[ad_1]

He says career is closed. It gave us $8 million in funding and a tight 12-slide deck. a lot To learn from the process. Not all in a good way but I’m getting a little ahead of myself.

We’re looking for more unique pitches to break down, so if you’d like to submit your own, here’s how to do that.

Slides on this floor

The team released this slide deck to investors in a memo as soon as it was available.

- Cover slide

- mission slide

- Problem slide

- The solution slider

- Section 1 of the drag slide

- Dragging slide part 2

- Business model slide

- Go to the market/customer funnel slide

- Customer rating and net advertiser results slide

- Market slide

- Group slide

- Thanks for the slide

Three things to love

What can you do to gain a place in the market? What are your marketing and customer acquisition channels? This question has only been partially answered by a professional, and that worries me a bit.

This deck set off a number of alarm bells for me – I’ll get to why in a moment – and I think the founding team faced an uphill battle pitching this to investors. Having said that, the company went through Y Combinator and was successful in raising $8 million from Catex, Exploration, Cold Start Ventures, Grant Park Ventures and others. Let’s try to find some clues as to why the company caught the eye of these investors.

If you have a drag, there is no problem

[Slide 5] Drag is king. Image Credits: Professional

Dragging really solves any problem a company might have. Building a company from half a million dollars to $12 million in revenue in four years is impressive, especially considering that to this point, according to its own press release, the company has raised $1.2 million in capital. Turning a $1.2 million investment into $12 million in revenue is enough to attract the attention of investors.

Finding an unusual customer

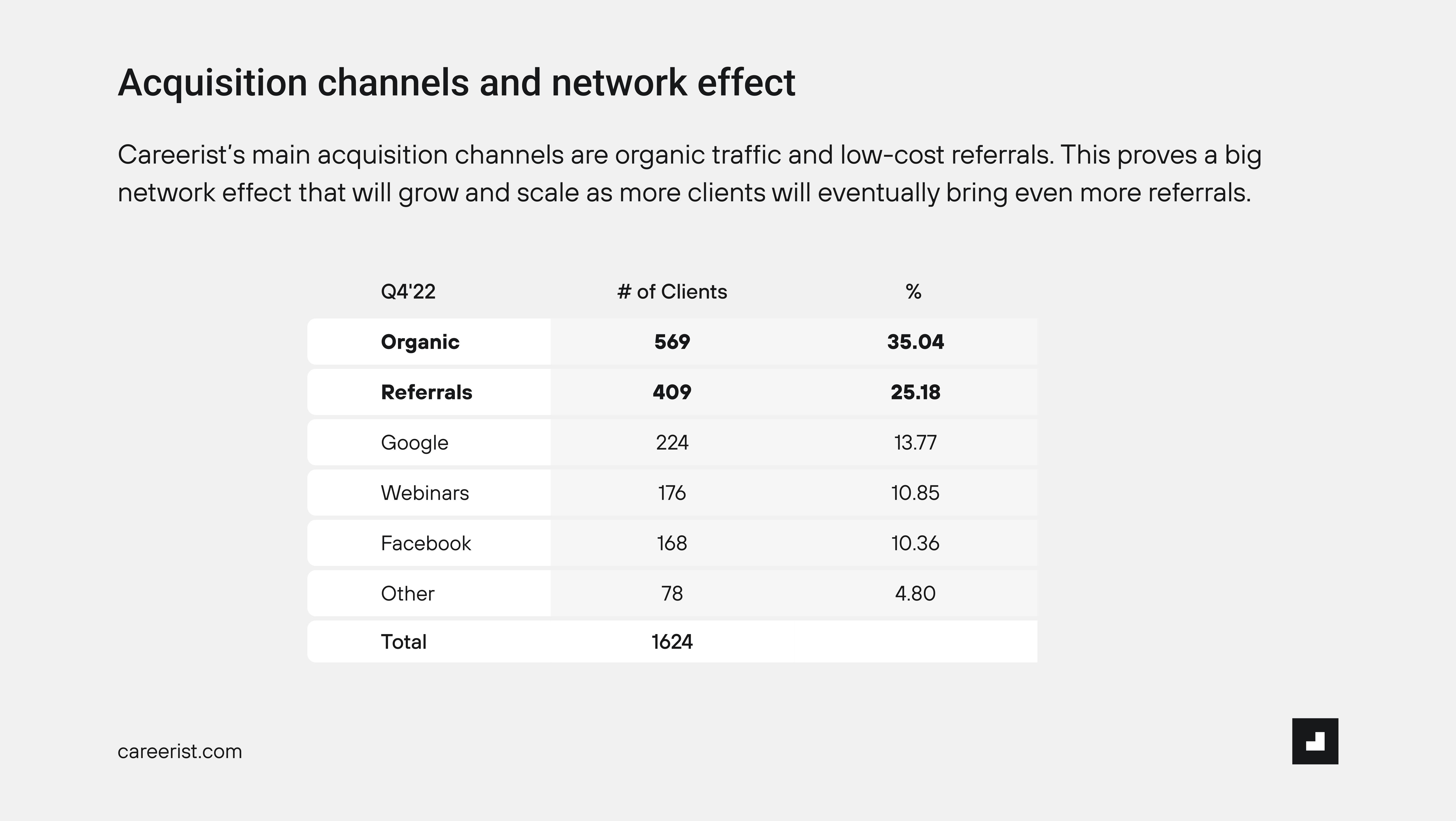

To drive that much revenue, you have to find your customers somewhere, and Professional seems to have cracked that nut:

[Slide 8] That’s some serious growth hacking. Image Credits: Professional

On the slide, the company says it gets 35% of its traffic organically and another 25% from referrals. Those are two extremely powerful, low-cost acquisition channels that drive rare, high-value customers. But that is a double-edged sword. Referrals generally scale well with other channels: if you get an average of 0.2 referrals and get 10 customers, you get two “free” customers because of the referral. The challenge is with organic traffic, which is very difficult to measure with interest. In other words, once you close $8 million in funding, how do you dramatically accelerate your sales?

It does not specify that the other channels (Google, webinars and Facebook) are paid acquisition channels. If they are, I would expect to see an analysis of the cost of acquisition (CAC), and whether these customers are referring additional customers. But overall, there’s a lot to like about this slide: having 1,600 customers paying you $12,000+ each (see slide 7 below) is truly impressive.

The best part is, you can actually check those numbers: The company says it has 1,600 customers and $19 million in revenue. That works out to about $12,000 per customer, ensuring that the number is internally consistent.

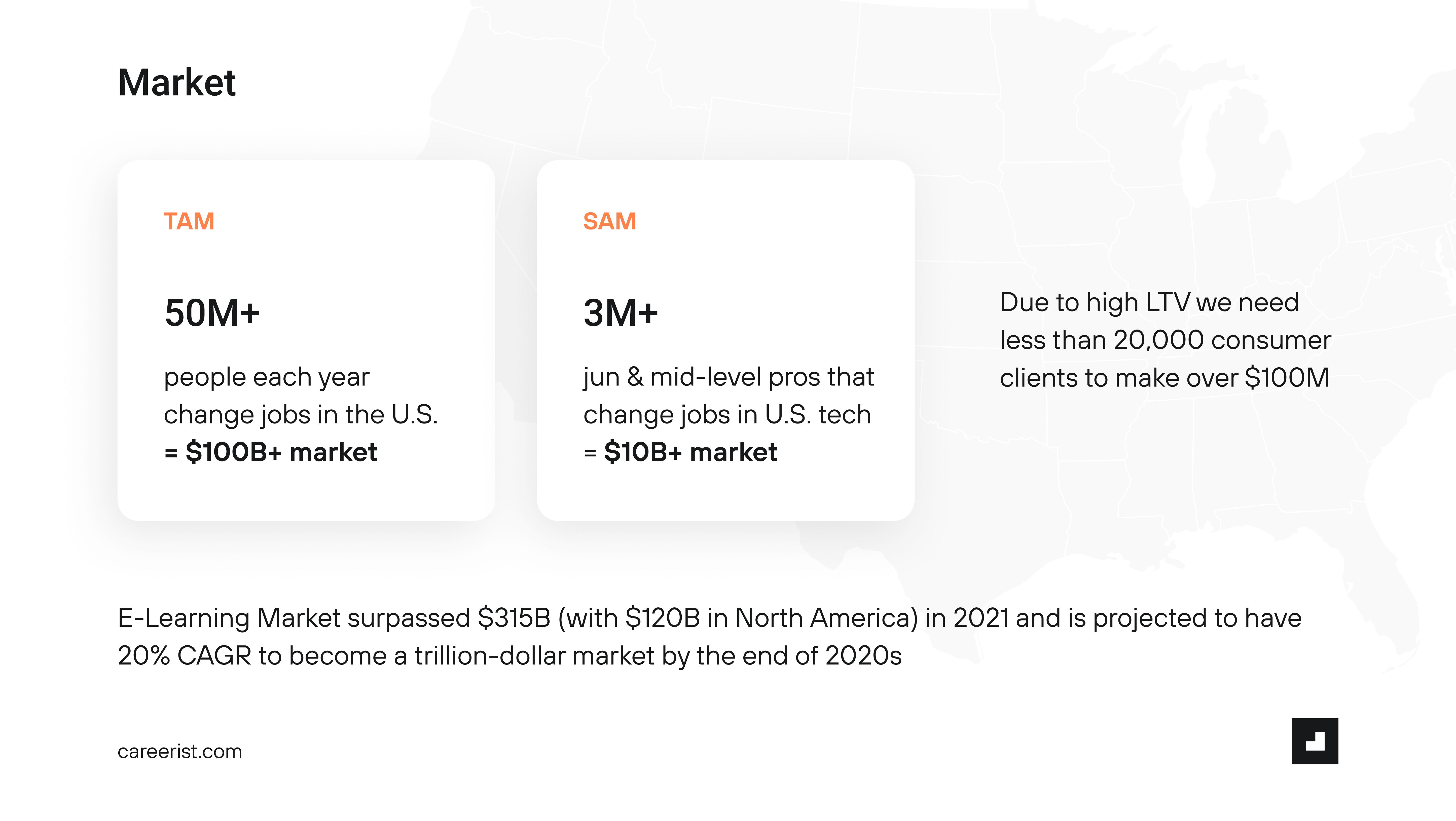

That’s one hell of a market size.

[Slide 10] E-learning is huge, finding jobs is popular and hiring the right staff is important. That all adds up. Image Credits: Professional

A careerist finds herself in a curious position here, with great opportunity. In fact, unless the company is seeing an extraordinary track record and lifetime value (LTV), these numbers are hard to believe. But in The pull in place, these numbers seem more or less convincing. Additionally, in truly massive markets (hiring, training, etc.), market size is like a checkbox.

One example of that is toothpaste: there’s no doubt that there’s a huge market for that, and no investor would argue with you about that. Then the questions become, “What can you do to gain a foothold in those markets?” They will be. and “What are your marketing and customer acquisition channels?” Professional only partially answers those questions, and that worries me a bit.

The above are some of the positives in Professional Plant Deck, but unfortunately, there are also a few Texas-sized red flags that make me wonder how successful the company is at raising money overall. I suspect the answer is as I tried to point out above. In the remainder of this tear, I’ll look at three things a professional could have improved or done differently, along with the entire pitching floor.

[ad_2]

Source link