[ad_1]

The pace of technological decline is creating ever-increasing insecurity for workers, but it’s also giving investors access to a new wave of technical and entrepreneurial talent.

There’s no easy test to determine which aspiring founder can turn their idea into a billion-dollar business, but VCs who know what questions to ask can uncover the right mindset, says Unlock Venture Partners co-founding partner Sanjay Reddy.

In this TC+ article, he shares an extensive list of questions to ask first-time founders to gauge their relative strengths and weaknesses across multiple vectors.

Full TechCrunch+ articles are available to members only.

Use discount code TCP PLUS ROUNDUP Save 20% on a one- or two-year subscription.

This post isn’t just aimed at VCs and angels: Reddy says the investor “trust is typically based on pattern recognition,” which means CEOs need to reliably answer specific questions like:

- “Why do you do this? Passion? Mission? Chip on the shoulder? Faith?”

- “Do you have control over your personal and business finances?”

- “How do you communicate your message to investors, colleagues, potential partners, etc.?”

There are many obstacles to starting a startup, but imposter syndrome shouldn’t be one of them. Anyone who can confidently answer the 20 questions in this post is ready to become an investor IMO.

Thanks so much for reading TC+, and have a great weekend.

Walter Thompson

Editorial Manager, TechCrunch+

@your main actor

3 tips for crypto startups to prepare for future compliance

Image Credits: Sorry (Opens in a new window) / Getty Images

Most startups can avoid getting into the weeds on legal issues before launching, but crypto companies are in a different boat. Faced with a tangle of state and federal laws, insufficient compliance can quickly create regulatory problems and undermine customer confidence.

In a TC+ post written by three lawyers from law firm Norton Rose Fulbright USLLP, the authors share some important information for any cryptocurrency startup operating in the US.

“By establishing a robust, risk-based compliance function… and following the latest regulatory guidance, cryptocurrency companies can better position themselves to weather the crypto winter,” they write.

4 Indian investors explain how their investment strategy has changed since 2021

Image Credits: Treasure (Opens in a new window) / Getty Images

For our latest survey, TechCrunch reporter Jagmeet Singh asked four Indian investors how their careers have changed since the onset of the global tech crash.

Venture capital funding in the region will “dry up in the second half of 2022,” so he asked about their current deal pace, what investment trends they’re seeing and how founders can access them.

- GV Ravishankar, Managing Director, Sequoia India

- Ashutosh Sharma, Head of India Investments, Process Ventures

- Vaibhav Domkundwar, CEO and Founder, Better Capital

- Roopan Aulakh, Managing Director, Pi Ventures

How a partner spent 8 years building a coffee empire

Image Credits: Haje camps (Opens in a new window) / TechCrunch (Opens in a new window)

Turning a college classroom project into a self-funded hardware startup takes a lot of work.

Partner first announced the launch of the Duo coffee maker with a Kickstarter campaign in 2013. Although that thing turned out to be a dud, Fellows now sells high-end kettles, grinders and other gear. Last summer, the San Francisco company announced a $30 million Series B round.

“In retrospect, it was the right call not to raise institutional money earlier. We’re only alive today because of this election,” CEO Jake Miller told TechCrunch+.

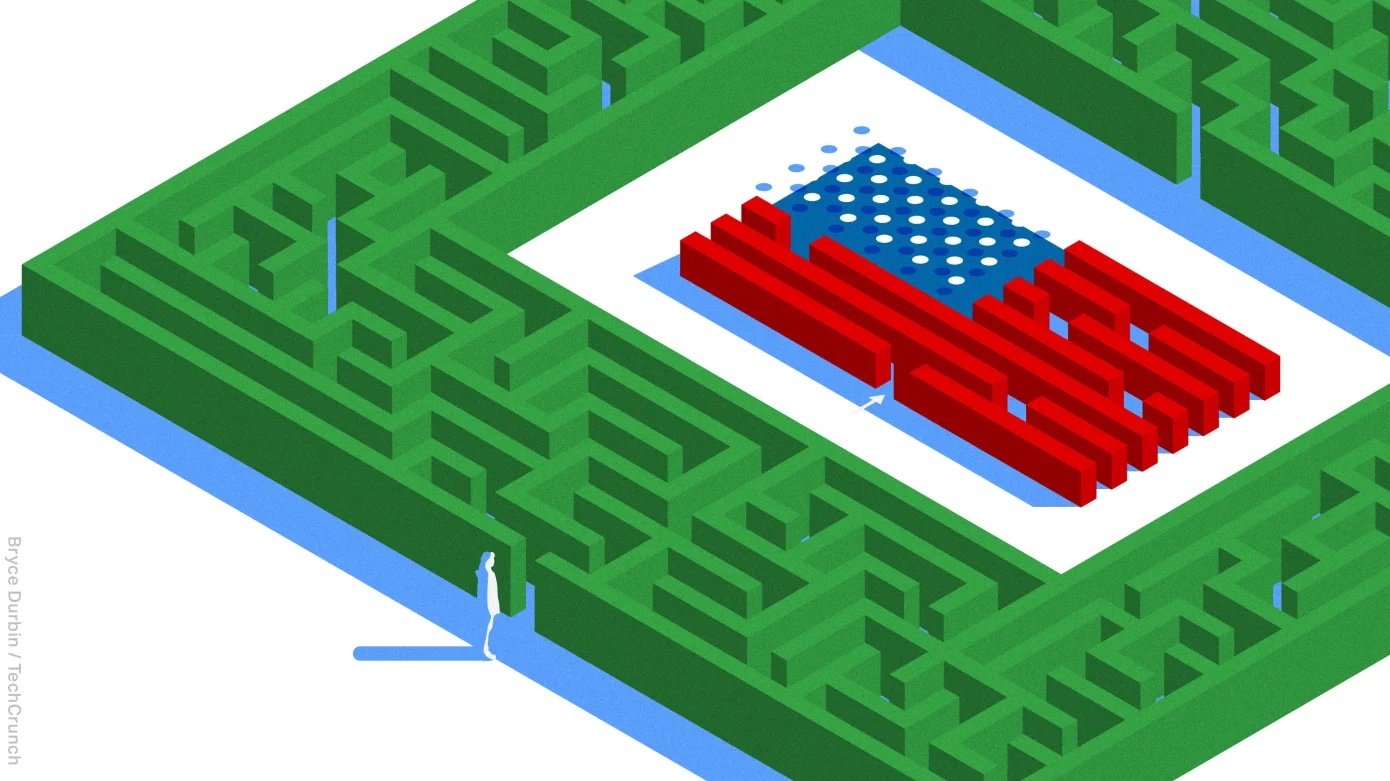

Ask Sophie: What visas allow us to expand our startup in the US?

Image Credits: Bryce Durbin / TechCrunch

Dear Sophie,

My co-founder and I started a B2B SaaS startup in Poland a few years ago, and now that the product market fits in a few countries in Europe, we’re looking to expand our market reach in the United States.

We really need to be on the ground to ask for our good users in the US. What visas allow us to do that?

– Planning America

Dear Sophie,

Can you please share details on the premium process for international student work permits?

– Psychological student

Pitch Deck Teardown: Prelaunch.com’s $1.5M Seed Deck

Image Credits: Prelaunch.com (Opens in a new window)

Earlier this week, Haje Jan Camps interviewed Prelaunch.com’s Narek Vardanyan to get his perspective on how hardware startups can validate products before they go to market.

In a follow-up, he analyzed the pitch deck from Prelaunch.com’s $1.5 million seed round, showing investors how the company monetizes product predictions:

- Cover slide

- Summary slide

- Market context slide

- Problem slide

- The solution slider

- Problem with the current solution slide

- Product Slide 1

- Results slide

- Product slide 2

- Product slide 3

- Product slide 4

- Vision slide

- Value proposition slide

- Dragging and sliding metrics

- Business model and price drift

- Market trends drift

- Why slide now

- Group slide

- Question slide

- Contact us slide.

[ad_2]

Source link