Vermont Business Magazine Citizens announced Friday that the National Citizens Business Conditions Index (CBCI) fell to 52.9 in the second quarter of 2022, down from an eight-year high of 59.5 at the end of the first quarter, but extending its streak above 50 to seven straight quarters. , indicates the conditions of continued growth for businesses. Citizens Bank has branches throughout Vermont.

Business activity remains healthy, but clearly slowing from the previous quarter. This could reflect that the economy is returning to a more sustainable level – or it could indicate that conditions are set to worsen. Consumer price inflation continued to rise quarterly, reaching an annual rate of 9.1% in the June report. The Federal Reserve (Fed) raised interest rates twice during the quarter. The Treasury market showed signs of bearishness as the spread between 2-year and 10-year bond yields fell below zero. Consumer sentiment has hit new lows. However, spending continued as pent-up demand from Covid restrictions continued to push economic activity.

“We are seeing several currents in the area. Anxiety levels are high, but the outlook of individuals is still good,” said Eric Merlis, managing director of global markets, Citizens. “Companies are still maintaining growth and positive momentum, and consumers are showing strength. We see markets trying to reconcile expectations with these conflicting signals.”

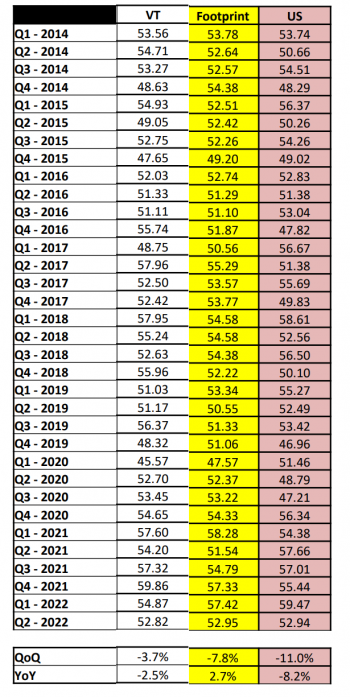

Citizens announced Friday that VT data in the most recent Citizens Business Conditions Index (CBCI) fell from the previous quarter (see chart) — but less than the national decline.

Citizens announced Friday that VT data in the most recent Citizens Business Conditions Index (CBCI) fell from the previous quarter (see chart) — but less than the national decline.

Three of the five index components were added in the second quarter, another sign of positive moderating activity after five-five in Q1. The Institute for Supply Management’s manufacturing and manufacturing indexes showed expansionary territory. However, they have also moderated since Q1. Around the first quarter of 2021, the manufacturing index peaked as the Covid recovery was at full speed. The non-manufacturing index reached a peak in the fourth quarter of 2021.

The index also showed continued strength in the ownership activity of the bank’s commercial banking customers, another fundamental component of CBCI. On the other hand, applications for new business formations decreased during the period, indicating a reduction from the CBCI and a pause from Q1.

Meanwhile, employment trends were neutral for the time being. This is particularly noteworthy at a time when growth is slowing and fears of recession are heightened. After an unexpected drop in GDP in the first quarter, a contraction in the second quarter could signal a recession, according to the standard definition. A typical recession is accompanied by a weak labor market and high unemployment – but the situation can be different in an area where the labor market is already facing labor shortages. If the U.S. experiences a “jobs-driven” recession, consumer activity could be buoyed — more so than a traditional recession.

While the path of inflation remains uncertain, this level of business activity is likely to be sustainable. As policymakers continue to tighten monetary policy and supply chain pressures ease, the inflation outlook may gradually moderate.

“Given the current market volatility and the federal government’s efforts to rein in inflation, it is not surprising that it has come down from last quarter’s peak,” Merlis added. “We may be at a sustainable level of business activity, but there are still headwinds to the activity.”

The index draws from public data and proprietary corporate data to form a unique view of business conditions across the country. An index value above 50 indicates expansion and indicates positive business activity for the next quarter. For more information on this last quarter’s index, please visit here.

Preparing your company for the economic cycle

Every company faces challenges and opportunities throughout the life cycle of a business, but there are certain strategies that most companies should consider when facing an economic downturn or recession.

Most companies have focused on downsizing during the pandemic, and many have raised excess capital to maintain liquidity.

Now, many middle-market and mid-sized corporate businesses are in a stronger position to face another economic cycle, but business leaders still need to consider measures to prepare for further price increases and manage inflation.

Here are five tips from Steve Woods – EVP and Head of Corporate Banking:

- Separate sources of income

Diversifying income streams can help stabilize cash flow during downturns. One of the best ways to diversify revenue streams is through mergers or acquisitions. Find a target that can act as an effective hedge if your market is disrupted.

- Assess your current cash flow

A cash flow assessment should go back at least as far as the pandemic to demonstrate your company’s resilience and give you valuable insight into potential obstacles for you and your financial partners.

- Lock in costs when possible

Solutions help provide certainty in volatile interest rate and foreign exchange rate environments. Commodity hedges can also be locked in as hedges to hedge against inflation.

- Difference between types of expenses

Maintenance costs are how much the company spends to maintain the current level. Development costs are new capital expenditures that typically result in revenue growth or margin expansion.

- Accept automatic payment solutions

Reviewing financial processes and procedures such as invoicing and adjustment areas can help streamline operations and eliminate unnecessary costs.

A wide range of solutions are available to automate and time payments to help your company maximize cash flow.

Nationally, the index fell to 52.9 in the second quarter of 2022, down from an eight-year high of 59.5 at the end of the first quarter, but extending its streak above 50 to seven straight quarters, signaling continued growth conditions for businesses. Business activity remains healthy, but clearly slowing from the previous quarter.

Earlier, the Treasury market signaled recession as the spread between 2-year and 10-year bond yields fell below zero. Consumer sentiment has hit new lows. However, spending continued as pent-up demand from Covid restrictions continued to push economic activity. The Federal Reserve is expected to continue its campaign against inflation by cutting interest rates sharply at a meeting today. Tomorrow may bring GDP news that suggests the US economy contracted for the second quarter in a row. Combined with this regional index, the economy may be returning to sustainable levels – or conditions are set to worsen.

7.29.2022. Supply, RI – Citizens Bank