With the collapse of oil these past few days, someone actually explained to me that the business is now long technology and short energy. How can anyone disagree except that I brought this up in June. over and over.

How many times did I show this gasoline chart at the beginning of June? This chart looks a little different, because this is a September contract and we were looking at July gasoline (so the prices are different), but the chart is the same. It failed to make a new high in early June, coupled with special stories on CNBC about five-dollar gasoline in the U.S. and Exxon (XOM). Crude oil and gasoline were at 95, not to mention the daily sentiment index.

At the beginning of July, gasoline broke that big rally and continued lower, these last two days have been very low. I don’t think the sentiment will carry or get it, but I know there is good support around that blue line (2.70).

I’ve been back at my desk for two weeks, and never once have I heard a $200 oil call, but that was pretty common in June. I’ve commented several times in June and since then, my inbox was filled with tech stock inquiries, but in May and June it was filled with smaller energy stocks. Now it is gradually becoming technical rather than energetic.

It’s not extreme yet, but I think it’s enough to see a crossover next week.

The whole week this week was a chop fest because if we don’t have Wednesday’s lineup, most of it is on the sidelines. That’s what the overbought situation is doing. You can see it on the chart when the Oscillator goes down.

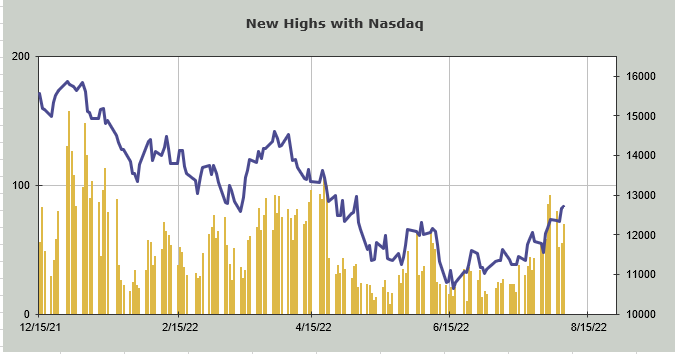

Thursday saw the Nasdaq hit its lowest new high for the first time since early April (it was negative then, but the market is in a different place now). It was only the second time since November 15 that more new highs were made than lows. I consider that part a positive.

What I don’t like is that the Nasdaq continues to rise even though the number of highs has been declining over the past week. I call it the index-mover effect when stocks like Apple (AAPL) move up, but everything else treads water or spins.

Then there is emotion. The American Association of Individual Investors bulls are at 30%, which is higher than 18%, but not extreme. The bears are down 41%, down from 59%. So this survey still has more bears than bulls.

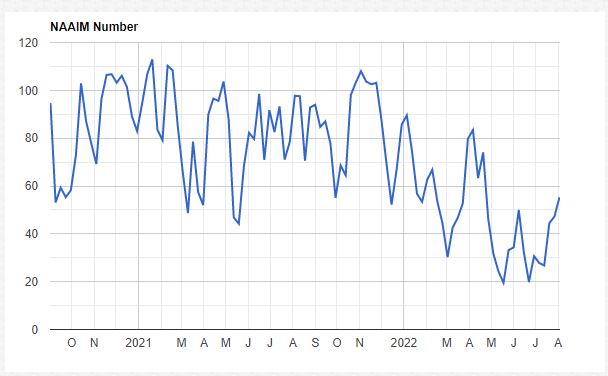

The National Association of Active Investment Managers (NAAIM) raised it from a low exposure of 20 to 55 in June. We call this more neutral. In fact, we must say that a shift is happening, but not as fast as other rallies this year.

I think we still need to do the overbought reading and regroup. One thing the bulls don’t want to see is energy and technology going down as banks go down. We’ve been there before and know what works on pointers and scope. And narrow markets are never good.

(AAPL is a holding in the Action Alerts PLUS member club. Want to receive an alert before buying or selling AAPL stock? Learn more now.)

Get an email alert every time I write an article for Real Money. Click “+ Follow” next to my line to this article.