[ad_1]

Tippatt/iStock via Getty Images

Twilio (NYSE:TWLO) fell amid the tech stock crash, then fell again later in the analyst day. The company eventually lifted medium-term guidance, citing a stronger macro as an explanation. TWLO once traded as one of the top. Quality stocks in the technology sector, however, are currently among the cheapest. The company has a large net cash position and is on track for non-GAAP profitability next year. Although it’s been a painful ride, I expect the collection to eventually reflect attractive fundamentals as this beat is so overdone.

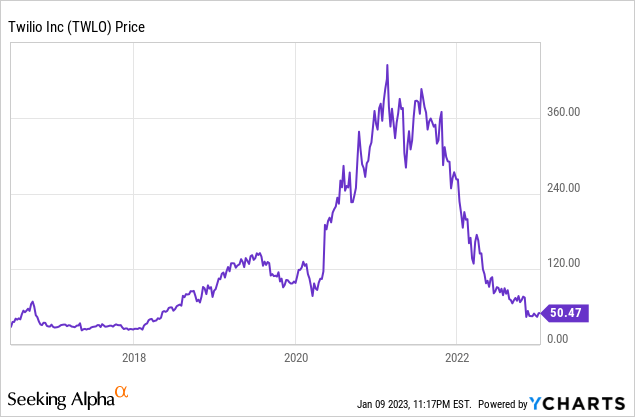

TWLO stock price

In the midst of the tech bubble of 2021, TWLO was extremely overvalued. But was the stock overvalued even in 2019 before the pandemic? The current share price seems to indicate this, with the stock down 70% from 2019 levels.

The last time I covered TWLO in October, I called it a “diamond in tech’s bloodbath.” The company nosedived after reporting third-quarter earnings.

TWLO stock key parameters

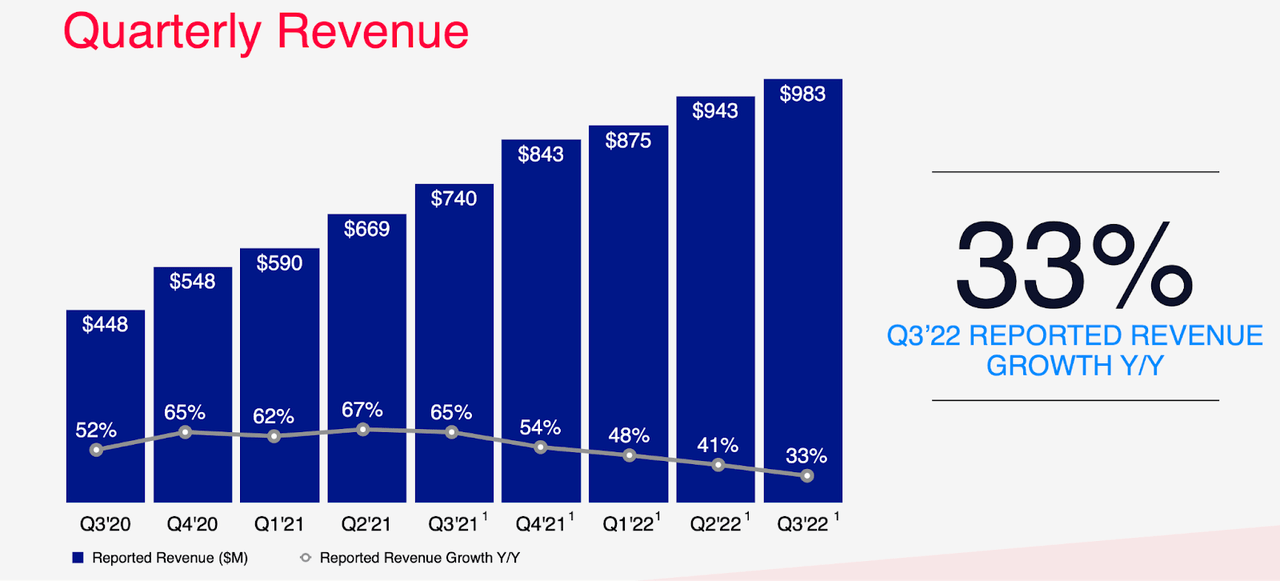

In the third quarter, TWLO continued to generate respectable growth of 33%, although this reflected the 5th straight quarter of a slowdown.

Q3 presentation of 2022

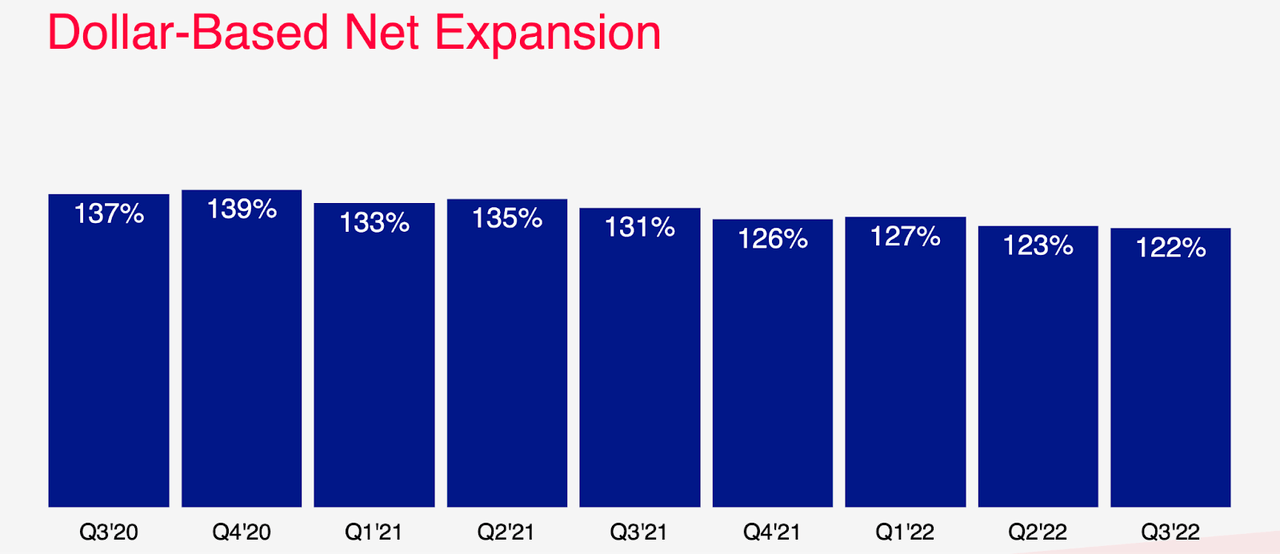

As usual, a high 122% dollar-based net expansion rate was the main driver of that strong growth.

Q3 presentation of 2022

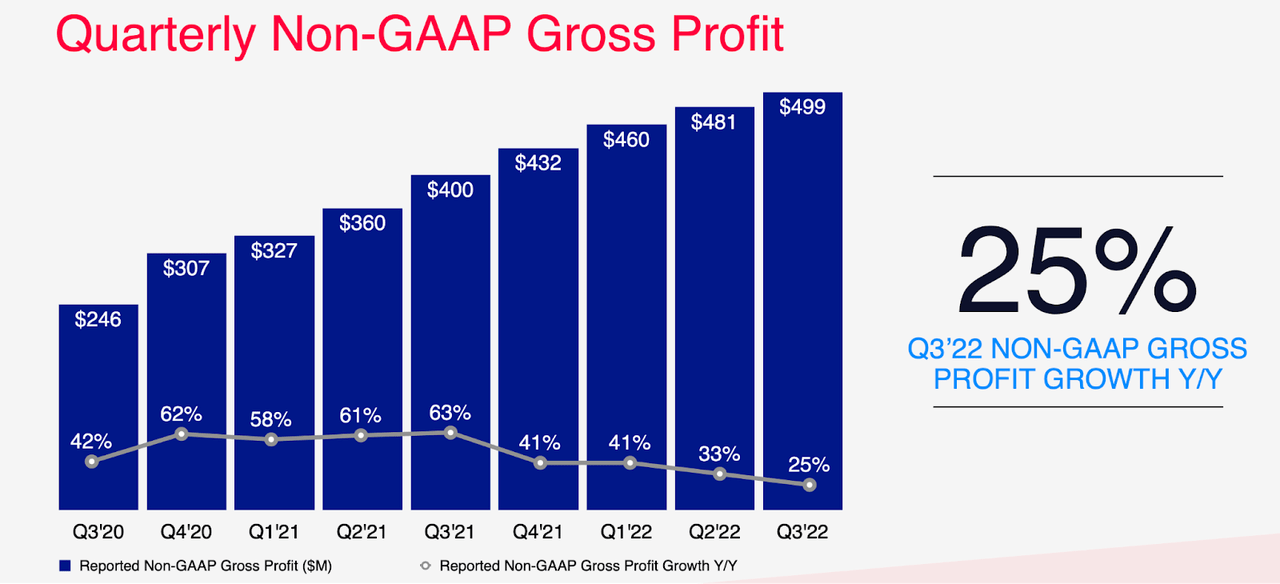

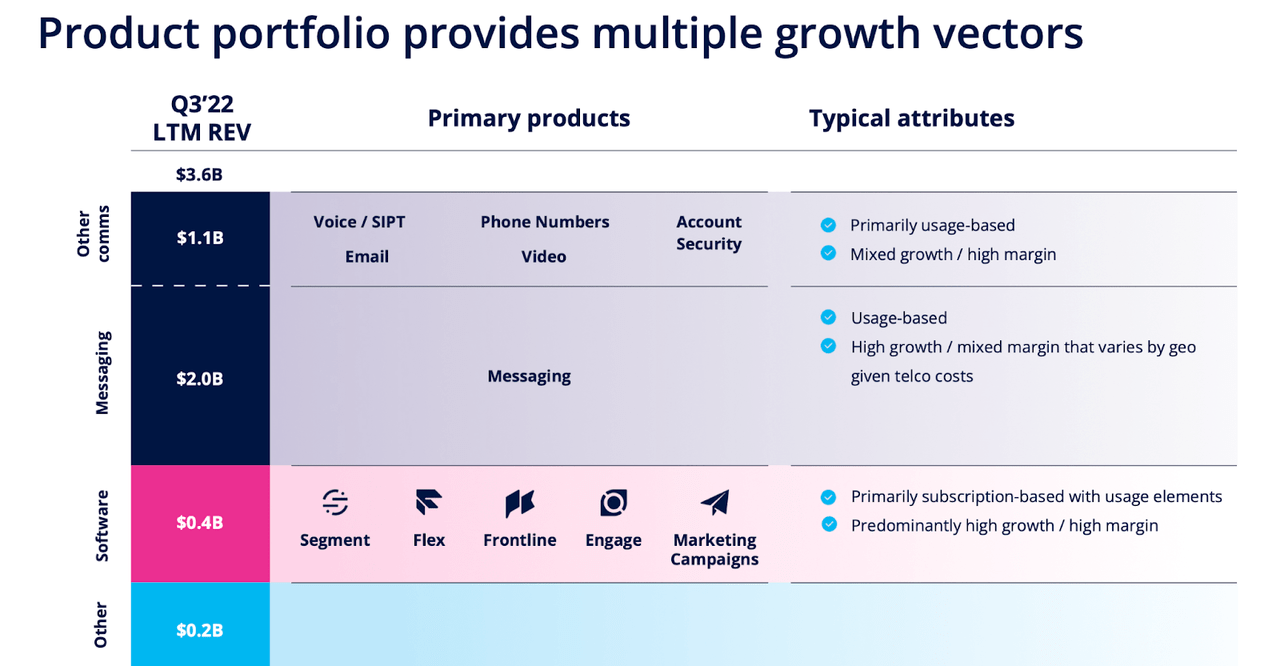

While revenue grew 33 percent, gross profit rose 25 percent as the company saw the strongest growth in its low-margin messaging business.

Q3 presentation of 2022

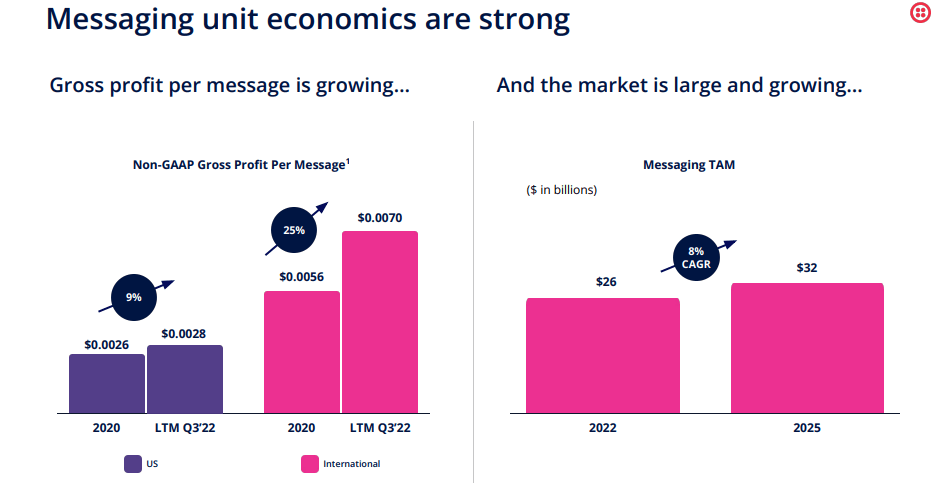

At the conference, management explained the difference as follows. Telephone carriers charge a TWLO fee to access their customers – that fee is passed on to customers. That access fee is especially high for international customers. Therefore, TWLO reports revenues including that fee, which has reduced gross margins for messaging revenues. Management believes that gross profit per message is a more important metric – it has increased significantly since 2020.

2022 Investors Day

TWLO widened its non-GAAP operating loss from $8.2 million to $35.1 million, reflecting higher headwinds in R&D and S&M.

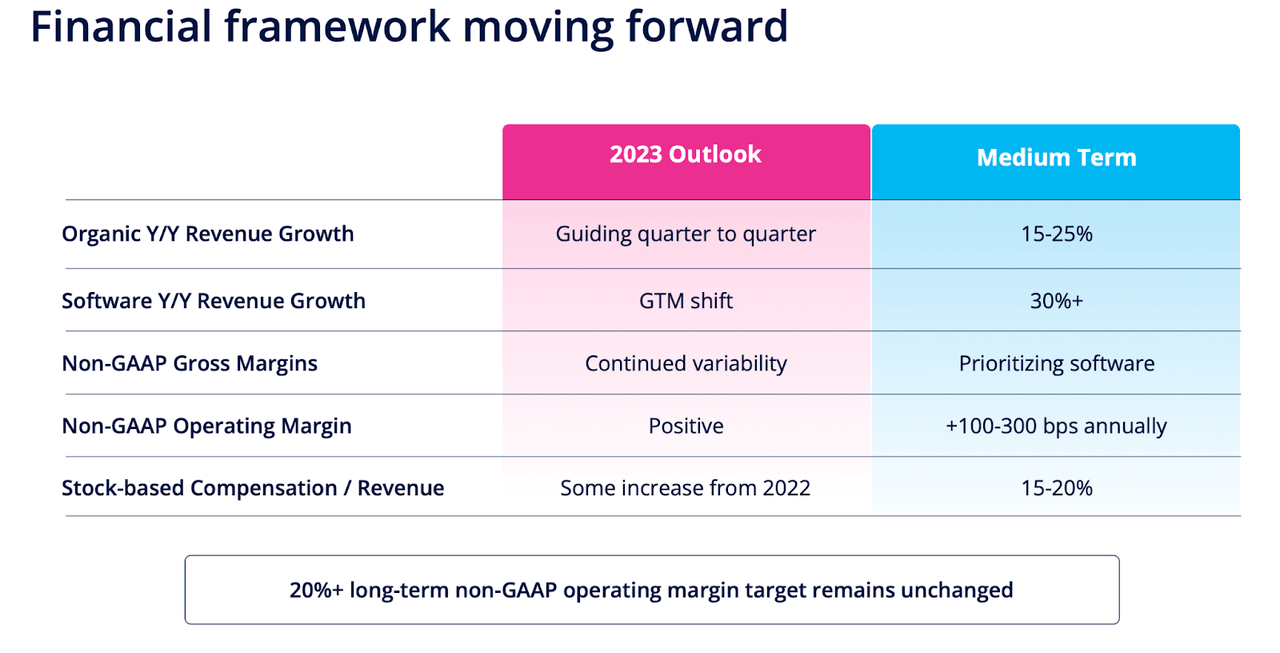

Looking ahead, TWLO guided for fourth quarter revenue growth of up to 19% and $15 million in non-GAAP losses. That pessimistic outlook came with an even more pessimistic medium-term outlook, as TWLO abandoned its previous 30+% guidance and instead guided for 15% to 25% organic revenue growth over the medium term. That attitude comes as the company looks to shift from a primarily consumption-based pricing model to a subscription model. TWLO expects software revenue to grow faster than 30%, but it will take time for software revenue to become a larger portion of total revenue.

Q3 presentation of 2022

On the call, management blamed “current macro headwinds” for the downbeat outlook. That improved macro picture seemed to indicate that it could lead to an acceleration in the medium-term growth outlook, but management stopped short of stating this directly. The market sold off heavily on the report, indicating that the guidance cut was already somewhat expected, but the stock’s fall after the earnings release indicated that the size of the guidance cut was surprising.

TWLO ended the quarter with $987 million in debt and $4.2 billion in debt (this ignores the $750 million equity investment in Synverse.) That $3.2 billion net cash position is about 38% of its current market value. That strong balance sheet is all the more interesting given that management has said it will report non-GAAP profitability starting next year.

Is TWLO stock to buy, sell or hold?

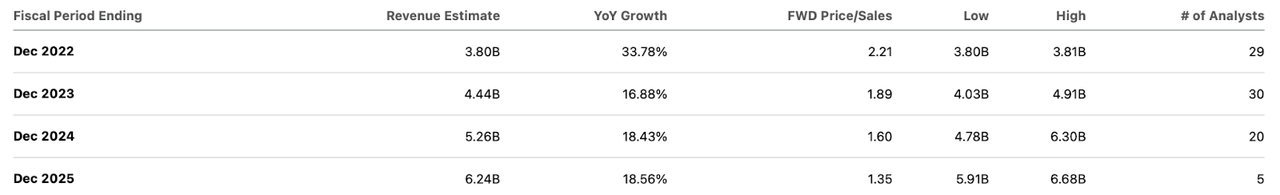

The reduction in guidance was a poor development, but I would argue that going into the report it was already priced in. TWLO is now trading at 5x gross profit and 2.4x sales.

Seeking Alpha

With reviews – and expectations – effectively rebooting, I like TWLO’s current setup. Management has long guided 20% operating margins. At 18% growth and a 1.5x price to earnings growth ratio (‘PEG ratio’), I see a fair value of around 5.4x sales or $114 per share. When growth returns and the company performs in a manner that demonstrates profitability (showing high multiples), it can be described as upside.

I continue to find TWLO taking advantage of global growth drivers to improve communication with customers known as Communication Platform as a Service (‘CPaas’). Companies are constantly looking for ways to connect with customers and drive higher sales conversions – TWLO products help satisfy those goals in the digital world.

Q3 presentation of 2022

With the stock so cheap, is management considering a share buyback? Management had the following to say about the share buyback program:

I think it was important for us to have a fort balance sheet. That’s why we have the amount of money we do. I really think during recessionary times; Otherwise, it is better to be more cash rich. That said, as we become more profitable and start generating free cash flow, I think historically we’ve done M&A, but I think you’re right that the stock buyback certainly has different directions it can take. It’s not something I take off the table. It won’t take a tick then, that’s something we’re definitely planning, but I think it should be on the options list.

While TWLO is not yet profitable on a GAAP basis, its large net cash position, modest cash burn, and commitment to non-GAAP profitability next year help significantly reduce the company’s financial risk. Couple that with a risk-free valuation and the stock looks very compelling here.

What are the main risks? Similar to how Meta Platforms ( META ) was negatively impacted by Apple’s ( AAPL ) data privacy changes, TWLO could be negatively impacted if AAPL (or Alphabet ( GOOGL ) for that matter) change the way they identify spam for text messages. TWLO also has a much lower gross margin than its technology peers, with gross margin standing at 47 percent in the most recent quarter. TWLO expects gross margins to improve over time, but the road to profitability (and higher margins for that matter) may be more difficult than peers with higher gross margins. Unlike cloud-based enterprise technology companies, where gross margins are inherently incremental, TWLO has always had to share a portion of its revenue with telecom service providers. In addition to these risks, I see TWLO as a company that will benefit from long-term structural trends as customer relations go digital. As we’ve discussed with Best Seed Growth Stocks subscribers, the best way to take advantage of a tech stock crash is to invest in carefully crafted tech stocks. I continue to rate TWLO as a strong buy and worthy of being a core holding in such a portfolio.

[ad_2]

Source link