for property A segment that must constantly reinvent itself, it’s surprising how resistant some venture funds can be to change.

As a partner in a venture capital fund, I attend many annual meetings, talk to many venture fund general partners and review many investors.

I was particularly struck by how many funds tell the same story and invest in exactly the same sectors: B2B SaaS, cybersecurity, cloud infrastructure tech, e-commerce brands and crypto/fintech.

As I’ve written many times before, Venture is about elephant hunting. The best funds have at least one, and ideally a few, highly successful, fund-returning investments. Ownership and allowing great companies to “ride” (and not sell early) is critical to excess profits.

But price returns only come from companies that are market leaders in large markets. A second-tier company and sometimes even a third-tier company may win, but it won’t really be big. But companies that end up at #300 or #99 or #20 on the market are not necessarily good investments.

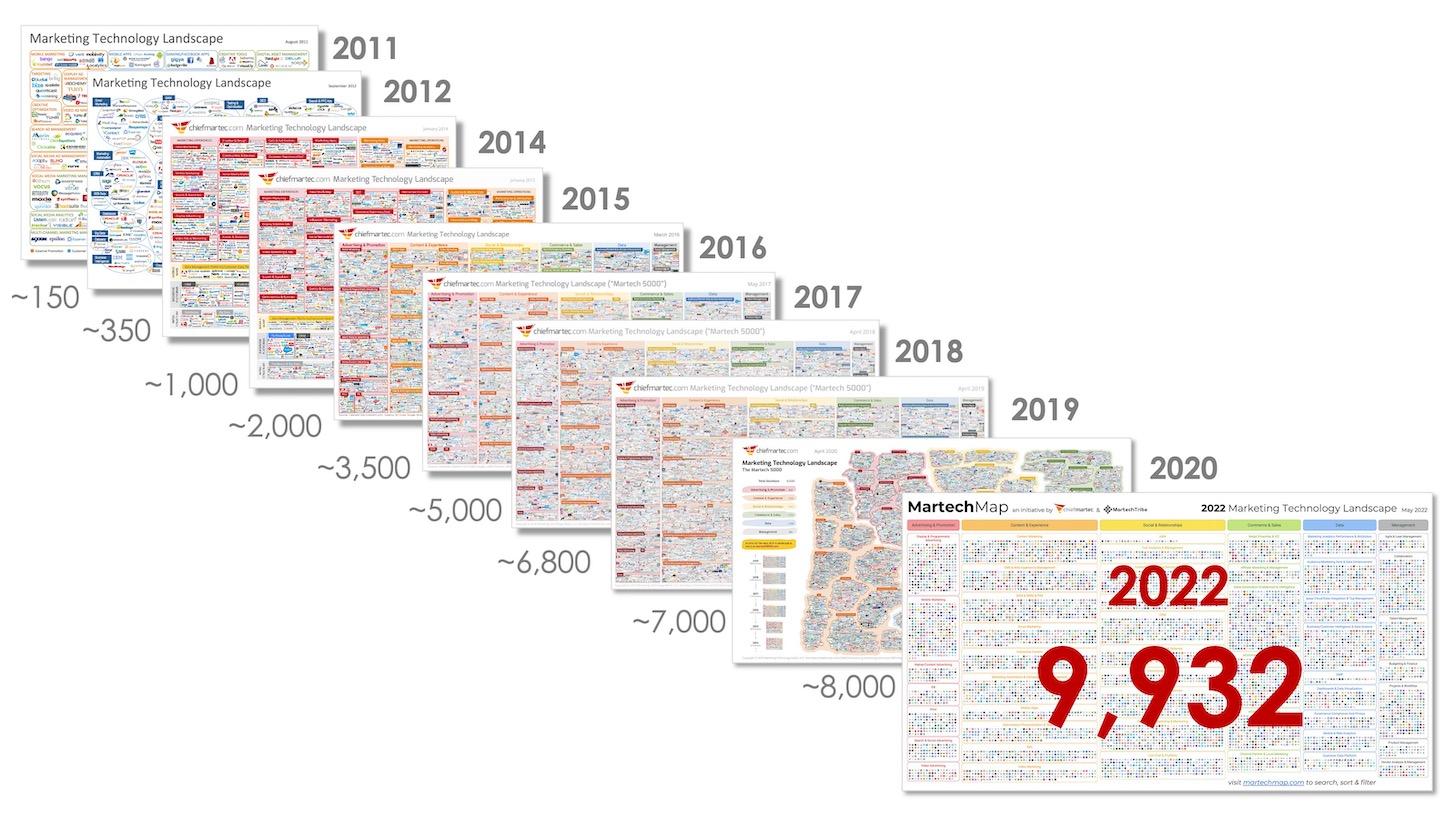

I was thinking about this recently when looking at a map of martech SaaS companies put together by chiefmartec and MartechTribe. It’s surprising how many commercial SaaS companies still get funded.

Image Credits: Scott Brinker of chiefmartec and MartechTribe

Although not as bad as marketing technology, we are seeing significant inflation in cyber security and fintech companies.

In my conversations with CISOs, the feedback I hear time and time again is that they are not looking for new point solutions as much as a comprehensive platform that will replace the dozen or so cybersecurity applications they have in their systems. In a market where capital is difficult to raise, many of the thousands of “me too” cyber security companies will be “secure”.

The same is true for some fintech areas. How many more payment companies can be created? How many more e-commerce finance companies can survive and grow?

Marc Andreessen once said, “Software is eating the world.” Unfortunately, investing is also feeding off reactions.

So, what’s a venture fund to do?

As an early stage VC, it’s not important to invest in what’s hot today, but what will be hot five to 10 years from now. VCs who invest in leaders tomorrow Markets tend to generate excessive profits.

That doesn’t mean one should stop investing in SaaS, cyber security or fintech. There will always be disruptive companies in those segments, but the balance has to shift to the massive markets that have reached disruption with underfunded technologies.

In my view, there are four relatively underfunded areas that could produce big winners over the next 10 years.