[ad_1]

Frequent readers know that I enjoy using illustrations, so I didn’t disappoint:

SaaS companies are leaky boats. If retention rates are not strong enough to overcome customer churn, they will take water until they sink.

Sid Jain, senior analyst at ChartMogul, conducted a survey of 2,100 companies and found that “more than half of SaaS businesses have lower sustainability in 2022 compared to 2021.

Full TechCrunch+ articles are available to members only

Use discount code TCP PLUS ROUNDUP One or two year subscription to save 20%

In this checklist, he compares net income retention rates by ARR range and identifies measures of product-market underperforming companies.

“What’s considered good net retention varies depending on the level of your business,” advises Jane. “Always consider the scale of your business when benchmarking.”

Thanks for reading TC+!

Walter Thompson

Editorial Manager, TechCrunch+

@your main actor

3 Ways to Boost Your Short Form Video and TikTok Growth Strategy

Image Credits: SOPA images (Opens in a new window) / Getty Images

With over one billion active monthly users, brands of all sizes are using TikTok to drive engagement.

But simply being on stage isn’t enough, writes development expert Jonathan Martinez. To give readers ideas for improving their short-form video strategy, he’s written a guide he “breaks down into three easy steps.”

- Competitor analysis

- Give ideas on content pillars

- Recruit creative talent

You are not raising money to increase your runway.

Image Credits: Siriporn Kaenseeya / EyeEm (Opens in a new window) / Getty Images

Raising money in an early-stage startup based on your projected burn rate is short-sighted — and unlikely to inspire investor confidence, says Haje Jan Kamp.

“Having clear KPIs that show progress against metrics you believe in (and, importantly, your board and prospective investors believe in) will unlock your next round of funding,” he writes.

Investors prefer debt over equity (but not venture debt).

Image Credits: Toshiro Shimada (Opens in a new window) / Getty Images

According to Jeremy Abelson and Jacob Sonnenberg of Irving Investors, a sharp decline in both VC activity and venture debt are the two main factors limiting fundraising and exit opportunities.

“Waiting for a rebound in public market multiples to maintain early valuations has not proven to be a good strategy, and now a growing number of large groups of companies are competing for a small amount of VC and crowdfunding capital,” they write.

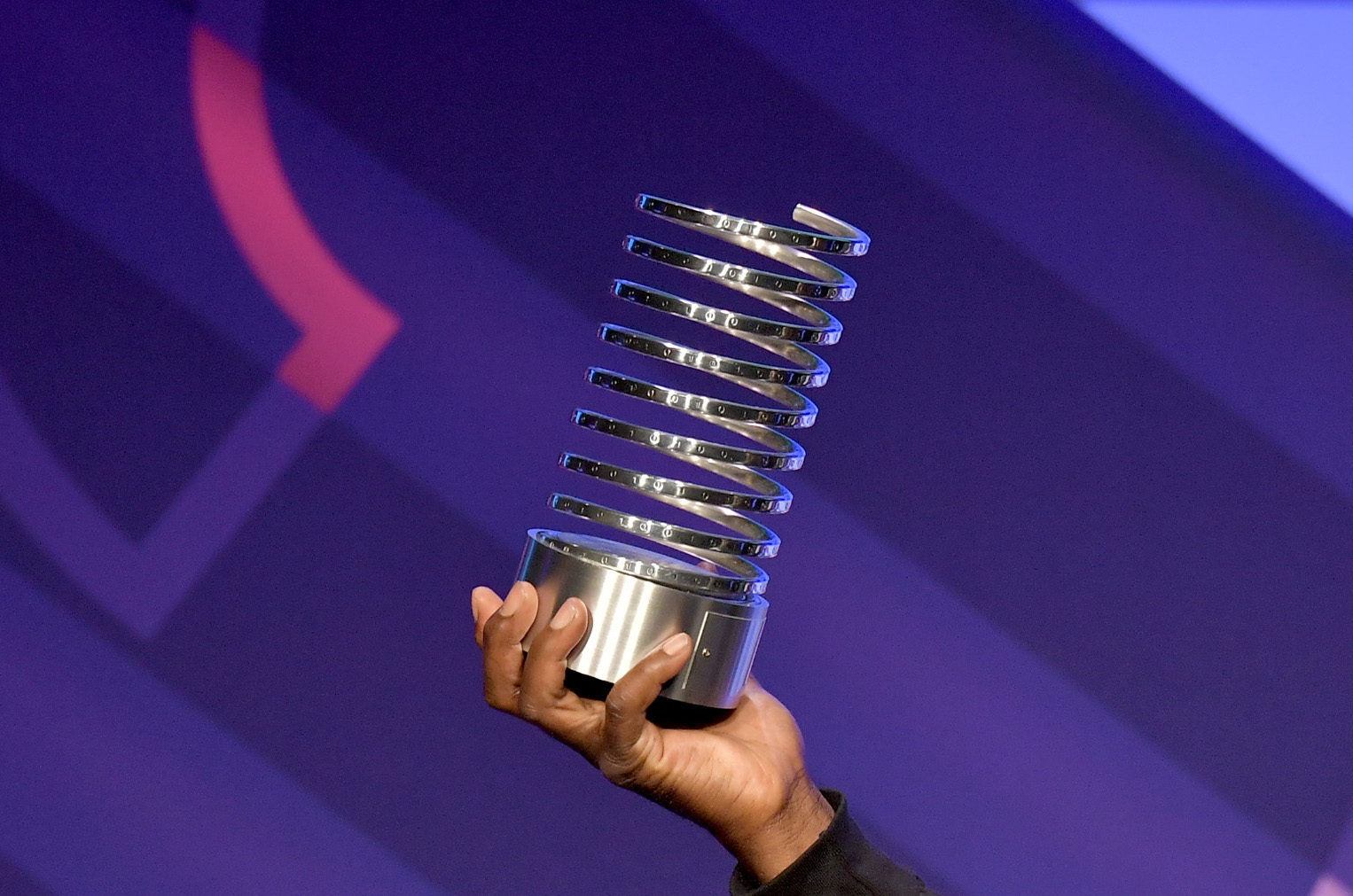

Vote for TechCrunch in the Webby Awards!

Image Credits: Michael Loccisano (Opens in a new window) / Getty Images (image edited)

Two TechCrunch podcasts, Chain Reaction and Found, were each nominated for a Webby Award in the Best Tech Podcast category.

Cast your vote before Thursday, April 20th!

Tech investors’ obsession with profits is waning.

Image Credits: z_wei (Opens in a new window) / Getty Images

Bessemer Venture Partners’ report of the Cloud 2023 suggests that investors who have shifted from a focus on growth to profitability are “still looking for growth,” writes Alex Wilhelm on TC+.

“For startup founders, the rapid change in investor preferences can feel like a whiplash,” he wrote.

But such an evolution in market preferences is actually quite logical and, frankly, somewhat boring how it plays out.

[ad_2]

Source link