Malvern, Pennsylvania-based Savannah, a company that builds financial software for legacy banks, announced today that it has raised $45 million. Part of the capital – $ 10 million – was debt, the rest was a series A equity share led by Georgia Capital Partners.

General manager Michael Sanchez He told TechCrunch that the proceeds will support overall growth and Savannah’s go-to-market and product development projects.

Savannah was founded in 2009 by Sanchez, who previously served as president of the International FIS Division. Prior to FIS, he started Sanchez Computer Associates, a supplier of core banking systems.

The problem Savannah solves is an architectural one. Sanchez TechCrunch tells us. Although banks have made digital transformation efforts, many have not made the transition successfully, he modestly said.

At his point, a study conducted in 2022 – between banks And credit unions that believe at least three-quarters have made the transition to digital — less than 25% — saw a meaningful increase in revenue. Moreover, in the year Only 11% financial executives According to Deloitte, they claim that their organization has been able to modernize processes to the point where they can easily incorporate new digital technologies.

“Today’s consumers prefer digital-only banking. This shift in consumer behavior has been underway for several years and has been accelerated by the Covid-19 shutdown, which has led consumers to complete everyday tasks, such as shopping for groceries, depositing checks or managing their accounts, all online,” said Sanchez. Email interview. Although banks seem to have all gone digital, most banks are not ready for this massive change in user behavior… This is a big problem for banks trying to stay competitive in an environment where there is a lot of fintech pressure.

Savannah solves this problem through templates, APIs and integrations to automate back-office and core banking processes. The company’s platform provides a “process architecture” to service various banking and customer channels, ostensibly speeding time to market and enabling faster responses to service requests.

A look at the Savannah service management dashboard. Image Credits: Savannah

In particular, Savannah tries to integrate third-party components of banking systems and put them into APIs, not just components, but also the rules, workflows, automations and integrations needed to carry out business operations. APIs are used as libraries for client and account services, reusable and complementary to SAVA.An enterprise content management system, a repository of bank content related to customers and accounts. Beyond this, Savannah provides a low-code UI framework for building internal and client-facing applications that interface with the aforementioned APIs.

“Pre-structured processes and integrations; [bankers using Savana] Get a real-time, comprehensive view of all customer accounts, cards, communications and more, while customers benefit from better and more personalized service,” continued Sanchez. “By automating processes between systems and people, it eliminates process silos and eliminates multiple, siled suppliers. [The] A turnkey, end-to-end platform preconfigured with hundreds of APIs.

Of course, Savannah doesn’t stand alone in the market for bank improvement tools. The fund, which aims to help banks better compete with fintech companies, recently raised $99 million at a valuation of more than $1 billion. There are also two technology startups, MANTL and Bankjoy, that make it easy for people to digitally open accounts at community banks and credit unions. One fintech that competes directly with Savannah is London-based 10x Future Technologies, which helps large and established banks build both next-generation services and tools to make their legacy services run more efficiently.

As the economic headwinds pick up, the competition will become more intense. Deloitte reported last week that fintech investment fell to $52.9 billion in H1 2022, down 24 percent from $69.6 billion in H1 2021. In particular, bank tech providers showed a 14 percent decrease in the first half of 2022 compared to the same period last year.

But Sanchez isn’t concerned — despite Savannah’s relatively small client base of about 10 client banks and fintechs. Sanchez says “a lot of components” will go with the Savannah between now and the end of 2022, though he wouldn’t say how many — or what to expect on the revenue front.

“Savannah’s digital delivery platform is the first and only technology solution to help banks overcome the operational challenges they face in meeting customer needs,” asserts Sanchez. “The banking industry is undergoing incredible change. Digital banking is rapidly evolving from being defined by a consumer mobile banking application to a digital end-to-end enterprise. Getting all the right pieces from core to customer is the new imperative for banks aspiring to become digital banking enterprises.

Regardless of the strengths of the Savannah platform, banks must grapple with the challenges of implementing new technologies like any other vendor. According to a study by the Monetary Authority of Singapore, it takes six to eight months for a bank to research, refine and develop a fintech prototype. One of the biggest obstacles holding banks back is the upfront investment in technology – which Forbes reports can amount to 10% of a bank’s annual spend.

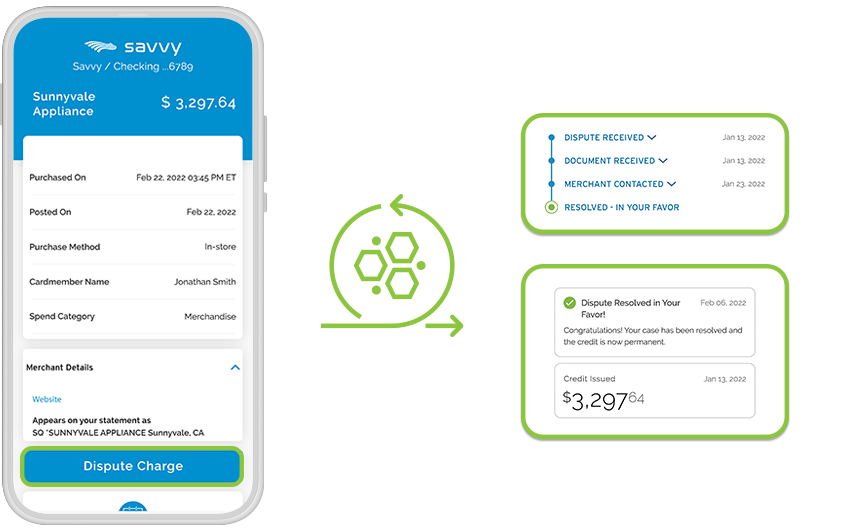

Resolve answers and other disputes in the Savannah forum. Image Credits: Savannah

Sánchez argues that Savannah has the advantage of experience in building digital systems for banks and financial institutions. For example, Mike Woelfel, the company’s president and CTO, previously led process automation systems in mortgage origination and servicing, consulting on corporate governance and finance.

Many of Savannah’s competitors have financial professionals among their ranks. But – broadly speaking – there may be something to Sanchez’s idea. A survey of financial services executives found that 70% believe a lack of skills or inadequate training is the biggest barrier to new digital initiatives in their organization. In other words, outsourcing is still attractive.

“As he says Digital-first bank trackingToday, nearly 50% of consumers prefer digital-only banking,” said Sanchez. “It will be necessary for banks to improve their technology infrastructure to meet the expectations. Ensuring a frictionless customer experience will be the difference between banks surviving and not.

So far, Savannah has raised $54.2 million in capital. (The company previously closed a seed round in April 2010 and a small venture round in February 2020; the Series A is the first round since the latter.) The headcount has reached 200, which Sanchez expects to grow to nearly 400 by the end of the year.