – problem slide

- “Goodbye Excel Sheets” – solution slide

- “Our approach is unique and different” – product slide

- “Automated Financial Reporting: Real Time in One Step” – Value Proposition Slide

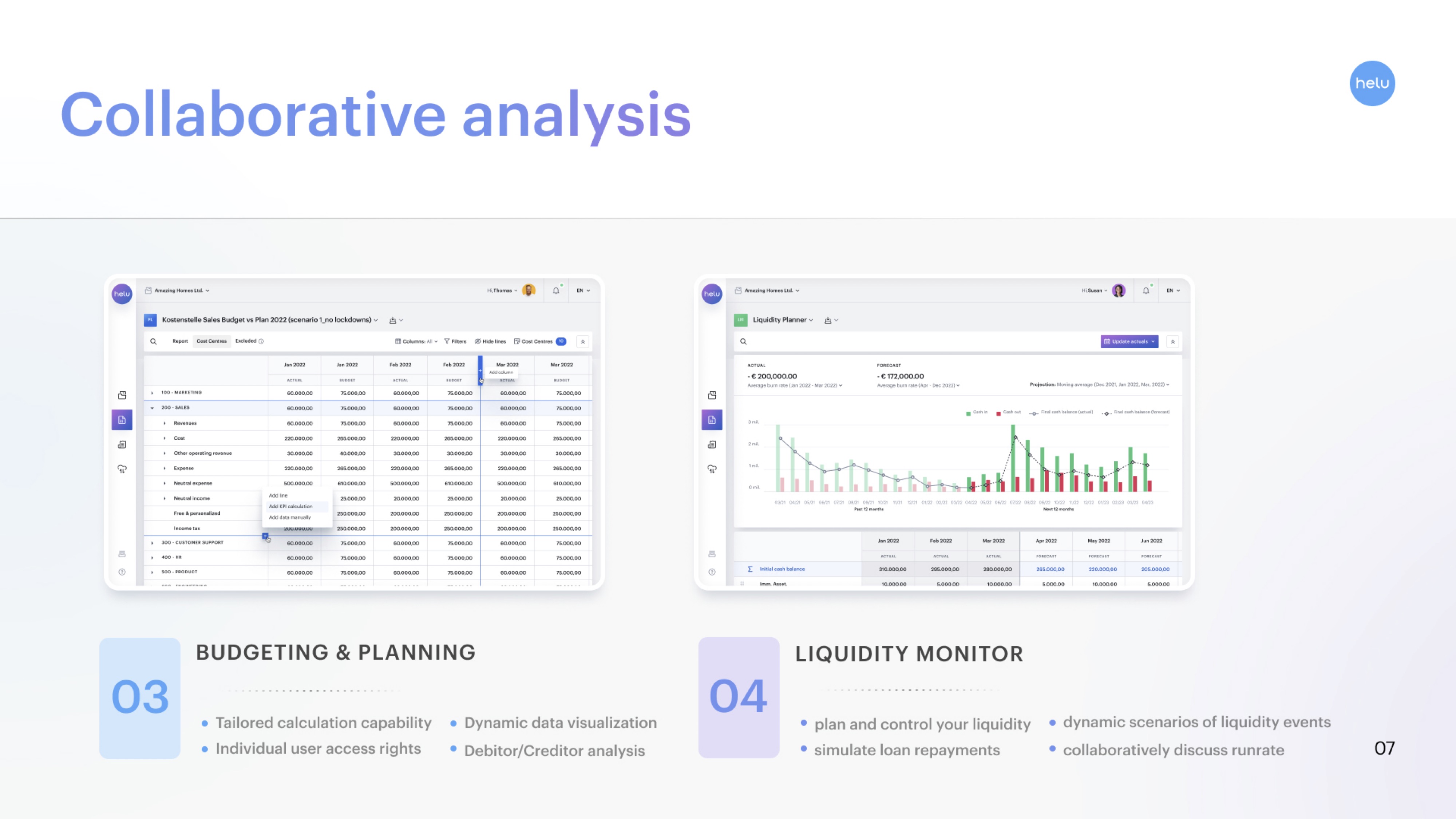

- “Co-Analysis” – Value Proposition Slide

- “Addressing the $100 billion B2B SaaS market globally” – TAM Slide

- “A multi-billion market in DACH alone” – SAM Slide

- “DACH market details” – SOM slide

- “Special position in DACH” – moat/competitive advantage slide

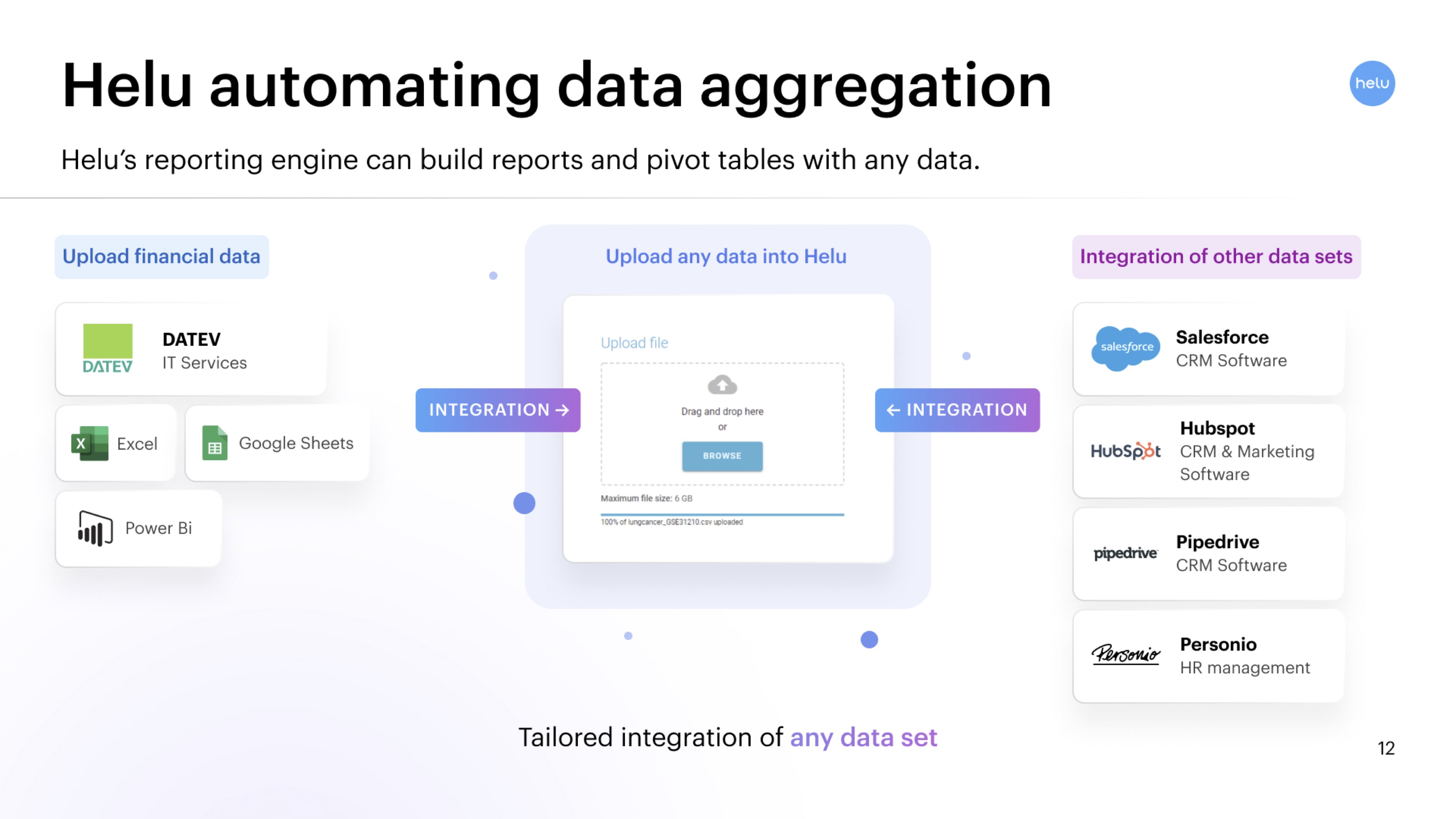

- “Helu Automatic Data Collection” – Product Slide

- “Helu’s typical customer” – customer profile slide

- “High-level international team” – team slider

- “Backed by strong investors and advisors” – Investors and advisors slide

- Closing the slide

Three things to love

All in all, Helu’s slide deck comes off as a bit strange as seen through Silicon Valley eyes. It’s strange to have an English slide deck that focuses on German-speaking countries, with no mention of English-language expansion plans. Some notable things are missing from this slide deck – but I’m getting ahead of myself. Let’s look at the best things first.

Solid value proposition

For founders working in a small niche in baseball, over-explaining what a product does can be really challenging. The truth is, the investors don’t care what your product does. not really. You need to explain what the customer will get out of it so that their concern will keep the customer coming back and they will be happy to pass on that part of the story. They do that by sharing the benefits or the value proposition. The Helu team does that well in a two-slide process.

[Slide 6] Value proposition part 1. Image credits: serial number

On slide 6, the team shows a couple of screenshots of the product, cutting nicely between explaining features and benefits. If you are trying to sell this product IAs someone who runs their own business, I’d like to see it more profit driven, but they’re not – they’re selling shares in the company to institutional investors, which is very clear about how financial reporting works. .

[Slide 7] Price proposition part 2. Image credits: serial number

The second part of the value proposition is more similar, but it helps to emphasize the strength of the software package. Most importantly, I can completely see how this operation is critical to concerns; You need to thoroughly research, simulate and analyze different scenarios. This package has you covered. Excel can do this, but good luck resetting the model to the pre-show states.

Now, these slides aren’t completely messed up. I would have liked more consistency. On slide 7, the bullets on the left have uppercase letters and the rest start with lowercase letters. Slides between “&” and “and” are copied to combine things together. But generally, they do the trick.

Show me the money. And take my money.

[Slide 12] take my money I have wanted this product since I started my first company. Image credits: serial number

I’m an Excel/Google Sheets nerd, and I think many investors in general. Entering and updating data is overwhelming, and the ugly little secret is that many of us are working with snapshots of data. These snapshots may or may not be updated. Are you working entirely on factual information? I guess snapshots are often not updated. That means you’re making massive, strategic financial decisions based on out-of-date data. It doesn’t take an MBA to realize that’s not the best way to run a business. I really enjoyed this slide, and the geek in me really wanted to see what this would look like in real life. Slide decks are both rare enough to introduce me to an entirely new product category. And It makes me play with financial modeling.

I have mastered this slide; It demonstrates the power of Helu’s tools in a way that helps a potential investor understand why this is so important. I wouldn’t be surprised if the investors asked one or more of their startups to try Hilu’s tools for financial modeling and reporting. They fall right in the middle of the bullpen for the product, and if it works as well as it looks, it’s a clear win. The slider itself is low key and simple, but if I strain my ears, I can hear a founder giving an example or two of how powerful this is.

Excellent pot

[Slide 10] Once you have a position in the DACH market, you are golden. Image credits: serial number

Okay, so this slide is one of the best and worst in this deck. We’re talking about the top three things I love, so we’ll talk about that in this episode, but spoiler alert: this slide is coming back in the “Three things that could be improved” below. If you’ve already read two pitch deck tears, here’s a chance to exercise: What’s wrong with this slide? Yes, it has a lot of words on it, but that’s not the problem – see if you can figure it out!

What I like about this slide is that it paints a picture of how Helu will become invincible once it gains a strong foothold in this market. And I doubt that 10 million dollars and a strong product will help in this. With “the world’s most complex accounting and tax system,” it won’t be getting any overseas competition anytime soon. I’m sure someone from the Internal Revenue Service will read that and start to feel a little competitive, but I buy that it’s probably a unique legal and regulatory landscape.

With an added twist: Germany’s Mittelstand is a powerful force to be reckoned with. These thousands of small but efficiently run businesses are hard to imagine in any other country; In the US, small companies tend to merge into larger companies. According to the company, 99.5% of all companies and 97.5% of all exporters fall into the SME category. That’s a landscape that most global SaaS businesses don’t know what to do with. For this unique set of companies, the local and cultural knowledge and construction tools that work so well mean that Hell can be completed in spectacular fashion. The company won’t come right out and say this is a “winner take it” market, but I think that’s what they’re getting at.

For the remainder of this tear, we’ll see three things that Helu could improve or do differently, along with a full deck.