[ad_1]

Back in January, Natasha It also closed the Juro Series B round, which added $23 million to its coffers. Juro aims to end contract negotiation madness by moving workflows from Microsoft Word and a handful of other ancillary tools into an all-in-one web-based platform for contract negotiation-to-signature workflows. It seems like a very good idea. The shutter worked; It helped Juro get a good dollar stockpile. But is the cover good? Let’s take a closer look.

We’re looking for more unique pitches to break down, so if you’d like to submit your own, here’s how to do that.

Slides on this floor

The company used a 15-slide deck shared with TechCrunch, which only made some light modifications. All the slides are there, but the company has partially glossed over the future road map and the exact financial numbers.

- Cover slide

- “It takes ~5 devices to process one contract” – problem slide

- “Starting contracts in MS Word files compounds the pain” – problem slide

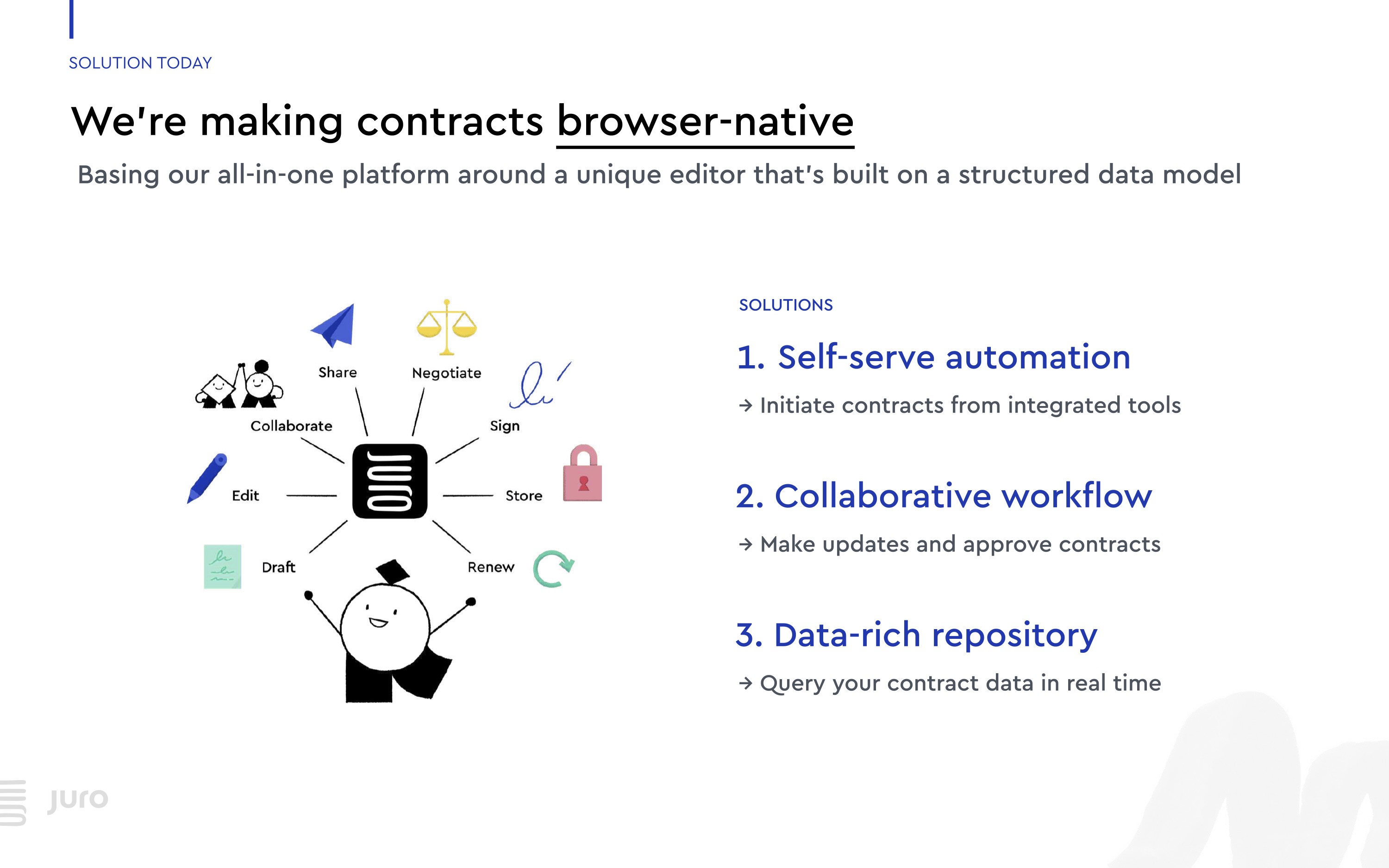

- “We are making contracts browser-native” – solution slide

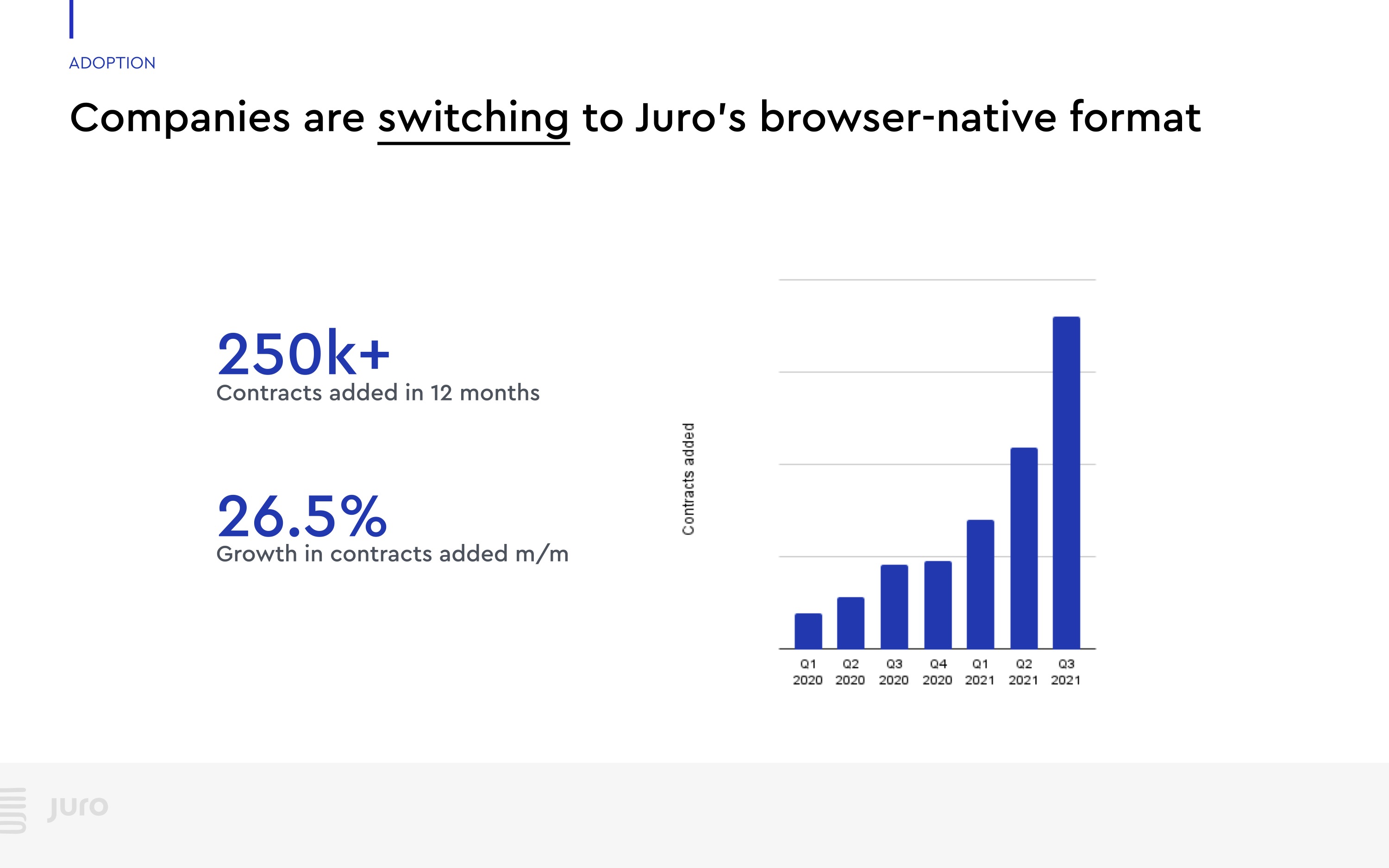

- “Companies are switching to the Juro browser-native format” – track slide

- “ARR is at $XXm+, Growing Predictably and Sustainably” – Financial Traction Slide

- “We are the only system that has been accepted by legal groups and we do it all in one” – competition slide

- “We have a repeatable GTM engine, externally driven” – Customer Acquisition Slide

- “While the slope is trending downwards” – retention slide

- “Our champions integrate the development of communities” – client slide

- “Helping ARR grow through land/expansion activities” – Go to Market/Market Expansion Slide

- “We have an experienced team on board and we are engaged” – team slide

- “With a record of capital efficiency” – financial highlights and investment partners slide

- “And to be the default way to agree terms with a broader objective” – product roadmap slide

- Closing the slide

Three things to love

There are many great things about Juro’s deck, but the clarity of the story is a particular highlight.

Yes, that’s a problem.

[Slide 2] Excellent problem statement. Image creditLaw

Anyone who has had to deal with contracts, especially contracts that are customized or at least for each client, has encountered this problem in one form or another. This shows for anyone who does large B2B or corporate deals; If you’re negotiating with someone bigger than you, it’s likely that their in-house legal team has a capital-T. Thoughts About your contracts and how you can’t use the lovingly crafted boilerplate contracts the way you thought.

For starters, this can be seen from time to time in due diligence; You should both have contracts with all of your customers and suppliers and, if required, be able to obtain and show signed versions during the due diligence process. If your contracts live in your email or (maybe) in a shared folder (somewhere, hopefully), this can turn into a nightmare.

The cool thing here is that most VC deals fall into this category. The term sheets are usually standard, but when the investment documents are finalized, a lot of custom language that varies from deal to deal can be inserted into each contract. The bottom line is that this company is probably an easy sell to many VCs looking at this deck: while the company isn’t specifically for the startup and VC ecosystem, Juro is at least partially solving that problem. Every VC has experienced it at one time or another.

If your company does something that VCs can recognize, they can use it to your advantage; It accelerates the “this is why it’s important” narrative. What a great benefit!

Rotate enough product to make sense

[Slide 4] yes. This is how we make product slides. Image creditLaw

Many startups fail at the temptation to spend too much time thinking about their product. Of course, the product is important, but not as important as the founders think. This is a series B deck, and Juro tells the real story here: if you have a lot of clients (and, as Juro will recognize in a moment), you shouldn’t spend too much time on you. Product. The customers love you, they’re paying you, and they’re staying. For series B, we are talking about growth. Yes, the product should be good enough not to actively scare away customers, but if you can sign them up and keep them, at least you’re on the right track.

In this slide, Juro shares enough detail that investors can get a high-level overview of what the product is and what its benefits are. It’s very well done, and lays things out just enough to make everything easy to understand. good job!

As a beginner, what you will learn from this slide is not to get bogged down in details. Keep it as simple as you can. At Pitch Coach, I sometimes ask my clients to tell the story without mentioning the product once. A bit extreme, of course, but once you add the production, it helps reinforce each part of the story enough to take the proper time and energy into the voice.

Drag, drag, drag

[Side 5] If you could use a single slide to raise capital, it would look like this. Image creditLaw

If Juro has the most important KPI ‘number of signed contracts’, this graph is unique.

Traction is the single most important slider you can have in your pitch deck. If you have one, run it as soon as you can. Well, we’ve had five slides in the Juror Pitch Deck and we’ve already talked about the slides before that. In fact, this is the first time that the company can say how well it is doing. And goodness, ever – it’s as descriptive a graph as you’ll see for any startup, and if Juro has “number of contracts” as its most important KPI, this graph is unique.

Notice the “if” in the sentence above. As an investor I like this graph. I love that the company is expanding so quickly. But here’s a catch: According to its pricing page, the company won’t automatically make more money if it holds more contracts. Granted, the two are strongly correlated, but I would have liked to see a more direct measure of attraction here. ARR, maybe. Number of paying customers. Leading with a pretty graph for a second KPI always comes off as a bit suspect. Slides 6 and 7 cover the company’s ARR growth, so I’m letting them slide here. Real VCs driven by metric numbers think.

The lesson? Be careful what parameters you are guided by. Some are intrinsically important but less important to investors. Some will be useful for specific aspects of the business (customer support ticket closing time and system uptime are critical for customer service and technical operations teams, for example) but it seems curious to see them on the pitch floor.

For the rest of this teardown, we’ll look at three things that Juro could improve or do with the full deck.

[ad_2]

Source link