[ad_1]

We are getting a more concrete update on the startup funding landscape in India, and as is true elsewhere, all the figures are in the red for the South Asian market.

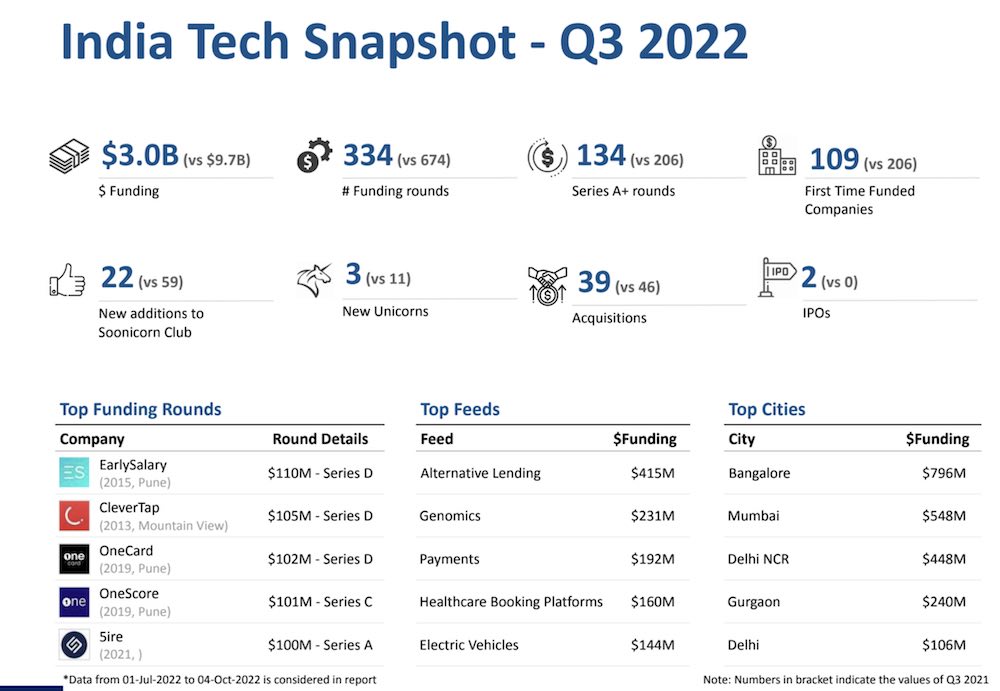

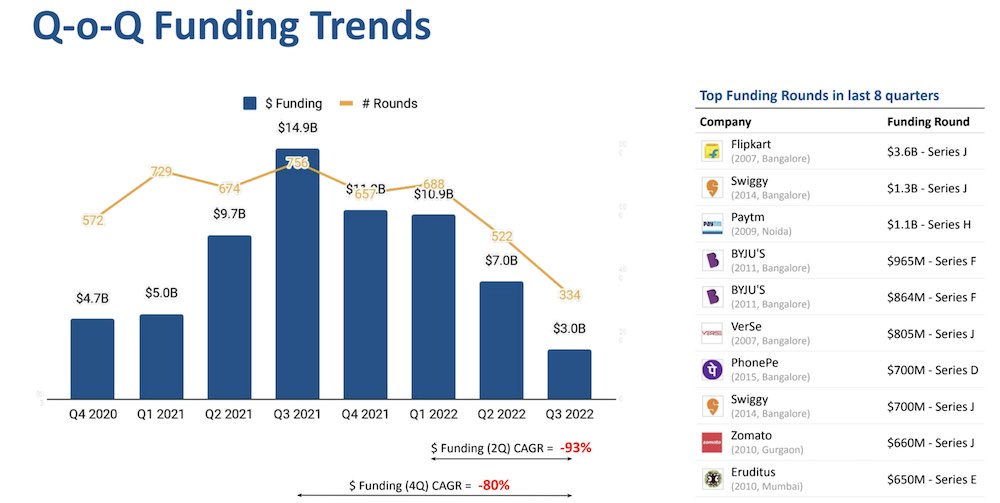

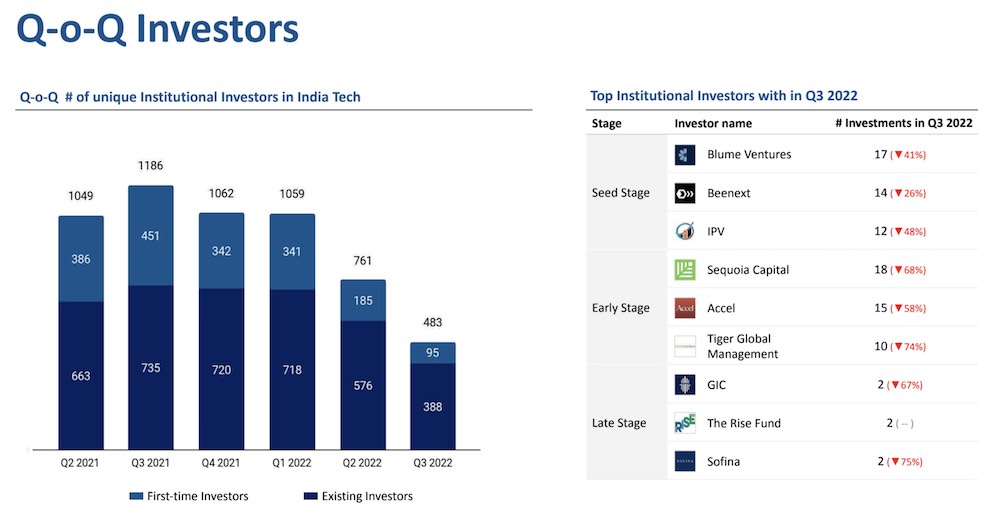

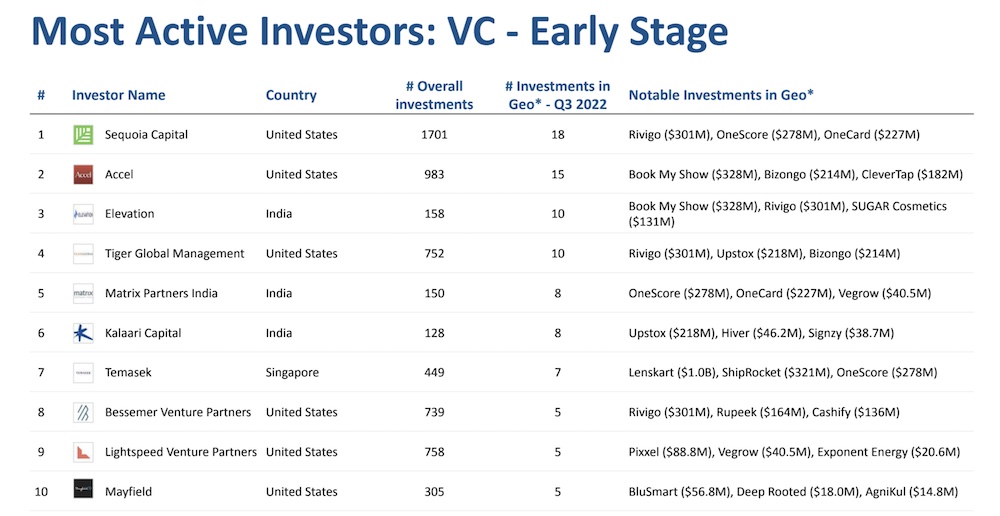

Indian startups raised $3 billion in the quarter ended September, down 57% from the previous quarter and 80% year-on-year, according to a report by market intelligence platform Tracxn on Tuesday. The figures are impressive for many reasons, the most obvious being that most of the top tier funds in India – Sequoia India & Southeast Asia, Lightspeed Venture Partners, Accel, Elevation Capital, Matrix Partners India have found it difficult to raise capital for startups at this time. – They raised a lot of money this year.

Second, the funding seems to be a serious concern in India. According to data compiled by Crunchbase, global funding is down 53 percent year-on-year and 33 percent quarter-on-quarter.

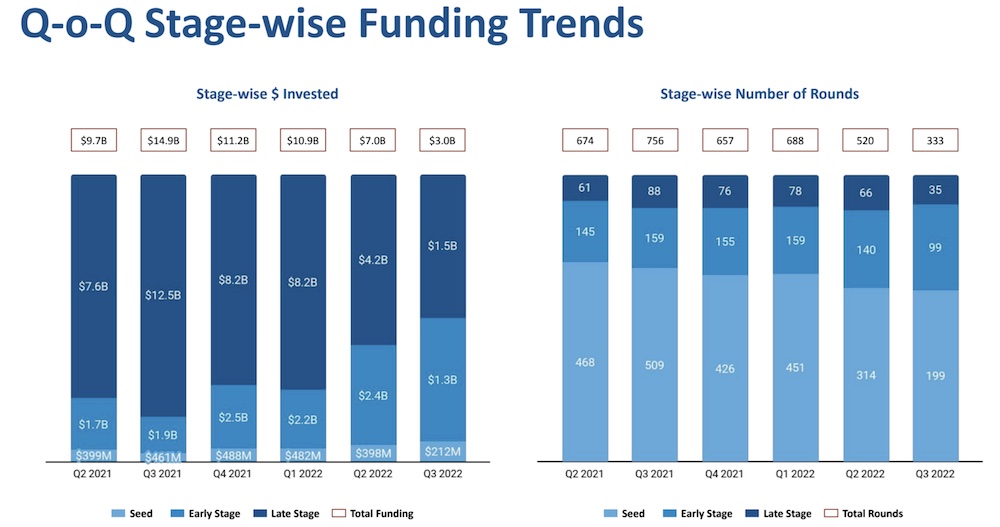

In Q3, India’s startup ecosystem saw 334 funding rounds, down from 674 in Q3 2021. Check sizes are shrinking for startups at all levels of finance. Late-stage startups that raised capital received an average of $42 million in funding, down more than 70 percent from $142 million in the same period last year, Tracxn said.

Investors around the world have become cautious in recent months as the market reverses much of the gains from a 13-year-long bull cycle. As a result, startups are finding it difficult to raise a new round of funding with a higher valuation than the previous round. Due diligence, which was largely out of fashion last year, has made strong returns as most offers are taking weeks, if not weeks, to review.

Masayoshi Son, the founder of Softbank, which raised more than $3 billion in India last year, warned in August that the funding summer could drag on because some unicorn founders are unwilling to accept lower prices.

Things don’t seem to be improving any time soon. Baiju, India’s most valuable startup, has postponed plans to go public this year. Budget hotel chain Oyo was once valued at $10 billion and is looking to list early next year, but its biggest backer has cut its valuation to $2.7 billion.

“India is currently experiencing a financial slowdown which is expected to continue for the next 12-18 months and the effects of the financial slowdown are expected to intensify going forward,” said Neha Singh, co-founder of Traxon. It has now filed for an IPO.

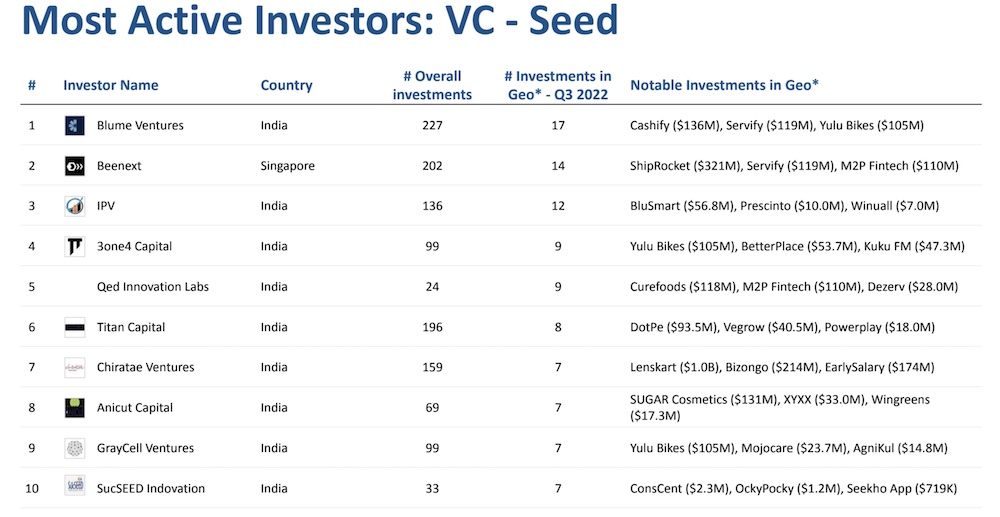

Some charts and other interesting statistics from the report:

[ad_2]

Source link