[ad_1]

Sesam, a French startup that helps financial firms and corporations meet their ESG goals by generating insights from digital content, has raised €35 million ($37 million) in funding to expand globally.

A growing backlash against ESG efforts from some politicians and vocal executives, companies are still aware of the reputational and business risks of neglecting their environmental, social and corporate governance (ESG) responsibilities – both in their internal operations and thirdly- the parties they do business with.

With that in mind, Sesame allows businesses to monitor text data from across the web – including news portals, NGO reports and social networks – and turn this into actionable insights.

supply chain

Sesame founders Pierre Rinaldi, Sylvain Forte and Florian Aubry. Image Credits: Sesame

In the year Founded in Paris in 2014, Sesame has amassed an impressive portfolio of clients, including US investment giant Carlyle Group, French corporate and investment bank Natis, Japanese international insurance company Tokyo Marine and UK-based property. Management company Unigestion.

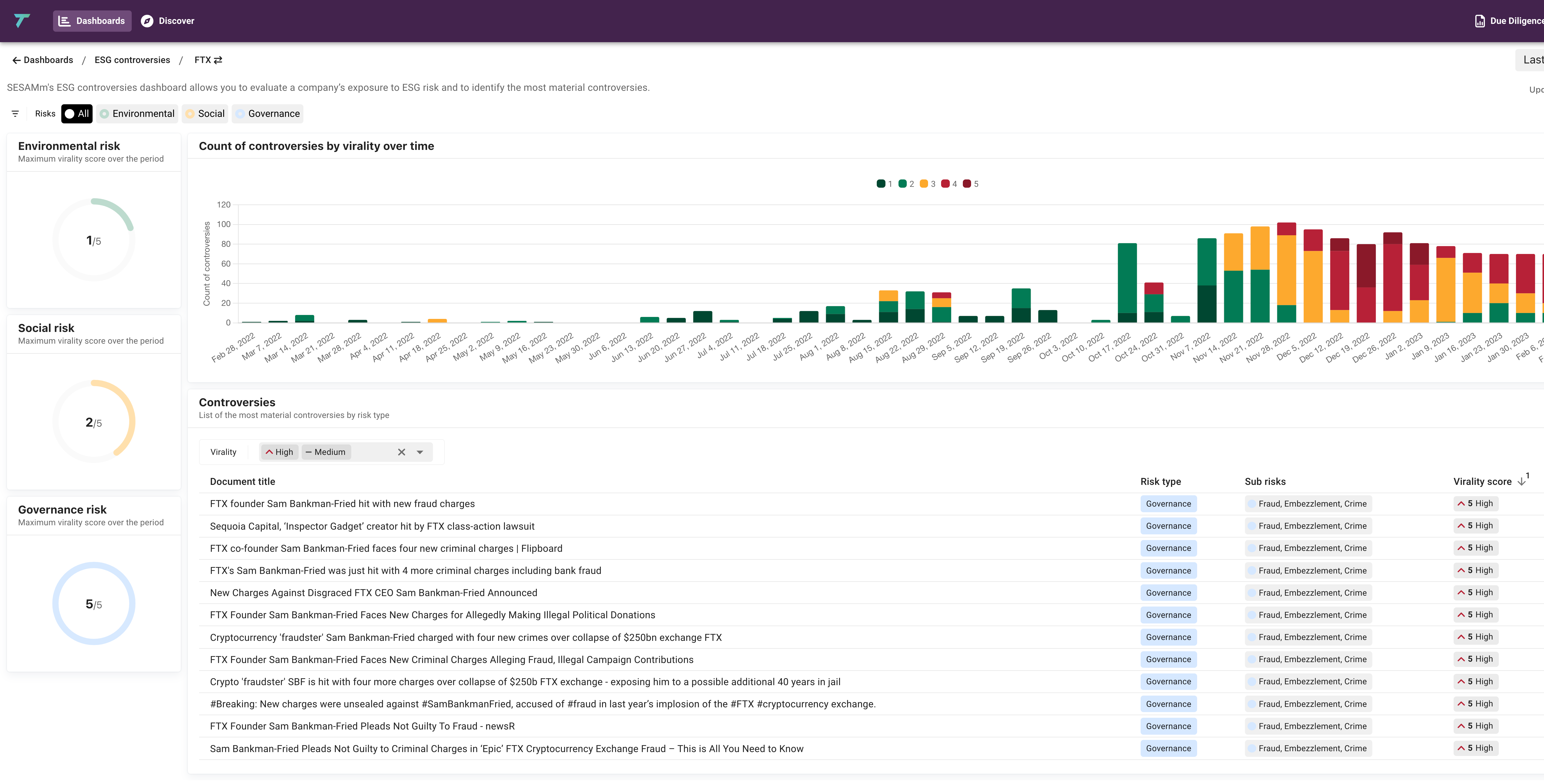

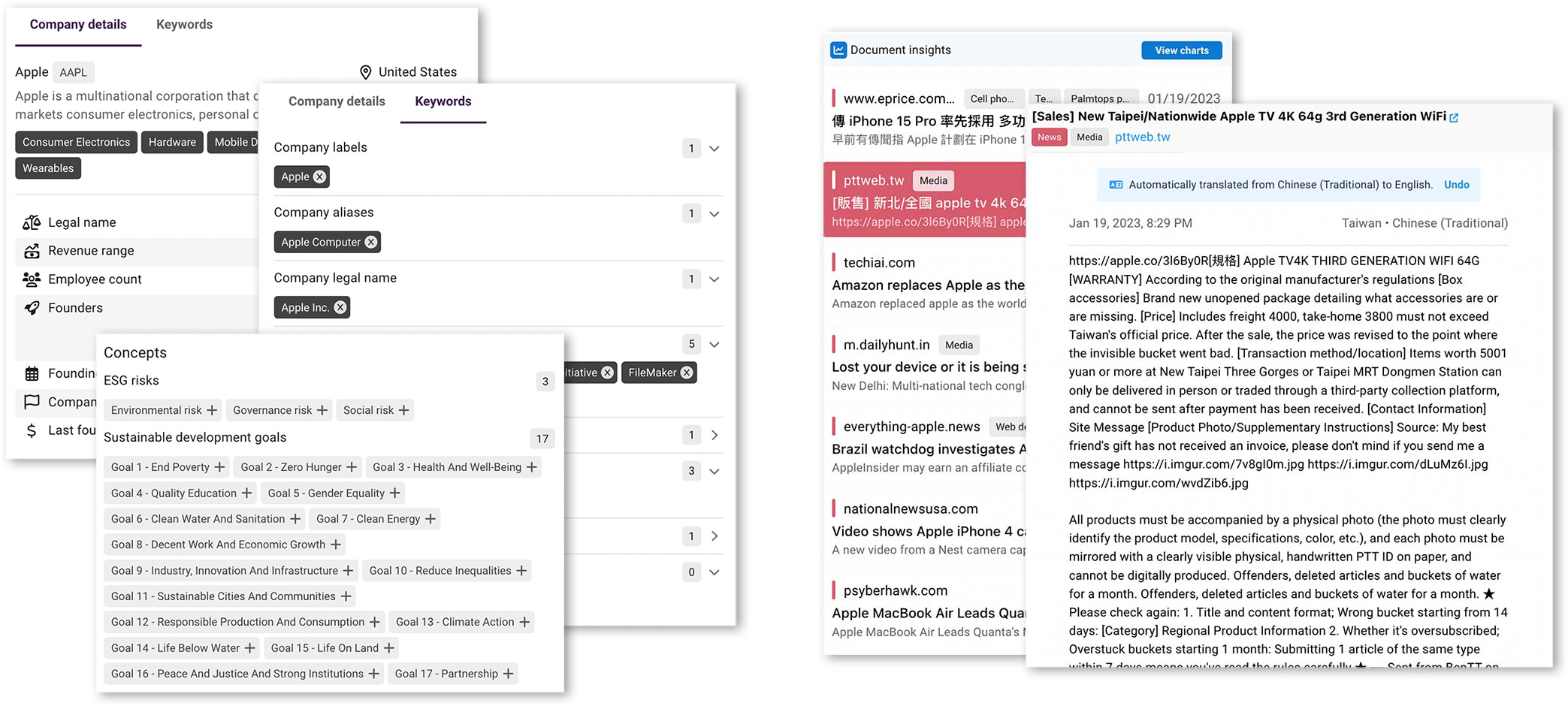

Companies can access TextReveal, Sesame’s flagship product, through several channels, including an API that brings Sesame’s NLP engine into their own systems. But on top of that, Sesam offers a web-based dashboard where companies can access data analysis, visualizations and notifications for various due diligence, compliance and ESG factors.

For example, a company that wants to keep tabs on its supply chain partners can use Sesame to track anything related to partners that hits the public domain. This allows them to proactively respond the moment they receive an alert through Sesam – these ESG alerts, which Sesam launched a few months ago via email or system integration, such as a Customer Relationship Management (CRM) application.

Elsewhere, private equity firms may use Sesame to conduct due diligence on potential acquisitions or investment targets. Indeed, Sesam boasts a “20 billion article data lake” on which it applies its NLP algorithms to identify mentions of any type of company.

“Private equity firms often engage with consulting firms to do due diligence on target companies,” Sesam founder and CEO Sylvain Forte told TechCrunch. is it. So frequently the results are not complete enough, leading to inaccuracies.

But the Sesame platform can be configured for any use cases, such as “share of voice,” competitor analysis, or any other topic relevant to a company.

“With the current ESG focus in the industry, many of our use cases are focused on that – however, we provide insights for many types of data,” Forte said. “This includes web insights on brands, thematic stock baskets and indices, company leadership reputations and macro-economic indicators such as inflation and more.”

An example of an ESG dashboard developed by Sesame. Image Credits: Sesame

According to Forte, Sesam pre-trains large language models similar to ChatGPT, the current poster child of generative AI — on all the data it collects and fine-tunes algorithms on its own databases. It supports 100-plus languages.

“Sesam integrates a variety of data – over 20 billion texts in 100 languages with 14 years of history,” Forte said. “Data sources include the most trusted news organizations, professional blogs and social media. Sesam manages the licensing of proprietary data sources from premium news outlets.

Sesamm NLP in action Image credits: Sesame

Sesame’s competition includes well-funded rivals, including New York-based AlphaSense, which received a $1.7 billion valuation last year, and Datamine, a more recent $4.1 billion company. And FactSet, a $15 billion financial data powerhouse, dove into AI-powered ESG data when it acquired Truvalue Labs three years ago.

However, with the ChatGPT hype train and growing corporate ESG commitments in the background, Sesame’s massive fundraising at a time when investor cash seems to have dried up tells a story.

“The increase in volume in challenging market conditions highlights the importance of Sesame’s focus on two key trends – AI and sustainability,” said Forte. “In turn, these tools allow organizations to make better decisions and fill information gaps, especially in ESG, for both public and private companies.”

So far, Sesam has raised around 15 million euros ($16 million), and in its latest cash injection — the so-called Series B2 round — the startup has brought in new and existing investors, some of whom are customers. These include BNP Paribas’ VC arm Opera Tech Ventures, which co-led the round with VC firm Ilaya; Carlisle Group; unity Raiffeisen Bank International’s VC off-shoot Elevator Ventures; AFG Partners, CEGEE Capital; and new alpha asset management.

Sesam said it plans to further expand its new capital into the US and Asian markets.

[ad_2]

Source link