[ad_1]

never ever You’ve played free-to-play video games on your phone, including mini-games and other content of variable quality and relevance, and you’ve probably seen an ad or two.

Insimo is where it works; It promises to use machine learning and other smarts to maximize ad revenue for game publishers, promising a 30% increase in average revenue per user (ARPU) from new users and 10% for paying customers.

In a hugely quantitative market where every penny counts and every cent has a huge impact on gaming companies, those numbers caught the eye of Insimo’s investors.

We decided to take a closer look around the deck to see if we could find our checkbooks or the big red “pass” button.

We’re looking for more unique pitches to break down, so if you’d like to submit your own, here’s how to do that.

Slides on this floor

Ensimo’s AI deck only has 12 slides, so the company needs to make every slide count. Here’s what’s included:

- Cover slide

- Problem slide

- The solution slider

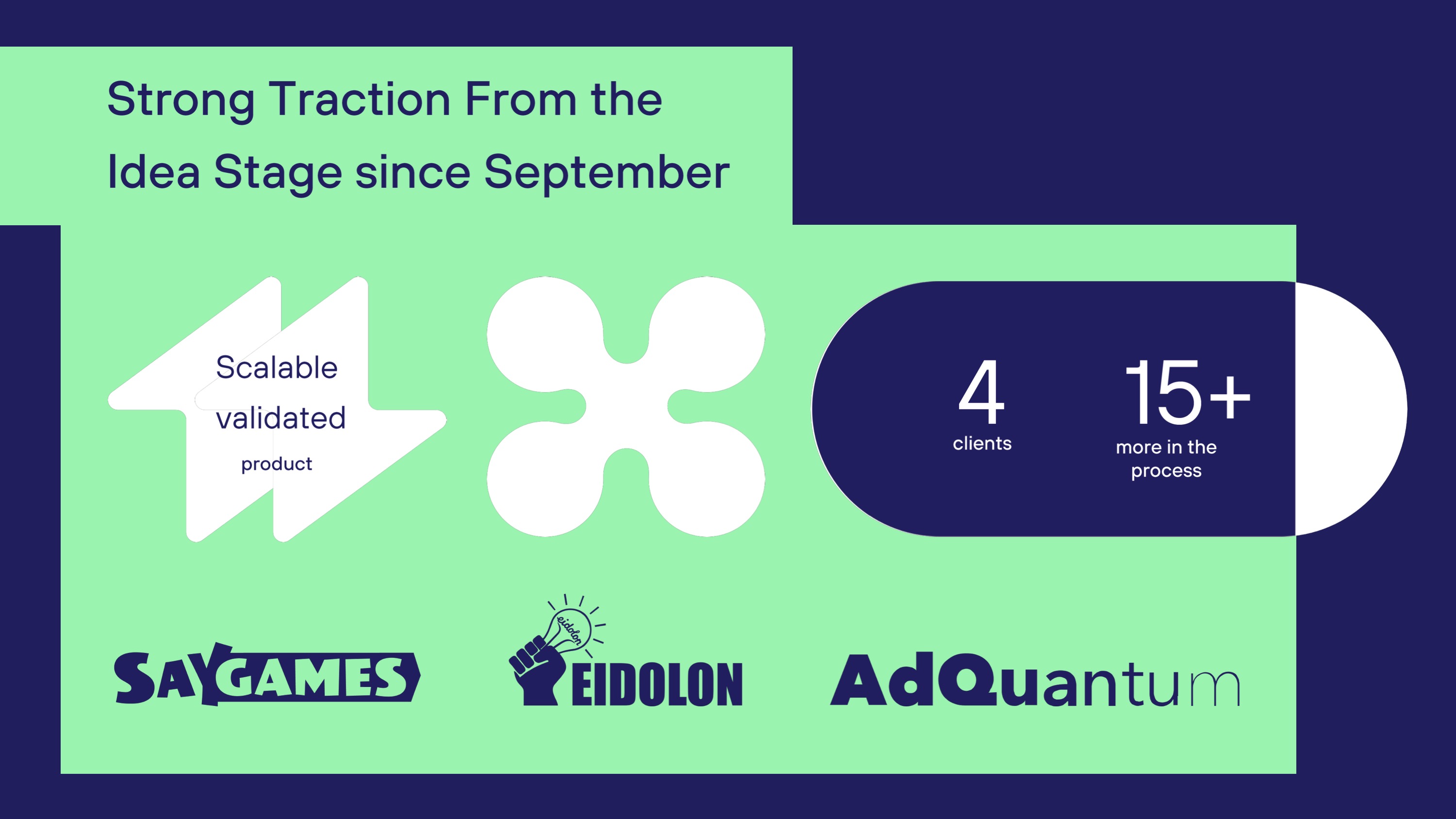

- Drag slide

- Customer slide

- Business model slide

- Market size slide

- Market direction slide

- Goals / targets slide

- Group slide

- “The question” slide

- Road map slide

Three things to love

There’s a lot to like about the Insimo Slide Deck. The design is fresh and includes many of the key features we expect to see in a pre-seed deck.

Big market

[Slide 7] That’s a big TAM. Image Credits: Enzymo

No one can argue with Incymo that it’s a huge market for video games marketing, and the company gets partial credit for coming up with different ways to calculate TAM and SOM — in this case, top-down and top-down.

A TAM of $72 billion per year is extremely naive, bordering on rationality.

Having said that, the top-down calculation looks like “every game on Google Play and the Apple App Store, multiplied by the $4,000 we pay per month, multiplied by the number of months in a year.” It’s a bold calculation, and I can see how the company got there, but even if it does it with 100% perfection, there will be too many games that can’t or won’t be customers.

A TAM of $72 billion per year is extremely naive, bordering on rationality. On the one hand, it doesn’t matter: it depends on whether the company has a large market, and I agree. However, any executive team that takes this approach to calculating TAM is proving its hand too sloppy.

A bottom-up SOM, however, is also quite uncomplicated. If I’m reading this slide correctly, the company is basically saying, “We have 600 people in our sales pipeline, so our market is to convert all of them at $4,000 a month.” And that’s unrealistic for a number of reasons: no company will replace all of its leads, and this SOM seems to indicate that at most 600 customers will enter the top of the funnel. A company that cannot replenish its leads over time is doomed to stagnate.

Look, I 100% believe that Insimo is in a big market and will probably get enough customers to make it worthwhile, but Slide Deck is your chance to show your investors that they understand the financial controls in your business. These slides seem to indicate the opposite; Not a good sight.

Drag is king.

[Slide 4] Drag trumps everything else. Image Credits: Enzymo

Liking a strong traction title is one of the things investors worry about more than anything else. I wish the company had shown me other metrics than “number of customers” and “many customers in the process” – for example, it would have been more powerful to show revenue or results.

There’s a big difference between signing up a major game studio that wants to use your product across its entire portfolio of games, and signing up an indie developer running a pilot at the same game studio. On one of the other slides, Ensimo mentioned that some game companies have annual marketing budgets of $20 million. Awesome, but doesn’t quite connect the dots to say he has it right. Signed One of these companies.

Another thing I’m tripping over about this slide is the “15 more in progress.” This means different things to different companies. Anyone who has done B2B sales knows that a healthy sales pipeline is the alpha and omega of a successful sales operation. Having someone “in progress” can mean anything – and without near-fit, it’s dangerously close to being just another useless measurement.

A clearly defined problem/pain point

[Slide 2] You have to love a clearly defined problem. Image Credits: Enzymo

There is no doubt that marketing for mobile games is easy and very competitive. The gap between No. 3 and No. 6 on the app charts is wide, and many of these companies are spending a lot of money to move to the top.

I 100% believe the company when it says that it spends a lot of time retargeting its target customers (game user purchase marketers) on repeat ads that perform well. A sample size of 20 seems a little low for this slide, so I would have liked to see a little more overall numbers, but that doesn’t detract from the clarity of the problem statement. (Although the grammar leaves a thing or two to be desired.)

in order to. Some of them were a few. Positive Things we found on this pitch deck, and you may have noticed we’ve added reminders. In a moment, we’re about to get even more salty and see a few things that Insimo could have improved or done differently, with a full pitch floor.

in a bind; It will be quite the trip.

[ad_2]

Source link