It is important to establish a business loan as soon as you decide to start a business. Having good business credit is always important, and you also need to understand how bad credit can affect your business. The most important aspect of business credit is your ability to secure financing. If you have bad credit, you may not qualify for loans, credit cards, and other forms of financing. This can be difficult for a new business. When you understand your score and keep it high, you’re on your way to running a successful business.

It is important to establish a business loan as soon as you decide to start a business. Having good business credit is always important, and you also need to understand how bad credit can affect your business. The most important aspect of business credit is your ability to secure financing. If you have bad credit, you may not qualify for loans, credit cards, and other forms of financing. This can be difficult for a new business. When you understand your score and keep it high, you’re on your way to running a successful business.

Building business credit doesn’t happen overnight. You need to make sure your business is registered with the right credit agencies, create business accounts that report to the business credit bureaus, and pay bills on time. Building strong business credit can benefit your small business in many ways. With a high business credit score, it can be less expensive to obtain business financing, secure business insurance, or establish payment terms with suppliers. It can even help your business land corporate contracts, as corporations often want to ensure financial stability and timely payments before awarding a significant contract. Because there is no notification when your business credit is reviewed, you may not know how your credit history has affected your business.

You can establish business credit in any business structure, including LLCs and S-corporations. You may be able to establish business credit as a sole proprietor with a registered business name. However, keep in mind that without a registered legal entity, you will not be able to properly separate your business and personal loan. Also note that personal credit cards are only reported to consumer credit bureaus, not business credit bureaus. Therefore, paying personal bills on time, while a good practice, will not help you establish business credit. Even if you use your personal credit cards to pay for business expenses, it won’t help you build a business credit portfolio.

Is your personal loan good for your business?

Yes, both personal and business credit are important for a small business owner. It is common for stores or lenders to request personal credit checks for small business credit cards or loans. Therefore, it is a good idea to raise your personal credit score. The good thing is that you can start building business credit even if your personal credit isn’t great. The key to building a good business credit score is doing business with companies that report payment history. Then pay on time and control your debt.

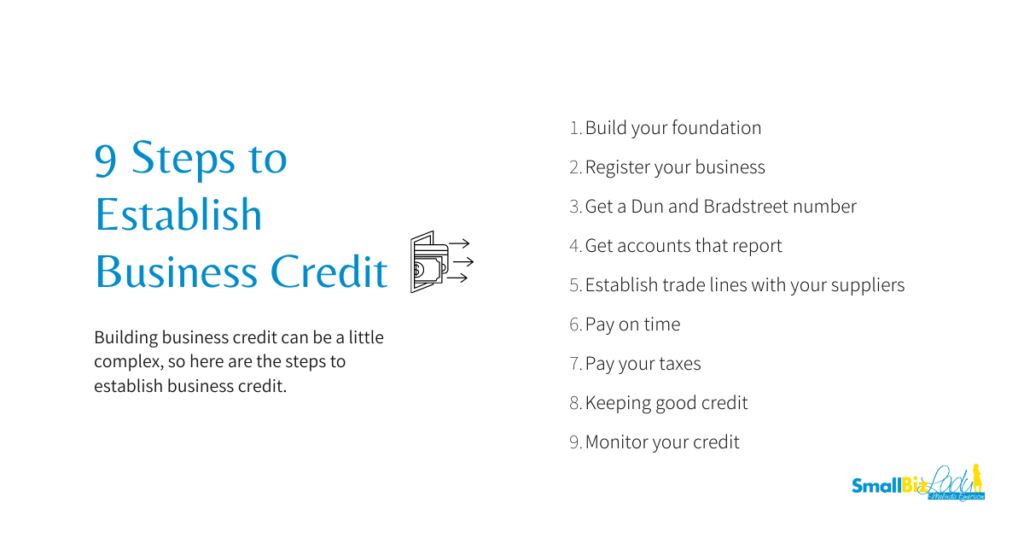

9 steps to establishing business credit

Building business credit can be a bit complicated, so here are the steps to establishing business credit.

- Build your foundation

- Register your business

- Find the number of Dunn and Bradstreet

- Find reported accounts

- Set up business lines with your suppliers

- Pay on time.

- Pay your taxes

- Maintaining good credit.

- Control your credit

1. Build a foundation

To effectively establish a business loan, it helps to establish your business properly. If your business is new, take the time to set up your business, so it looks professional. Find a business phone number and, if possible, sign up for directory assistance. Get and use a professional email address. If you are just starting out, choose a business address that is a PO Box or your home address and use it permanently.

2. Register your business

Most businesses must be officially registered with their state. If you have formed a business entity such as an LLC or S Corp in your state, you should have completed this step. Annual records may be required. (If you start your business in another state, you may also need to register your business in the state where you do business.) You may also need to obtain a professional or business license. Check your state requirements. Some business credit agencies may use such public information to start your business credit profile.

3. Get a DUNS number

A DUNS number is your business identifier with credit reporting agency Dun & Bradstreet. If your business doesn’t already exist, you should request one, and it’s free. Credit security, Equifax, And Expert They all have unique identifiers (numbers to identify your business in their system), but you don’t have to start this quest with them. An EIN is a business identification number that every business must obtain from the IRS. You don’t need to have one to establish business credit. However, you cannot open a commercial bank account without an EIN.

4. Establishing reporting accounts

To start building your credit, you need to establish accounts that you report to the business credit bureaus. Ideally, you want to have at least two to three credit accounts with reporting companies. They can be vendor accounts from an office supply store, a business credit card, or a credit-builder account. Additional accounts can come in handy as your business grows. When it comes to your business credit score, Most small business lenders like to see a business credit score above 75. Still, local lenders like CDFIs or Community Development Financial Institutions may consider lower scores for small businesses or startups. Conventional consumer finance companies will not offer loans to individuals with a credit score below 600.

Three of the most affordable reporting accounts are as follows

Summa office supplies

Strategic network solutions

Ohana office products

The benefit of doing so is reporting your payment history to the credit bureaus and establishing your business credit. If you’ve established business credit, these three reports will strengthen what you’ve built. These companies send information to the credit bureaus on the last business day of each month.

5. Set up business lines with your suppliers

Suppliers often extend trade credit, allowing you to pay several days or weeks after receiving the item. This bill-to-pay relationship can boost your business credit score if your supplier reports the charges to the business credit bureaus. You can set up business lines with any small vendor, such as your water supplier, payroll company or wholesaler. If those vendors don’t report to the credit bureaus, you can list them as a business reference on your account, and Dunn & Bradstreet will follow up to collect your business data.

6. Pay on time

Payment history is the single most important factor in building business credit. You must keep accounts current and active to demonstrate business growth and creditworthiness. Pay on time or early if you can, and you can build your business credit score faster.

7. Pay your taxes

Unpaid taxes or business debt can result in a lien, which gives creditors the legal right to seize your property to satisfy the debt. And unpaid debt can eventually result in a judgment — or judgment — against your business to collect the debt. These negative marks on your business credit report can make you sad. Bankruptcies, for example, stay on your Experian credit score for 10 years; Tax liens, judgments, and collections remain for seven years.

8. Save your credit

One of the most important steps in building a business loan is maintaining it once you reach the level you want. Paying bills on time or early and maintaining a good relationship with your suppliers, creditors and creditors are the easiest ways to maintain your business credit score. However, it’s important to remember that part of building good business credit is developing strong financial habits: saving money, paying bills on time, and making informed financial decisions about the future of your business. Creating these habits feeds the overall financial experience your business needs to establish trust and build a successful track record.

9. Take control of your credit

Monitoring your business credit history can alert you to problems so you can investigate further. Check your credit reports and scores with more than one major credit reporting agency to see if your accounts are helping your scores. If not, consider adding additional credit references. If you find an error, file a dispute with the credit bureau that reported the error.

New accounts may not appear on your business credit reports for a few months. Once you do, you’ll need several months of hourly payments to establish business credit and get a good credit score. Whether you have a new business or a well-established one, if you take the steps above, you can establish business credit within six months to a year. The good thing is that you can spend up to $100 a month to build your business credit.