[ad_1]

kosmos111

Co-produced with Williams Equity Research

On January 6, 2023, Newtek (NASDAQ:NEWT) announced it had completed its acquisition of National Bank of New York City.

The latter, a nationwide financial institution, is 59 years old. Asset manager Newtek, meanwhile, only took off at the turn of the century. 1998, to be precise.

Perhaps that relative “new kid on the block” status is why it took so long for the deal to close. The two entities first announced their intentions on August 2, 2021, more than five quarters ago. They were waiting to receive approval from the Office of Comptroller of Currency (OCC).

Some More Facts and Figures to Know About Newtek

I interviewed CEO, President, and founder Barry Sloan on January 12. It was a great conversation, including his assertion that the company is set to expand significantly from here.

He also had this descriptive commentary I’ll share:

“… historically, as a non-bank, we were the largest non-bank SBA 7(A) lender in the United States. We also did other types of loans that were always business loans… what we’ve learned from being an SBA lender for 20 years [is] we always take personal guarantees and everybody that owns 20% of the business are greater. We take the personal assets and lean them, we take the business assets and lean them, but we offer the borrower no covenants and we offer them a long-term AM schedule with no balloons. So the borrowers love our loans, whether they’re in an SBA format or in a C&I format, because we give them total flexibility and they pay a higher rate for that. Because of that, our returns on equity for that business are between 20% to 30%.”

I’ll quote that interview further as we go along. But I also want to acknowledge how we wrote about Newtek shortly after the drama began – drama that included it shocking:

“… investors with an announcement [that it would] be converting from a BDC [business development company] to a bank holding company. A similarly surprising event occurred in 2014 when Newtek converted to a BDC.”

That was another issue at hand.

The August 2021 article was unusually popular relative to NEWT’s market cap and investor base, receiving 150 comments. That’s probably because of the response below:

Seeking Alpha

But we had to address it considering how iREIT on Alpha was extremely and consistently bullish on NEWT in early 2020 as the shutdowns set in.

TD Ameritrade

These transactions – purchases at $7.62 and $9.82 on the same day in March of 2020 – are from my personal TD Ameritrade account. I know subscribers appreciate “walking the walk,” so there’s proof that I did.

The Source of Newtek’s Share-Plummeting Problem

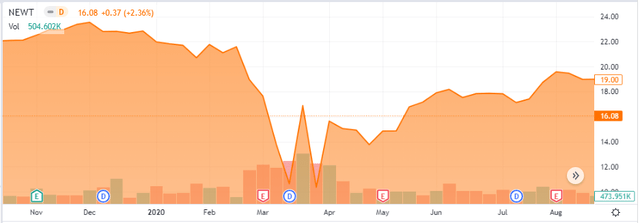

Seeking Alpha

Notice the chart doesn’t indicate the stock ever traded in the single digits. Yet I made multiple purchases below $10.

TD Ameritrade

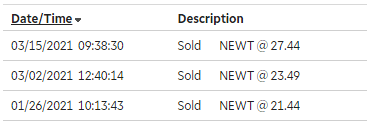

I exited most of my position in the $20s and early $30s about a year later. That turned out to be good timing, though far from perfect. But I’ll take the win regardless.

Since that August article, NEWT has generated a -32.6% return. That compares to -13.2% for the S&P 500 over the same period.

While I considered the stock overpriced at the time I sold it… I didn’t expect it to eventually reach $15 per share.

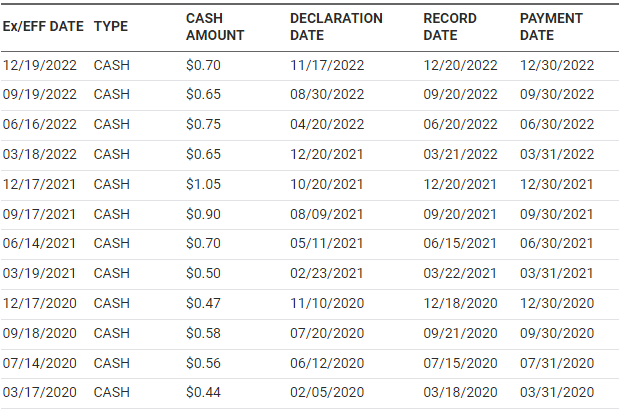

Nasdaq

This is especially true considering how the stock’s annual dividend rose from $2.05 in 2020 to $3.15 in 2021. It landed at $2.75 in 2022.

Keep in mind that NEWT had non-recurring gains from PPP loans during part of 2020 and 2021.

Also consider this: Even excluding 2021’s miraculous performance, NEWT’s annual dividend rose 34.2% from 2020 to 2022. That’s not a dividend growth rate you’d correlate with a stock that’s down more than the market.

So what’s the issue?

I’d say it’s a very common market foe: the problem of uncertainty.

In this specific case, investors were borderline terrified by the uncertainty. What would the new firm look like? Would it pay a decent dividend? Will other dividend investors like me bail on the stock before I do?

Those questions remained for quarter after quarter after quarter (after quarter after quarter). But we finally have great insight into what the combined firm will look like.

Newtek December 2022 Update

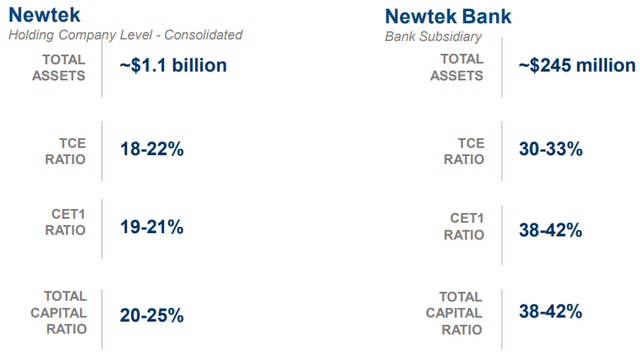

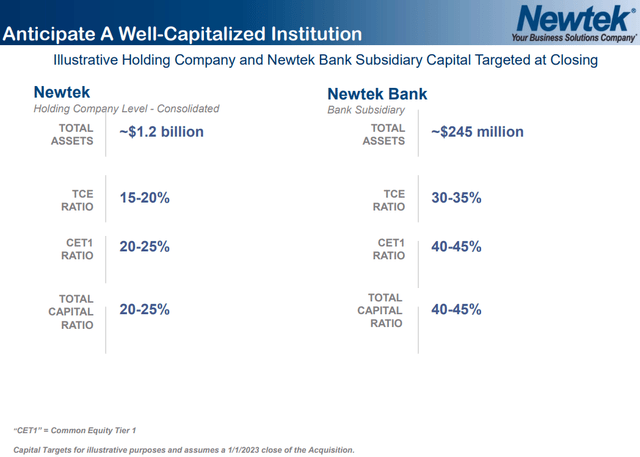

The new Newtek bank has notably lower leverage than the old entity. Let’s explore how…

Clarity on the Combined Firm

Below are management’s expectations for the same metrics as the last chart, just in Q2-22.

Newtek Q2 Presentation

In short, management has shifted toward a better capitalized/more conservative profile – possibly because of higher interest rates and changes in the credit/loan markets. Regardless, it’s valuable to see how management’s expectations have shifted.

So what can we expect from here?

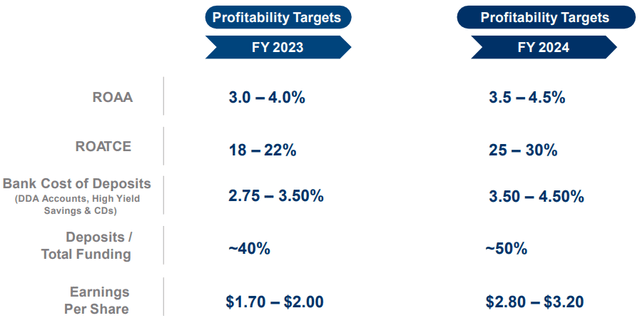

Newtek December 2022 Update

Return on average assets (ROAA) can be a puzzling accounting term, but it’s just what it sounds like. The initial ROAA midpoint on $1.1 billion assets equates to $38.5 million, or $1.85 per share.

As ROAA and return on average tangible common equity increase in 2024, expected earnings per share (“EPS”) grows to a midpoint of $3.0 per share.

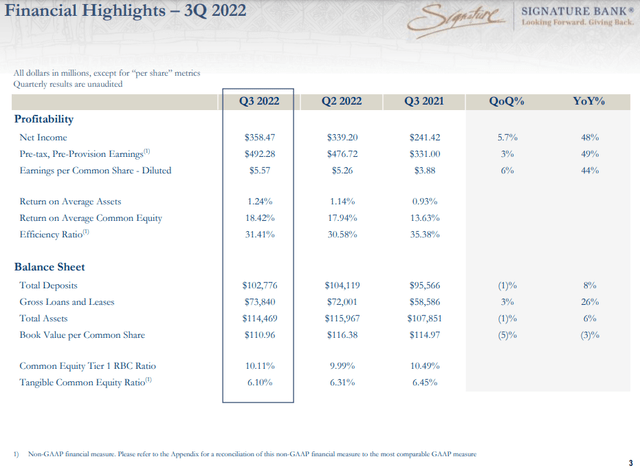

Unless you analyze banks on a regular basis, that might not mean much. But let’s put it in context with another bank we cover:

November 2022 Signature Bank Presentation

To be clear, Signature Bank‘s (SBNY) business isn’t the same as Newtek’s. High leverage with low-risk assets can be safer than low leverage with high-risk assets.

Still, we see many similar ratios between Newtek and Signature Bank. Though, Signature’s Q3-22 ROAA is half of Newtek’s initial target. And Newtek’s expected return on equity metrics are 10%-20% better.

That’s even better than it looks. For one thing, the combined Newtek has much safer capital ratios than Signature. It’s actually about twice as conservative.

Now, is it safer to obtain a 5% return by applying 50% leverage to a Treasury bond or to just buy corporate bonds yielding 5% with no leverage? There is no correct answer.

That said, this does give us a good comparison of how Newtek thinks the combined firm will perform. And it’s optimistic.

Let’s see if we agree…

Newtek’s Revenue and Cash Flow

Newtek’s revenue and cash flow are more difficult to model. But we’ll do our best with the information we do have.

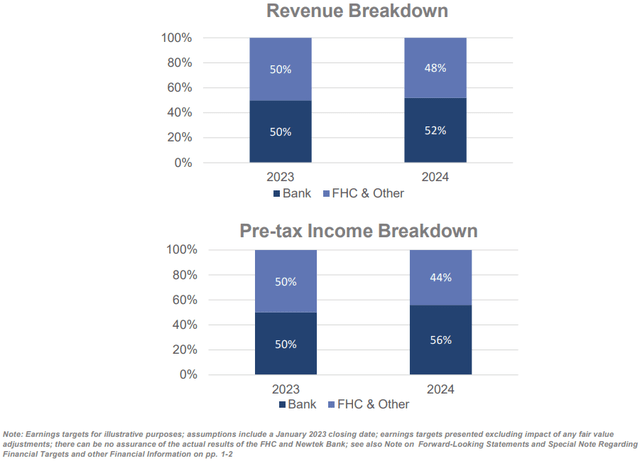

Newtek December 2022 Update

Newtek expects the bank to generate 50% of the firm’s revenue. That’s a big number and is important to consider from a valuation perspective. Newtek also expects the bank’s relative contribution to grow over time.

Using the midpoint for 2023, cash flow supports a 10.6% dividend (more about that topic soon enough) at the current stock price of $17.4. At the upper end of guidance, that’s 11.5%.

Banks, however, tend to have dividend payout ratios in the 25%-35% range, depending on their structure. Newtek will likely be on the higher end, so that’s a realistic yield of approximately 4% this year.

That’s 40%-50% higher than big banks like JPMorgan (JPM) and Wells Fargo (WFC). It’s equally greater than its more direct peers like Cullen/Frost (CFR) and Signature.

Then again, it’s also a lot lower than the current yield closer to 15%.

So… Given the market is forward-looking, what about 2024? It’s less than a year away, after all.

Using the midpoint estimates, the realistic dividend rises to 6%.

Since banks have different regulatory structures and opportunities than BDCs, how should we value the combined firm? Let’s give it a shot now that we have more information.

Assessing Newtek’s Valuation

Newtek’s consolidated firm is conveniently expecting 50% of revenue to come from its previous business model and the other half from its banking division. Since we’re still working with limited data, we’ll assume that correlates with profitability too.

Certainly, Sloane expects more business opportunities up ahead. As he told me:

“Now, owning the bank with lower cost of deposits, we will be able to offer your vanilla, multi-family, self-storage, very selective retail, very selective office maybe to a medical office, that may not have the PGs at tighter spreads. But it’ll be your classic 30% equity, high debt service coverage ratio, your typical CRE loan you can get anywhere else.

“But that’s to blend the portfolio and to be diversified. You can’t make a lot of money doing those loans today. That’s why banks trade that really lousy multiples of earnings and lousy multiples of book. That’s why we’ve experienced this as a BDC, now being able to lever more with lower cost deposits.

“You’re going to see, we put out an illustration in December, our return on average assets is between 3% or 4%. Our return on tangible common equity is between 18% to 25%. You don’t see that in a bank.”

SBNY is a very beaten-down bank right now, possibly because of its crypto exposure. It trades at 20.8x forward earnings estimates, whereas its larger sector trades at 15x-25x.

A 17.5x ratio would equate to $16.2 per share for the banking division alone in 2023. If we use 22.5x instead – which isn’t unreasonable given its profitability metrics detailed earlier – that’s $20.8 per share.

Just for the bank.

BDCs tend to trade for 9x-12x earnings and 0.9x-1.2x net asset value (NAV). Believe it or not, Newtek was consistently ranked #2 in terms of premium to NAV for years, behind only the legendary Main Street Capital (MAIN). That was partially due to extremely strong sector-leading cash flow growth.

September’s NAV was $16.04 per share. If we assume, as we did for the banking division, that’s half the company, we land at a minimum of $7.22 per share.

The bottom end of a cash flow multiple methodology is $13.65 per share. So the midpoint of those two is a reasonable proxy for the low end of what the business is worth.

(These are adjusted for the fact the BDC business is half the combined company.)

At the bare minimum, assuming management hits the low end of its 2023 full-year targets… Newtek is worth $10.44 alone and the bank is worth $16.2, or about $26.65 per share. That’s a 53% capital gain from current share prices.

Using the midpoint, that increases to $11.72 and $18.5, respectively, or about $30.22 combined.

Moving to halfway between management’s midpoint and top – plus the 1.2x NAV multiple – we arrive at $12.75 and $22.5, or $35.25.

Using 2024’s projections and the same system, we increase those numbers by 62.2%. Or $42.2 on the low end and $57.2 for the 1st quartile threshold estimate.

We think that’s a very fair range.

Discussing the Dividend Situation

During the interview with Sloane, we got to discussing the dividend situation – yet another aspect of the price-point panic we discussed toward the beginning of the article.

I’m going to share that entire segment of conversation, starting with my remarks:

“… I know you don’t have a huge analyst pool. And whatever analyst pool you do have, you’ve got a market cap of around under $400 million or so. So you’ve got only a few analysts, but it appears to me that the analyst estimates that I’m looking at right now are BDC estimates. So again, I know you’re not going to provide any guidance in terms of bank guidance, but what are your thoughts there? I feel like there’s a little bit of distortion, especially when you consider the BDC numbers that I’m looking at now.”

Here’s his response:

“From the day that we declared we have signed a contract to buy a bank in August 2021, the almost immediate headlines from all my BDC analyst friends (we have four of them basically) is the dividend’s going to be cut. Then every report they put out, that’s the headline. Dividend cut. Dividend cut. Dividend cut. That really does a lot of good for the [news] algorithms. The reality of it is we stopped giving forward guidance as a BDC. We stuck to a dividend quarter to quarter because we didn’t know when we were going to get approved. So there’s really no guidance out there.”

Yet people jumped to conclusions anyway. Unfortunately, they so often do.

A Key Consideration

Here’s another important element we haven’t talked about yet.

Management has stated it expects the new dividend to be classified as qualified. As a refresher, that means dividends are taxed at 15% instead of ordinary income rates.

You can find highly detailed coverage here, but the fundamentals are more easily explained. Assuming your household earns more than $83,000 and less than $517,000 (half that for individual filers), you’ll pay 15% on dividends in non-retirement accounts.

This isn’t a small thing.

BDCs, just like real estate investment trusts (REITs), are pass through companies. They don’t pay corporate taxes but pass the liability through to the typical investor.

That’s if it’s not partially (traditional IRA) or fully (Roth IRA) sheltered in a retirement account.

So someone in the 24% tax bracket earning $1,000 in dividends from a BDC or REIT keeps $760.

After NEWT’s conversion to a bank, he or she keeps $850 from the same investment. And if your household has taxable income greater than $190,750 ($95,375 for single filers), that delta is even more in your favor.

If you’re the kind of investors that considers a 7.5% yield a lot better than a 6%… you should feel the same way about switching to a qualified dividend.

In summary, investors in non-retirement accounts gain up to a 30% income boost due to the bank conversion and corresponding reclassification of the dividend to “qualified.”

In Conclusion…

We’re consistent advocates for long-term investing, and that’s particularly important here. Investors in Newtek should allow at least two years for:

- The firm to generate solid results post-conversion

- The market to recognize it.

That could take a while.

That said, Newtek remains a complicated but highly compelling investment case. We see 50%-75% capital gain potential in 2023 and 225% gains over a 2-3 year period.

And don’t forget this final important data point.

Yahoo Finance

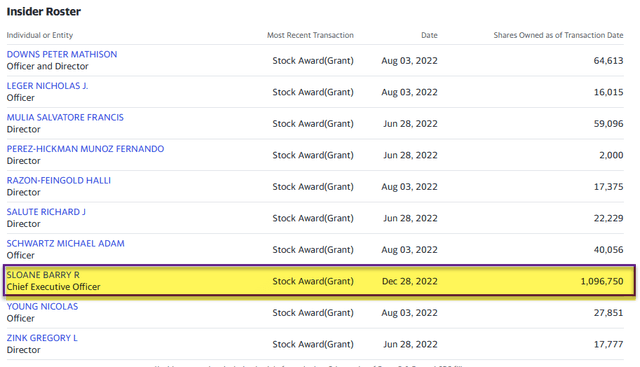

CEO Sloane owns 1.1 million shares, worth $19.1 million. In addition, as he told me in our recent interview. “Insiders own, in fact, 6% of all the outstanding shares.”

It’s never a good idea to follow insiders blindly. But this level of alignment with investors is rare.

Our guess is Mr. Sloan is quite motivated to prove the market wrong about Newtek.

Note from Brad Thomas: NEWT is now over 5% of my securities portfolio.

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while providing a forum for second-level thinking.

[ad_2]

Source link