[ad_1]

we are

The iShares Expanded Tech Sector ETF (NYSEARCA: IGM) is not a liar. It has more components than the iShares S&P 500 Growth ETF (IVW) and focuses more on mid-cap technology: It is spread. Where is mid-cap tech? More consumer-facing tech stocks lie. Those are more vulnerable to the risk factors that we see in the current economic situation, and they have already seen the underlying disease. However, if we were to take technology exposure, we would prefer the deeper tool as the math is in the rear view mirror despite the same multiplier. But neither is particularly comfortable in the current environment.

Division of the IGM

IGM has 330 holdings compared to 246 from IVW. Exposures are very similar in terms of order. Apple ( AAPL ) is being followed by other tech megacaps trading on US exchanges. What we notice is the difference in weight. As it expands, IGM will weigh more heavily into smaller capitalizations in the technology space, digging deeper into the US tech barrel.

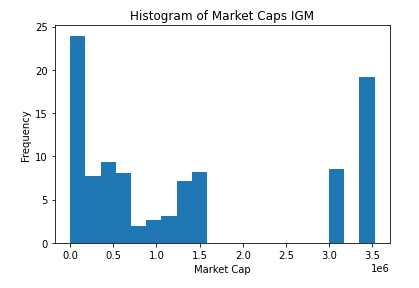

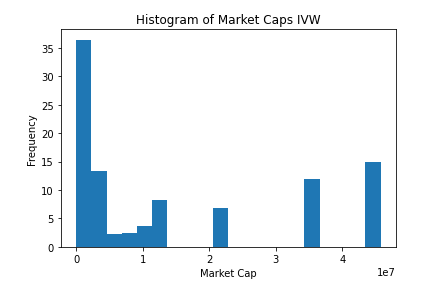

IGM Market Cap Histogram (iShares.com) IVW Market Cap Histogram (iShares.com)

There is more density in IGM than small cap stocks.

In terms of PE, both trade at roughly the same 24x, which is more or less in line with S&P multiples, indicating that both ultimately represent the most index-moving industries in the US. Despite the price angle, we think IVW deserves lower expectations as large enterprise-focused tech companies are not yet as smart in the current economic climate as smaller consumer tech businesses are facing. Expectations should not be the same.

Comments

In relation to the economy, the issue we have been focusing on this cycle is the gap between corporate and consumer spending. So far, corporate spending has been stronger. As corporate profits and investment ultimately depend on consumer demand, we think there may be a reckoning as consumer confidence has taken a serious hit and will continue to deteriorate for some time to come. Expectations for IGM should be a bit more rosy as shares have made a big hit, down 27% and 20% YTD for IVW, of course, with little room to fall. While some elements of the economy, being an enterprise-oriented business, should fundamentally support large allocations in IVW, everything else suffers in a recession. To some extent, regardless of the need for cost centers and supporting services, they may be more resilient, which is probably how the market sees a win-win situation between these ETFs. This will benefit IVW, but we still think that confidence in those stocks has not yet seen impact fundamentals and a shake-up in confidence, and they are considered unsustainable.

However, neither is particularly attractive. These stocks have packed some beta and the market is rising from Tina’s conditioner. Other asset classes are becoming more interesting. Indeed, a lot of money has gone into bond ETFs. So we are waiting with these equity market completers.

While we don’t often make macroeconomic comments, occasionally drop by our Marketplace service here; Value lab. We focus only on long-term value propositions to find global misfit stocks and target. Portfolio yield about 4%. We have done well for ourselves over the past 5 years but have had to get our hands dirty in international markets. If you’re a value-investor, serious about protecting your wealth, we at Value Lab can be your inspiration. Give our no-strings free trial a try to see if it’s for you.

[ad_2]

Source link