[ad_1]

You don’t have to move to San Francisco to launch a startup, but working here has some advantages: mild weather, natural beauty, great food, and sure, the world’s largest venture capital.

Y Combinator’s Demo Day took place this week, and although the event itself was virtual-only, 86% of founders in YC’s Winter 2023 batch lived in SF when they attended.

The ongoing AI boom also contributes: 54 of the 282 companies in this group are “building specifically generative AI startups,” reports Natasha Massarenhas.

Full TechCrunch+ articles are available to members only

Use discount code TCP PLUS ROUNDUP One or two year subscription to save 20%

Following tradition, the TechCrunch staff has picked favorites from the latest batch.

Please note that these are for entertainment purposes only, as “we do not provide investment advice or recommend that anyone start or support.

Thank you so much for reading. Have a nice weekend!

Walter Thompson

Editorial Manager, TechCrunch+

@your main actor

VCs to Remarket Startups: Let’s take some accounts

Image Credits: Kinga Krzeminska (Opens in a new window) / Getty Images

Thanks to the general interest in sustainable marketing, remarketing is growing to new heights, and VCs are looking for what’s to come.

In the year After ET went public in 2015, companies like Poshmark, The Real Real, and thredUP followed suit, attracting more investors to the sector. Last year, VCs poured nearly $6 billion into resale platforms, said Brian Schwarzbach, an investor at Cathay Innovation.

In a post for TC+, he explores three remarketing niches attracting VC interest and shares “fodder for founders building startups in this (re)space.”

Funds that offer ‘friends and family’ checks can make the difference that underrepresented founders need.

Image Credits: Above Earth / Getty Images

America’s longstanding wealth disparity between white and black families contributes to the disparity among startup founders.

Median liquid wealth for a black household in America is $3,630, but this figure rises to $79,000 for a white household. As a result, “the average black founder collects less than $1,000 from family and friends,” reports Dominique-Madori Davis.

Since the average friends-and-family round is $23,000, they should “secure the total liquid assets of six black families,” according to a white paper by venture fund Fifth Star.

Pitch Deck Teardown: Smalls’ $19M Series B Pitch Deck

Image Credits: Small ones (Opens in a new window)

Subscription cat food startup Smalls has raised $34 million since launching in 2017.

Now the company has 50 employees, plans to open a cat cafe and is looking at retail expansion. The founders shared their Series B with TC+, minus “certain details for the company’s valuation and current earnings.”

- Cover slide

- Market slide

- Problem slide

- Mission Slide (“We’re here to make 9 lives 10”)

- Competition slide

- Product slide

- Slide how it works

- Why now interstitial slide

- Business metrics slider

- Critical steps slide

- Group slide

- The use of funds is sliding

- Slide in the middle of the performance

- CAC slide

- Go to the Market/Growth Channels slide

- Value prop slide

- Churn analysis slide

- LTV slide

- Future plans middle slide

- Market Extension Slide Section 1

- Market extension slide part 2

- LTV extension slide

- Question and target levels sliding

- Thanks for the slide

Here’s how the early stage venture market is doing today as YC rolls out a new batch

Image Credits: Viaframe (Opens in a new window) / Getty Images

Drawing from Map’s “First Cut – State of the Private Markets: Q1 2023” report, Anna Heim and Alex Wilhelm crunched the numbers to get a first-hand feel of the VC landscape.

Pre-fund valuations for seed-stage startups are down slightly, while Series A, B and C rounds appear to be “showing signs of recovery” given “moderate round sizes and deal prices.”

What is a fair price premium for startup stocks?

Image Credits: Javier Ghersi/Getty Images

Redpoint Ventures’ Market Update Report contains insights for Series B and C founders planning to raise money this year, writes Alex Wilhelm.

“Mid-stage startups are still very expensive today,” he wrote. “Either the stock market needs to get some of its juice back, or startup prices need to drop further to get things back to ‘normal’.”

6 common challenges cyber security teams face and how to overcome them

Image Credits: That Hiltula (Opens in a new window) / Getty Images

Cybersecurity product teams operate under unique pressures, says investor Ross Haleliuk.

It’s not just that they’re working in a crowded market – “It’s an incredibly dynamic place, the landscape sometimes changes overnight.

Because many startups lack frameworks for building customer relationships and validating model metrics, Halleliuk, head of product at his own company, shares strategies that help security vendors better “understand their target market and the solutions they need.”

Ask Sophie: How do we transfer H-1Bs and Green Cards to our startup?

Image Credits: Bryce Durbin / TechCrunch

Dear Sophie,

I was recently laid off.

I’m co-founding a cleantech startup with two former colleagues who were laid off. Both of my co-founders are on H-1Bs and had green cards from their previous jobs with our company. I am an American citizen.

What do we need to do to transfer H-1Bs and their green cards to our startup? Based on your experience, do investors care about the amount of money a startup spends on visas and green cards for their entrepreneurs?

– Founder for the first time

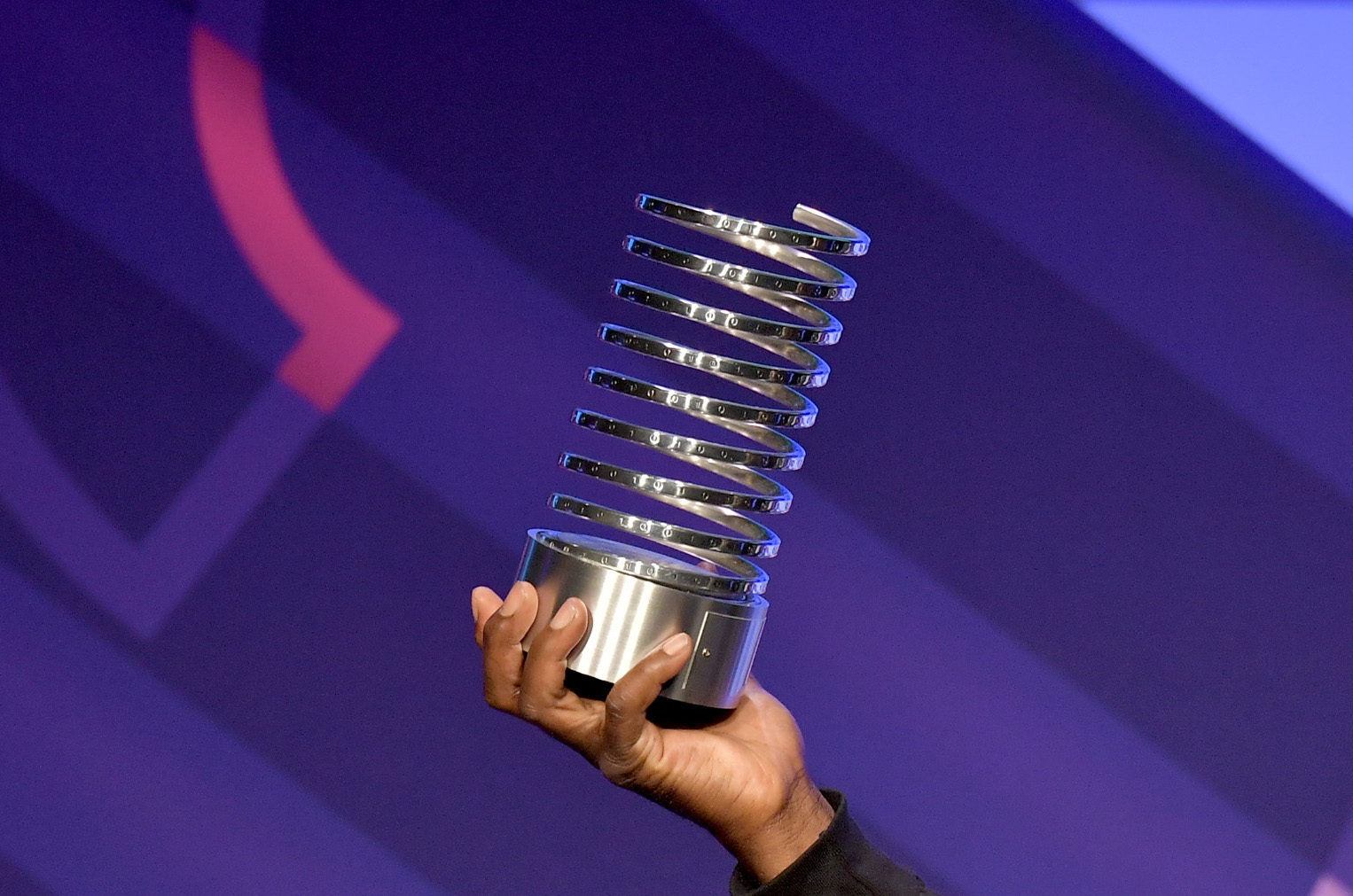

Vote for TechCrunch at the Webby Awards

Image Credits: Michael Loccisano (Opens in a new window) / Getty Images (image edited)

Two TechCrunch podcasts, Chain Reaction and Found, have been nominated for Webby Awards. The best technology podcast category.

Cast your vote before Thursday, April 20th!

[ad_2]

Source link