[ad_1]

SweetBunFactory

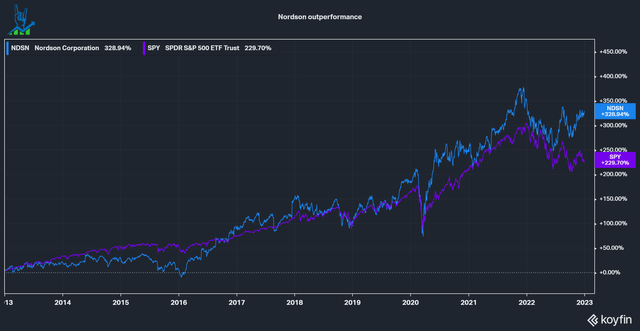

Nordson (NASDAQ:NDSN) is a precision technology-focused industrial company that has comfortably beaten the S&P 500 over the past decade. Nordson is said to be a high-quality business, so we’ll see if it can live up to its reputation. It may present an attractive investment opportunity at current levels.

Nordson Decade of Excellence (Coifin)

What is precision technology?

Accuracy is an undefined term in technology that usually means that something is correct. Nordson divides its operations into three divisions serving five end markets.

- The Industrial Precision Solutions segment accounts for 51% of revenues and is Nordson’s focus. The division includes adhesives, industrial coating systems, management and control solutions and polymer processing systems. In summary, mainly packaging and other processes are performed at the end of the industrial production process.

- The Medical Liquid Solutions segment accounts for 27% of revenues. The division also focuses on products focused on the storage or transfer of fluid management and other medical devices.

- The Advanced Technology Solutions segment accounts for 22% of revenues. The division includes electronic processing, test and inspection systems.

We have seen that Nordson focuses on the final stages of industrial manufacturing processes such as packaging, testing and inspection of machines, parts and consumables. This leads to high recurring sales (51% of revenue is parts and consumables, the remaining 49% is system sales), the holy grail of any investment. Recurring revenues increase the certainty that a company (and analysts) can forecast its business and reduce the need to sell new products. Ideally, you want to have a small system sales percentage that requires a high volume of repeat sales. Nordson is very close to that setup.

In addition, Nordson has a highly diversified customer base spread across five end markets, accounting for between 12 and 30 percent of total revenues. You can get a better picture of Nordson’s various product offerings in the image below.

Nordson End Markets (Nordson Investor Approach)

Grow organically

Nordson is operating in stable industries due to its high recurring revenue mix. In the table below I have prepared some numbers based on 2022 regarding various segments (expected growth rates/CAGR are taken from management). For the most part, Nordson does not expect any abnormal organic growth in its business and expects organic growth in all its segments to be 3-5% with some potential upside. A 3-5% organic growth rate doesn’t appeal to me, so they either need to trade at a higher FCF yield or grow earnings in some other way.

| Income | EBITDA margin | Expected CAGR | % of Total Revenues | |

| Industrial accuracy | 1337 million dollars | 35% | 3+% | 51% |

| Medical fluids | 690 million dollars | 40% | 5+% | 27% |

| Advanced technology | 563 million dollars | 25% | 5+% | 22% |

Growth in M&A

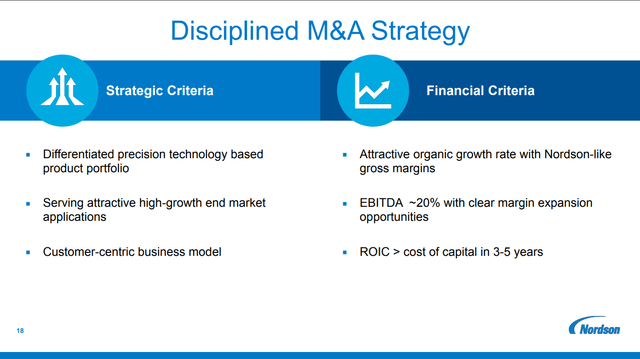

Due to the lack of organic growth, Nordson rarely acquires companies to add to its portfolio. Over the past decade, the company has spent a total of $1.66 billion in cash on acquisitions, which is a very modest 12.6% of the free cash flow the company has generated over the same period. Mergers and acquisitions are known to be risky endeavors for companies, common knowledge is that 70-90% of M&A value is destroyed. Therefore, a company doing strategic M&A must show good framework and discipline in its approach. I would like to see the following aspects of such a strategy:

- Strategic fit in the business model. This could be gaining market share in existing business lines, entering neighboring businesses, or cost synergies. I don’t like to see completely unrelated businesses being bought. Due to a lack of knowledge in those areas, it often backfires. Nordson makes this point and points to a product portfolio within Nordson’s circle of competence and in high growth end markets.

- Integrating new businesses is always critical; When two business cultures collide, it often leads to failure. Nordson wants a customer-centric business model, as Nordson has with its Ascend strategy.

- A major contributor to why most M&A destroys value is the focus on revenue growth. That is why I want to focus on the profitability of the business. Nordson explains the margins and wants at least a 20% EBITDA margin plus room for improvement. In addition, you want the ROIC to exceed the cost of capital in 3-5 years. This last part is a bit generous, in my opinion, because a good company should always generate earnings above the cost of capital.

- Finally, the price paid is very important and often a major contributor to depreciation. Although Nordson hasn’t been clear about the hurdle rate or preferred multiple for acquisitions, based on the latest additions (EV/EBITDA among top juniors), the company appears to be buying at multiples of its own. It’s not great, but it doesn’t seem like overpaying either.

Nordson’s M&A Strategy (Nordson’s Investor Approach)

Efficiency lever

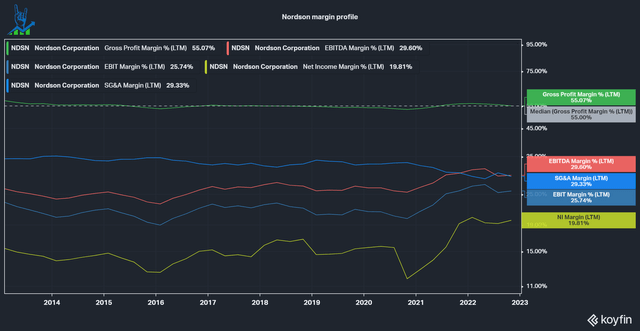

The last margin improvement the company pulls is because of revenue growth, not revenue growth. The graphs below show that gross margins are stagnant at 55% and profit margins are on the rise. A very good metric to track that gets little attention is the SG&A margin, which represents the company’s largest expense. We can see the SG&A margin gradually decline from 35% to 29%, while profit margins increase by approximately 5-6%. The company still has room to grow its margins, but it won’t be very meaningful. Additionally, we can look at Nordson’s reinvestment efficiency by looking at the spread between ROIC and WACC, which is a healthy 8%. We aim for at least 2%; Otherwise, the company is losing its share price.

Nordson Margin Profile (Coifin)

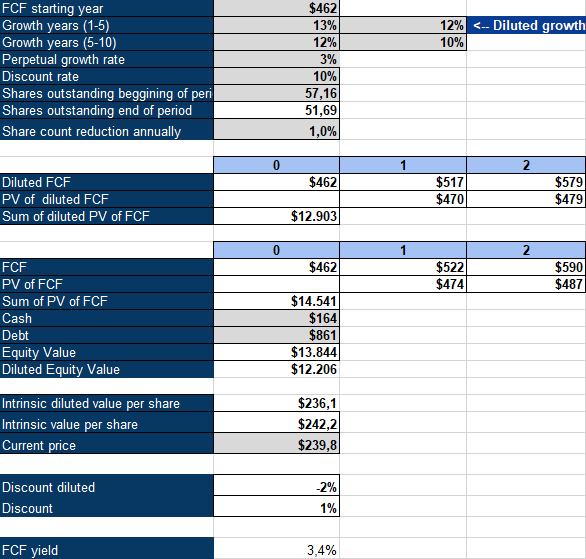

Trade in quality over fair value

To value Nordson, I performed an inverse DCF analysis assuming a 10% discount/required rate of return, a 3% perpetual growth rate, and a 1% annual reduction in the stock count through acquisitions after the last decade. According to the model, Nordson should grow FCF by 12% in the first five years, then 10% in the next five years. With management guided by a vision of 7+% sales growth and 10% EBITDA growth in the medium term (20-25), we can therefore assume that FCF should be around the 10% mark. At this price, I don’t see a great return coming to Nordson. The company will need to deploy more money to M&A than the historical 10% of FCF to grow quickly enough to justify leveraged value.

Nordson Inverse DCF Model (Authors Model)

[ad_2]

Source link