[ad_1]

When the founder They sell their company, its value gets a lot of attention. But the heavy focus on valuation often results in consideration of the taxes that shareholders and stakeholders pay after the sale.

After exiting, some founders may pay 0% tax while others pay more than 50% of their sales revenue. Some founders can walk away with twice as much money as other founders with the same sales price – due to circumstances and tax planning. Personal tax planning can ultimately affect a founder’s take-home income due to changes in the exit tax assessment.

How will this happen? The tax payable ultimately depends on the type of equity owned, how long it is held, where the shareholder lives, potential future tax rate changes and tax planning strategies. If you’re thinking about taxes now, chances are you’re ahead of the game. But determining how much you owe isn’t easy.

In this article, I’ll provide a simple overview of how founders can think about taxes and an easy way to estimate what they’ll owe in taxes when they sell their company. I also explore advanced tax planning and optimization strategies, state taxes and future tax risks. Of course, remember that this is not tax advice. Before making any tax decisions, you should consult with your CPA or tax advisor.

How shareholders are taxed

When it comes to reducing capital gains tax, QSBS (Qualified Small Business Stock) can be a game changer for those who qualify.

Let’s assume you are the founder and own equity or options in a typical venture-backed C-corp. A number of factors determine whether you will be taxed at short-term capital gains (ordinary income tax rates) or long-term capital gains, as well as qualified small business stock (QSBS) rates. It’s important to understand the differences and where you can optimize.

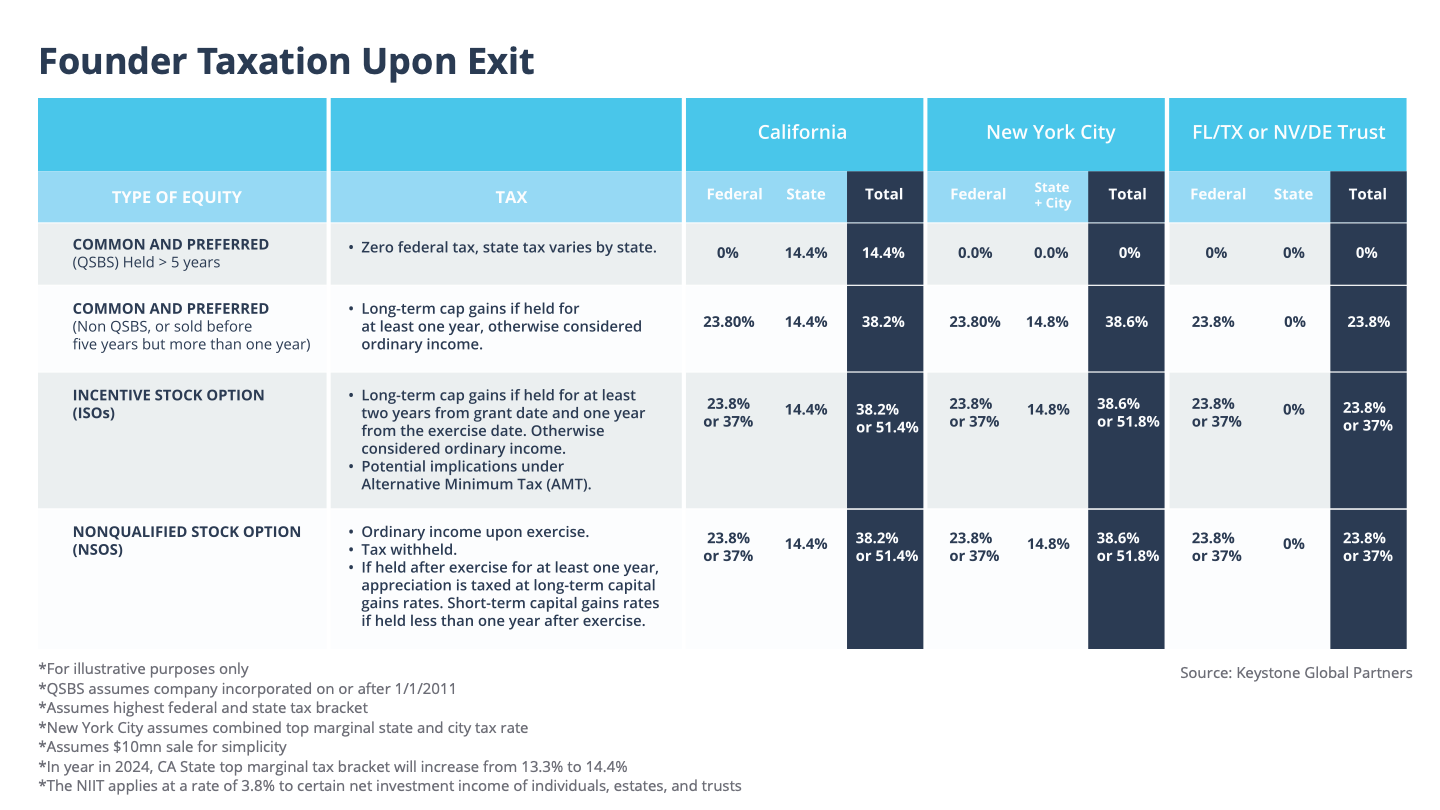

Below is a chart that summarizes the different types of taxes and when each applies. I will also break this down to show the combination of federal + state + city taxes.

Founders with exits that raise more than $10 million should explore some of the advanced tax strategies I mentioned in one of my previous articles because there is a $10 million QSBS exclusion and opportunities to further reduce taxes.

Image Credits: Keystone Global Partners

As shown above, some of the more common factors that affect how much tax a settlor owes after exiting include QSBS, trust creation, where you live, how long you’ve held stock, and whether or not to exercise your options.

[ad_2]

Source link