Welcome to The Interchange! If you received this in your inbox, thank you for your subscription and vote of confidence. If you are reading this as a post on our site, please register over here So you can receive it directly in the future. Every week, I look at the hottest fintech news from the previous week. This includes everything from funding rounds to trends to niche analysis to hot takes on a specific company or event. There’s a lot of fintech news out there and it’s my job to stay on top of it – and understand it – so you can stay informed. – Mary Ann

Hello and happy new year! I feel like it’s been a while since I sat down to write this newsletter. i miss!

Before I get into the news, I just wanted to say that I hope you all had a restful and enjoyable holiday. Ours was very low-key but not a bad thing. However, I’ll admit it took a while for my brain to get back into working mode this week…so bear with me.

I posted an article on Friday Door entranceA $21.5 million Series B raise. The story was among the most read on the site that day, more proof people Really Interested in technology related to the rental property market, especially when it comes to investing. Dorsted, meanwhile, says it’s more than a full-service property management company, guaranteeing landlords lower rents. If he can’t get the promised amount, he will make up the difference. If more is found, well, the owner gets the extra – not the company. Doorstead said it deliberately chose to make money by charging an 8% management fee so that its incentives matched the homeowners it served. By being willing to pay the difference, the company says it’s been able to reduce the amount of time rental properties sit empty. So homeowners are not only getting guaranteed rental income, but they’re also renting out their properties faster and making more money that way, say company founders Ryan Waliani and Jennifer Bronzo. Notably, Dorsted announced that it had acquired the Boston assets of another venture-backed firm, Knox Financial, which covered the 2021 increase. I don’t have the details of what caused the latter company to go out of business, but in I suspect we will see more of this in 2023. And by “kind of like” I mean startups getting assets from other startups. Go here to hear the Equity Podcast staff’s thoughts on the Doorstead model.

We published an interview I did during the break. GGV CapitalHans Tung and Robin Lee during the fourth quarter. For those who don’t know, GGV is a venture firm with $9.2 billion in assets under management, from seed to growth stages across a variety of sectors including consumer, internet, enterprise/cloud and fintech. Some of the highlights of the interview include that Tung’s views are not the end of the world. He told me that a beginner would rather raise a round than close, and that in the end it’s the results that matter. Refreshing! They share some of their advice for their own portfolio companies. Meanwhile, Lee gives her thoughts on why embedded fintech is hot.

In the year While I’m sure there will be more down rounds in 2022, Tung expects we’ll see more in 2023 as startups that grew in 2021 start running low on cash. I agree with his view that there is no shame in raising a bottom round. Valuations have been overvalued and any downward rounds announced this year will in most cases reflect valuations that are more realistic and easier to defend.

Burstead Co-Founders Ryan Waliani (CEO) and Jennifer Bronzo (COO) Image Credits: Door entrance

Weekly news

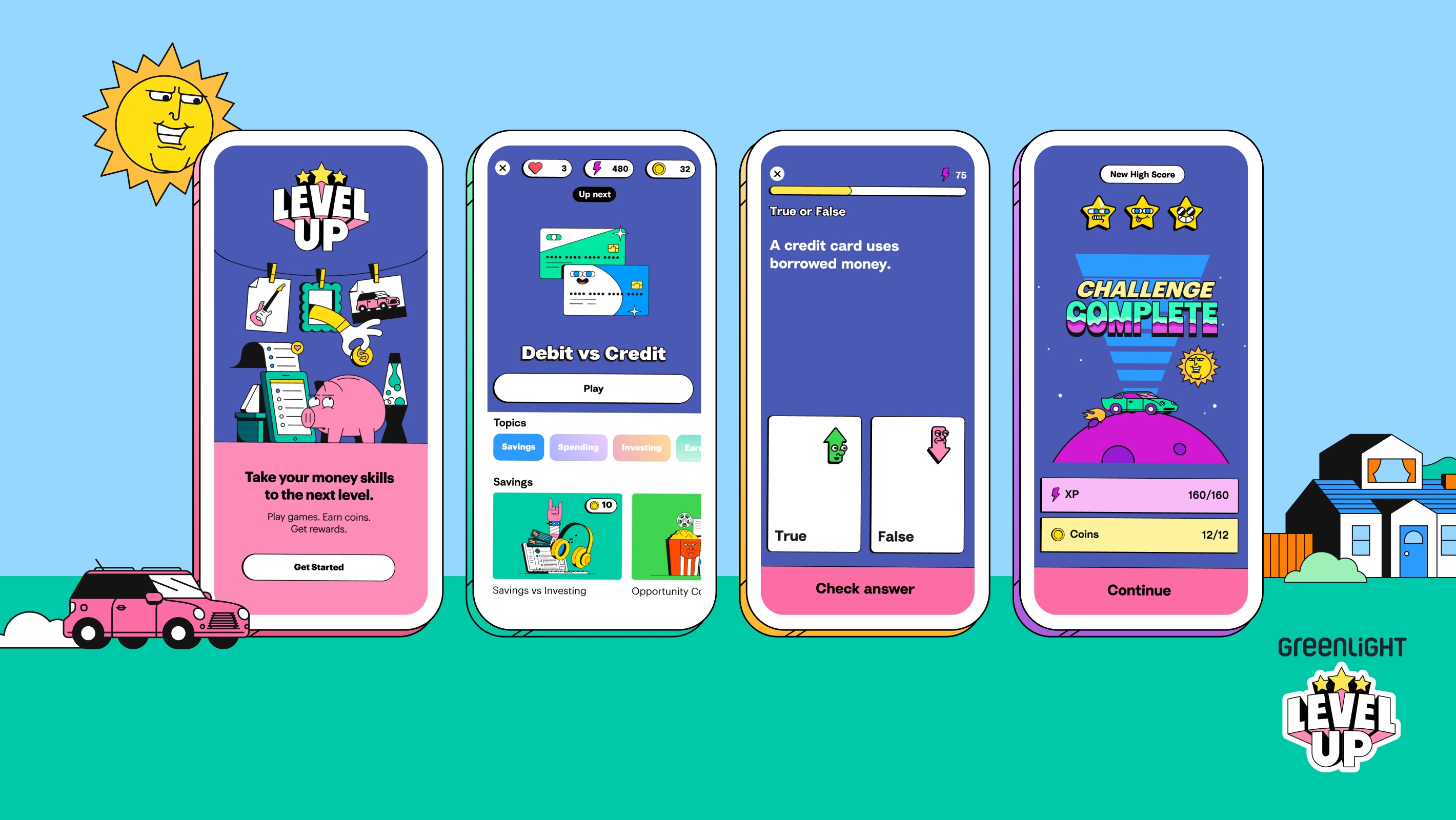

On January 6, a self-described family fintech Green light Greenlight Level Up, an interactive, curriculum-based financial literacy game launched. Clearly, the company is trying to appeal to the younger generation’s love of playing games digitally, although one has to guess how long it took to include the game in its offerings. A spokesperson told me via email: “Kids can earn virtual coins, practice points and engage in real-life money lessons through dynamic graphics, story-based gameplay and animations on their mobile phone or tablet – taking and applying gamification principles.” They can acquire one of the most important skills they will need for the rest of their lives. Of course, process finance is not a new concept. Last year, I wrote about Trust, one of the country’s largest financial institutions, acquiring fintech startup Long Game in an effort to appeal to a younger customer base.

Baas start Synthera He said he is getting married. compound (meaning “one” in Arabic), a digital Islamic investment platform that bills itself as the world’s first halal investment app. Synterra said it is providing the infrastructure for Wahd to reach its 3.5 million American Muslim followers.Wahd currently has more than 200,000 customers in the UK and Malaysia, and is using Synterra’s gift to build bank accounts and roll. It launched an app-linked debit card program for Muslim Americans. Specifically, a Synctera spokesperson told TechCrunch that “Wahd currently offers halal investments structured according to Islamic principles and standards to US clients. With Synctera, Wahd can offer its customers bank accounts (making funds easier and smoother) and debit cards (convenient access to funds). Syncterra CEO/Founder Peter Hazlehurst wrote in an email: “We’re excited to help Wahd launch banking products for US customers….We look forward to seeing mission-driven companies like Wahd use embedded banking to help people make their money better.” in the future.” In recent years, we’ve seen fintechs shape their offerings to cater to very specific demographics, such as Hispanics, blacks, Asian Americans, and immigrants in general. Only time will tell if such a focus will pay off.

Based in Boston Mendoza Ventures — which describes itself as a “female and Latinx-based fintech, AI, and cybersecurity venture capital” — announced its first close on $100 million in funding — its third. Unfortunately, the company won’t share how much it intends to invest yet, but in a press release it said the fund will “prioritize investing in early-stage growth with a focus on diverse founding teams.” Hi, we are always here for any initiative aimed at uplifting the various founding teams. In particular, Bank of America led the first closing, which included participation from Grasshopper Bank and other undisclosed investors.

To start the year, Happy ventureManaging Director Victoria Treger wrote a guest post for TechCrunch, giving her predictions and where she sees opportunities in the fintech space. Meanwhile, Bessemer Venture Partners’ Charles Birnbaum told us in an email that “when FedNow is finally scheduled to launch broadly in mid-2023, all eyes will be on opportunities around instant payments.” While the Clearing House’s RTP plan is modest to date, we expect FedNow’s use of its existing FedLine network to accelerate rapid payments adoption from 2023. Payroll, insurance payments, supplier payments, and more, and at the application layer for more seamless b2b and consumer payment experiences. It’s still showing institutional adoption of blockchain technology in financial services. For example, SWIFT says it will “continue to experiment with central bank digital currencies (CBDCs), while many banks have joined the USDF Consortium to facilitate the transfer of value on blockchains through bank-mined deposit stable coins (Statcoins).” He predicted that it would continue.

Speaking of blockchain, MercurioA crypto-focused startup that built a cross-border payments network has now launched a BaaS solution, which it says “unlocks a unique feature – the ability to manage bank and crypto accounts in one platform.” A company spokesperson told me in an email that the goal is to facilitate traditional banks opening crypto accounts for their users and to provide crypto platforms with a way to open bank accounts that allow their customers to store, transfer and pay in fiat. /crypto. I covered the company’s rise in June 2021.

It was great to see a startup I covered last year named the best invention of 2022. other It raised $18 million last May to grow its offering, which aims to help people build credit using recurring payment forms like digital subscriptions to Netflix, Spotify and Hulu. Personally, I’m a fan of the startup’s comprehensive credit-building efforts, which challenge the old credit scoring model here in the United States.

Last week, Darrell Etherington and Becca Skutack joined. Brakes Co-founder and CEO Henrique Dubugras joins him and co-founder Pedro Francesci to discuss why the two friends who met online as teenagers decided to launch the corporate card company and become co-CEOs. Other things.

According to payment transparency tracker Comprehensive.io; Scratch It is not clear exactly about the payment. The fintech giant does not include salary ranges in its CA or NYC job postings. The tracker also found that a strategic account executive at fintech startup Bolt can do it – are you ready for it? – $374,000 to $462,000 OTE/year. (If you see me right now, I’m doing Kevin in “Home Alone” with a shocked face.)

As reported by Manish Singh: “Suhail Sameer, the BharatpeThe Indian fintech startup will step down from the top role later this week as it struggles to steer the ship after firing its founder last year over allegations he misused the company’s funds. More here.

Image Credits: Green light

Funding and M&A

While we’re not seeing many megaarounds in the fintech space here in America, TechCrunch’s Manish Singh reports that India has seen two significant developments in the fintech world in recent weeks.

India’s fintech fund vision given $900 million in fresh funding.

India’s fintech CreditB is close to raising $700 million in new funding.

Meanwhile, in South Korea, fintech TOS has raised its valuation to $7 billion.

South Korean financial super app TOS closes $405M Series G as price rises 7%.

Other funding deals reported on the TC site include:

Jinger started working undercover to lend money to companies for software

Fintech Vint hopes to transform wine and spirits into a mainstream asset class

Early-stage Mexican fintech Aviva is making loans as easy as video calls.

And elsewhere:

Saudi startup Manafa has raised $28 million for expansion

And that’s a wrap. I’m not usually one for decisions but I can say I I’m trying to start this year off better. The past year has been challenging in many ways, but it doesn’t help to be negative or doom and gloom. There is still much to be glad and thankful for. So my wish for 2023 is more resilience and optimism for all of us because we can’t always control what happens. can Control how we respond. Thanks again for your reading and support. I’m always here for your feedback! Until next week…xoxoxo Mary Ann