[ad_1]

Fintech freight and logistics platform Denim, formerly known as Axel Payments, has raised a Series B funding round led by Pelion Venture Partners with Crosslink Capital, Anthemis, Trucks VC, FJ Labs, Tribeca Early Stage Partners and Reform Ventures at a “nine-figure” valuation. CEO and co-founder Bharath Krishnamoorthy told TechCrunch that the new cash, a combination of equity ($26 million) and debt ($100 million), will be used to grow the business and provide working capital to denim customers.

Krishnamoorthy and Denim’s other co-founder, Sean Vo, had been friends for 16 years before starting the company. Vo was in the credit risk division at Barclays and a full-stack developer at Fintria, a fintech company, while Krishnamoorthy was an associate at several law firms, including Gibson, Dunn & Crutcher.

“We saw a huge gap in the freight brokerage market, where legacy systems — ie paper checks, physical file — still existed, and we developed an intuitive payment technology to streamline brokers’ operations and attract the best carrier relationships through the platform,” Krishnamoorthy told TechCrunch in an email.

To that end, DENIM provides financial products, operational tools and automated workflows to freight brokers – intermediaries between shippers and carriers. The company handles brokers’ invoices, collections and payments and also offers debt financing.

“The industry has shown a reluctance to abandon its old processes – many shippers still pay freight brokers within 30-60 days, even though carriers expect immediate payments. These longer time frames can create cash flow problems,” added Krishnamurthy.

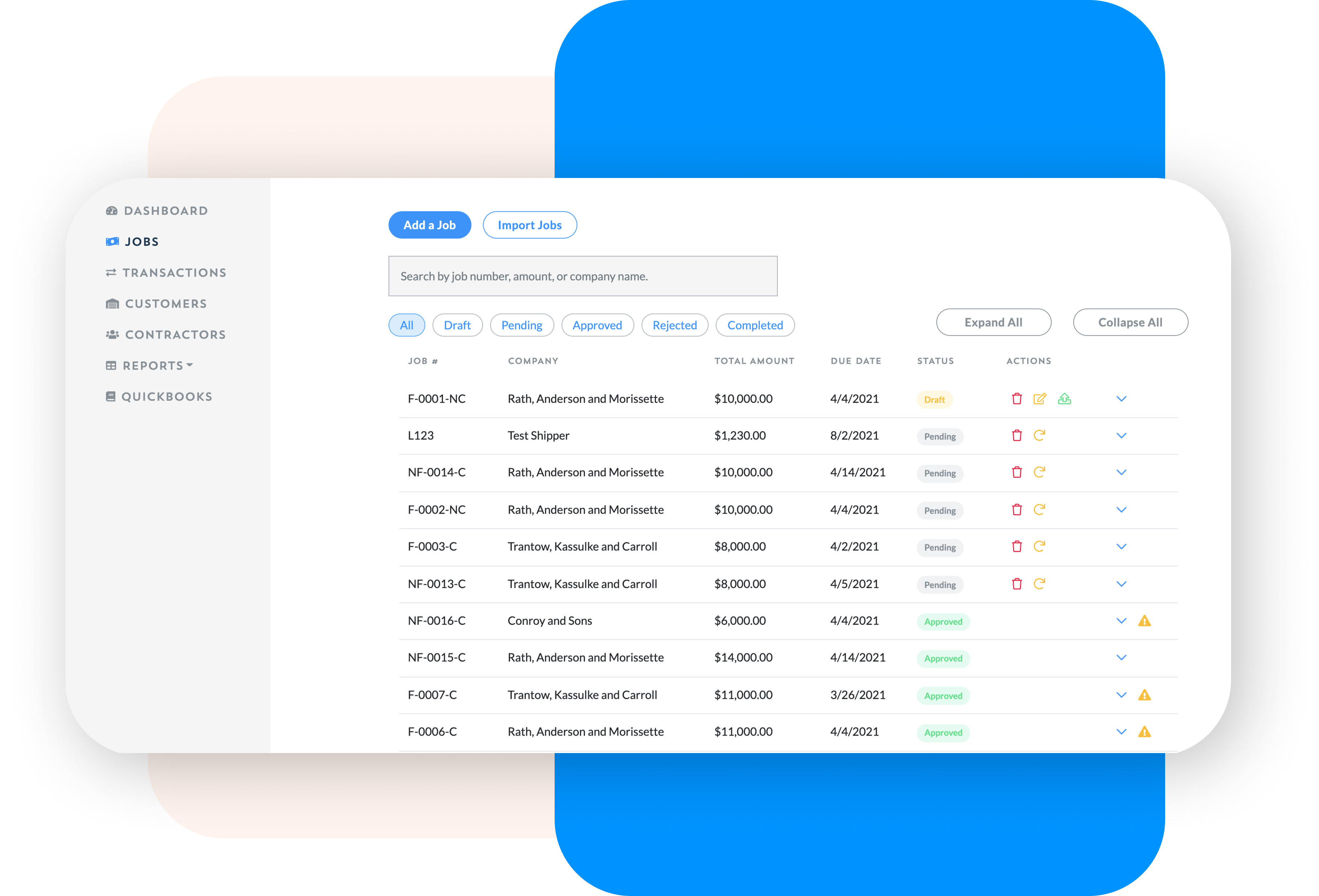

Managing operations in denim.

Denim uses algorithms to reduce the amount of time the operations team spends assessing the risk of receivables purchased from brokers. For each shipment, these algorithms evaluate 20 different data points and either approve the purchase or indicate the need for a manual review.

In addition, the Denim platform integrates with accounting software such as QuickBooks, allowing brokers to share data between different existing systems. From the dashboard, users can view metrics such as pending or completed jobs, total volumes, most frequently used service providers, and fastest paid customers.

“This enables a combination of automation, financial stability and accurate reporting Cargo Brokers and their partners to navigate the dynamic changes in the economy. And most importantly, it ensures that the entire supply chain is moving in the right direction,” Krishnamoorthy continued. In our current economic environment, companies cannot afford to ignore back-end risks and slow processes.

Denim competes with other fintech companies in the space, including TriumphPay, HaulPay and OTR Capital. Interestingly, Krishnamurthy declined to say how many customers the company currently has or where its revenue comes from. But since its launch three years ago, Denim has volunteered to connect more than 7,000 freight brokers, shippers and carriers.

“Despite the slowdown, Denim is uniquely positioned to continue growing its platform and workforce. We have established a financial model based on healthy unit economics,” said Krishnamoorthy. We are bringing new solutions to market so that freight brokers can seamlessly operate at full capacity and adapt to supply chain changes. And We’re hiring talent that aligns not only with our business goals, but with our core values.

Denim has 100 full-time employees and plans to reach 120 by the end of the year, supported in part by the new equity. To date, the startup has raised a total of $165 million.

[ad_2]

Source link