[ad_1]

There is a beautiful gentleman. You may have heard of a small company called Uber. In the year It was a Crunchies finalist in 2011 (for best location app, along with Runkeeper, Foursquare, Airbnb and Grindr) and has been doing well ever since.

As of this writing, Uber has a market cap of $69 billion (cool) And it’s the beginning of a global star.

But it wasn’t always like this. Fifteen years ago, the company planned to raise a $200,000 round of financing with a different name (UberCab) and a different business model (limos delivered from your smartphone via SMS). In the year Launched in San Francisco in 2011, it quickly followed in many other cities.

A lot has changed in the last 15 years. For one thing, the original iPhone was just getting started (without the ability to install apps!) and fundraising was very sophisticated.

The Uber floor has been floating around the internet for a while; In the year We shared it as a gallery in 2017, and it doesn’t look like a good example of how a pitch deck works these days. Still, let’s take a trip down memory lane and see what Uber got in its first pitch — and where it made some spectacularly stupid mistakes.

We’re looking for more unique pitches to break down, so if you’d like to submit your own, here’s how to do that.

Slides on this floor

- Cover slide

- Problem Slide (“Cabs in 2008”)

- The Solution Slide (“Digital Snow Could Now Make Road Snow Unnecessary”)

- The solution slide (“UberCab Concept”)

- Product Slide 1 (“1-Click Car Service”)

- Value Proposition Slide 1 (“Key Differences”)

- Mission (“Principles of Conduct”)

- How It Works Slide 1 (“UberCab Apps”)

- Slide 2 How It Works (“UberCab.com”)

- Slide Layout ( “Use Case” )

- Value Proposition Slide 2 (“User Benefits”)

- Value Proposition Slide 3 (“Environmental Benefits”)

- Product Slide 2 (“UberCab Fleet”)

- Go to Market Slide 1 (“First Service Area”)

- Technology Overview Slide (“Technology”)

- Competitive Advantage Slide (“Demand Forecasting”)

- Market Size Slide (“Total Market”)

- Market Segmentation Slide (“Market Composition”)

- Go to Market Slide 2 (“Target Cities”)

- Scenario Planning (“Possible Outcomes”)

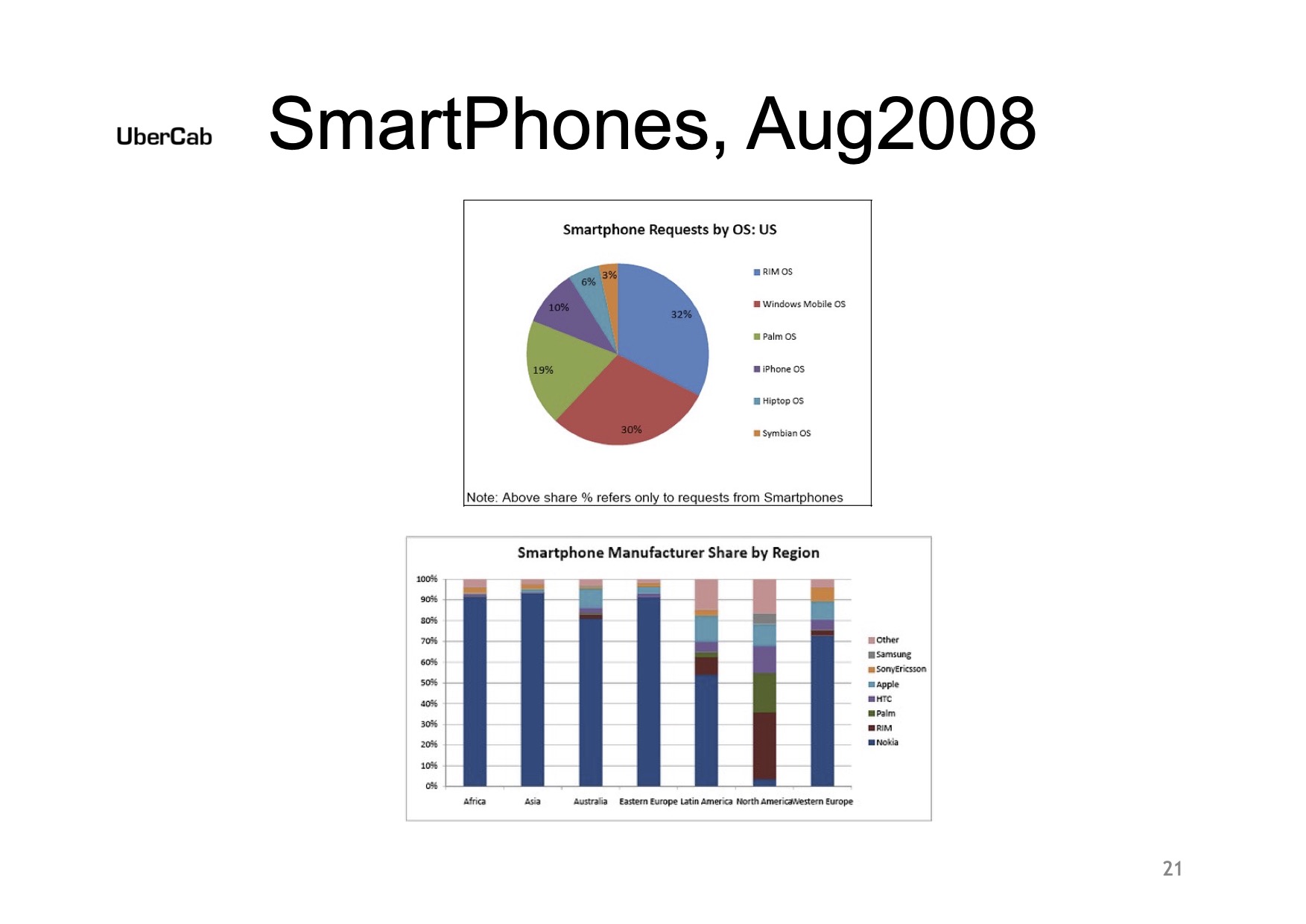

- “Why now?” Slide( “Smartphones August 2008” )

- Roadmap Slide 1 (“Future Optimization”)

- Marketing Slides (“Marketing Ideas”)

- Roadmap Slide 2 (“Location Based Services”)

- Drag Slide (“Progress to Date”)

Three things to love

There are some lovely historical gems in this slide deck, some of which are fun idioms from the past. Others are legitimately insightful views of where Uber could grow, even in this very early deck.

Uber knew location-based services would be big.

[Slide 24] Uber knew from the start that it could have nearby markets as an option. Image credits: Uber

Today, it’s hard to imagine a world without Uber in it, but in this slide deck, it’s clear that Uber didn’t know how influential it was, but it knew it was in “location-based services.”

It came after the random-guest model that Lyft pioneered, but Uber knew delivery would be a key source of growth. The company By 2010, it was predicted to be a $3.5 billion industry. Considering Uber Eats is estimated to be worth $8 billion by 2021 and nearly $11 billion last year, it’s safe to say that Uber’s predictions are right.

That was a fantastic idea in 2008 because Uber had not yet started and did not have a clear vision of how to launch UberX.

Made by smartphones

Of course, with the benefit of hindsight, this is incredibly obvious, but…

[Slide 21] Smart phones. They are things. Image credits: Uber

In 2008, smartphones started to become a thing. According to Uber’s deck, BlackBerry leads the pack with 32% market share, followed by Windows Mobile (30%), Palm OS (19%), iPhone (10%), Hiptop (6%) and Symbian (3%). Of all those operating systems, it’s sad to think that most of them don’t even exist these days. Apple’s iOS sits at a 60%-ish market share in the US, with Android accounting for the rest. And then there are some so-rans.

The exciting — and crucial — smartphone (and its ubiquitous data on cell phone plans) was the technology that ultimately unlocked Uber’s current business model: drivers can drive, passengers can hail, etc. The company doesn’t do much. Prediction of where the market will go, but he knew one thing: smartphones [sic] They were an important part of the way forward.

As a startup, Uber is showing that it is building a company on two new technologies: location-based technologies and smartphones. That’s pretty smart, all things considered. And there’s one important thing to learn from this when building your own pitch deck: Tying your company to major macroeconomic or technological shifts is a great way to capture a huge tailwind.

What is (best/worst) possible?

[Slide 20] Okay, this is just funny. Image credits: Uber

As a founder, you really shouldn’t have an “exit” slide on your pitch deck. It’s ignorant and stupid. I’m including it here because of how incredibly, painfully wrong it is.

Uber’s founders, in their wildest dreams, thought the best-case scenario was $1 billion in annual revenue. To be fair, he earned $8.6 billion in 2022 is it. More than 1 billion dollars, so the company, of course, was right. But he hopes there will be a “realistic” scenario for a profit of $20 million to $30 million a year. That’s interesting — because for years, Uber has been experiencing huge losses while facilitating aggressive growth rather than profits. I really like this slide.

The lesson here? Avoid making any predictions about your exit or results. Call the market size and date.

In the rest of this teardown, we’ll look at three things Uber could improve or do differently.

[ad_2]

Source link