Group 4 studio

Investment thesis

InMode’s minimally invasive products had triple-digit top-line growth in FY21. The strong interest was driven by the functional differentiation of the InMode proprietary platform, an aesthetic evolution of the Paradigm 2. As more R&D pipelines reach production, InMode will have stable long-term revenue development.

Mod External sources Manufacturing most of the products in Israel for its tier one suppliers such as Flextronic and Medimore. InMode has proprietary manufacturing equipment and assembly lines from its suppliers. In addition, InMode has gradually acquired ownership from tier one suppliers; The vertical integration allows InMode to maintain an 80%+ gross margin.

Only five Wall Street firms—Canaccord Genie (OTCPK:CCORF), UBS (UBSBaird, Needham, and Barclay (BCS) – actively cover INMD. as desired Israeli ETFs As it grows, I believe InMode will attract more attention. From my review of DCF, INMD is currently valued at 40% higher.

Company overview

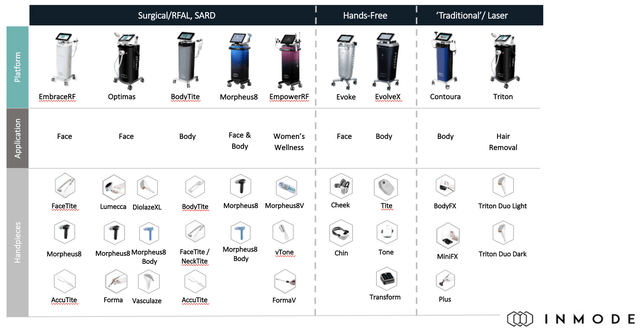

mode (NASDAQ:NASDAQ:INMD) is a medical device technology company based in Israel that aims to address customers’ pain points when choosing between plastic surgery and laser treatments. INMD’s sales come from three channels: minimally invasive surgery/RAFL/SARD, hands-free and non-invasive laser. InMode has 15 products in the clinical pipeline, with products expected to be brought to market in the coming years.

InMode product lines (INMD Investor Relations)

InMode has an experienced management team. CEO Moshe Mizrahi is the founder of Syneron Medical and has been a serial entrepreneur in the beauty industry for decades. CTO Michael Crindell was Mizrahi’s colleague at Syneron Medical, a pioneer in beauty innovations. Kreindel holds Several patents Related to radio frequency. CMO Dr. Spero Teodoros was an award winning plastic surgeon. MEETH FELLOWSHIPThe oldest plastic surgeon training program in the United States. Theodore is Head of Clinical Development for InMode.

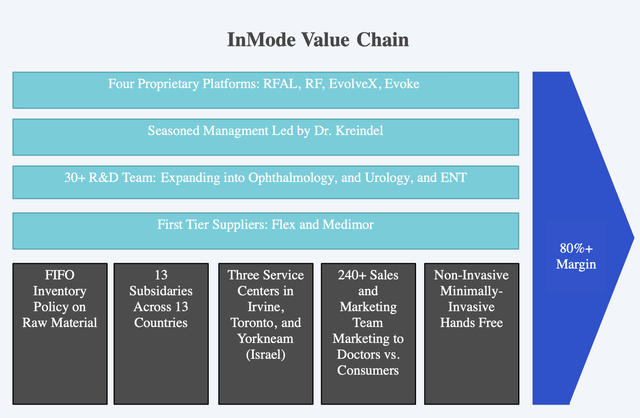

Value chain

InMode has an integrated value chain, I highlight the critical secondary and primary activities that can sustain INMD’s growth in the long term.

INMD value chain (made by author)

Main functions

InMode has three distribution centers in Irvine, Toronto and Yoknem (Israel). The outbound logistics was completely outsourced to a third-party supplier, and next-day shipping was standard. Given the current size of InMode, this is a light-asset approach to avoid fixed logistics costs.

InMode Service Center in Irvine (google maps)

InMode has a. 239 Sales and Marketing Team Due to its aesthetic business nature. The history of S&M illustrates the importance of marketing through multiple channels. As demand for minimally invasive surgery continues to grow and physicians seek access to this capability, it is a traditional marketing focus for physicians. As INMD offers products through multiple channels, the S&M team expands beyond surgeons to ENTs, urologists and ophthalmologists. Coupled with international expansion, we see an increase in the number of S&M groups.

InMode targets KOLs from various fields to provide testimonials on the InMode product. KOLs are critical; As we see in Envision’s startup, the advertising is based on the guidance of KOLs. InMode’s marketing to customers through brand ambassadors like Paula Abdul, who matches the “beauty standard” of InMode’s target demographic.

Secondary activities

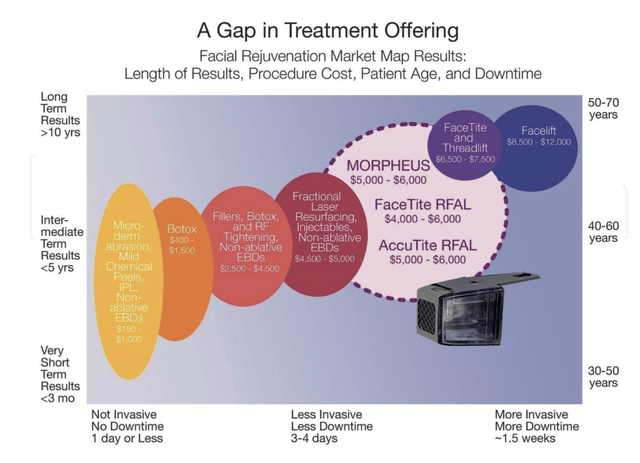

In the secondary activities of the value chain, InMode takes ownership Four ownership platforms Radio Frequency Assisted Lipolysis (RFAL), Deep Subfraction RF, EvolveX and Evoke. The innovations are the cornerstone on which InMode has built its die to differentiate itself from its competitors. RFAL uses directional radio frequency to achieve a reduction of up to 40% of total heat on the face and body skin. Morpheus and other RFLs fill the gap between non-invasive and plastic surgery. RFALs offer longer-lasting results than laser treatments, while spending less money than a facelift. In addition, RFALs of There is no visible scar, appeal to female customers aged 40-60. It has a middle-aged population High Energy extraction in the United States.

Facial rejuvenation market map (Robert Stephen Mulholland)

InMode has a dedicated R&D team to meet evolving industry standards. According to the 20-F, InMode aims to use its R&D pipeline to expand its customer base. In particular, InMode is looking to develop the next generation of product lines, such as the second generation of EvolveX. In addition, InMode will expand its existing offering for dry eye treatment, GSM. It targets symptoms, snoring and rhinorrhea treatments and erectile dysfunction.

According to Canaccord Genuity’s interview with INMD CFO Yair Malca, InMode has a multi-year new technology plan with an average of 2 product launches per year over the next 3-5 years. In addition, InMode launched Envision, a dry eye treatment platform. Envision will soon be available in the market. in Q2 earnings Call, CEO Mizrahi said about Envision’s launch: “I believe it will launch in the United States and then Europe and Asia, if not the end of this year, then the beginning of next year.” Envision will bring more disposable income to InMode once it launches.

InMode has had an exceptional 80%+ gross margin over the past three years, contributed by long-term contracts with suppliers. InMode outsources most of its production through third-party suppliers Medimor, Flex and Resonetics. But InMode built and owned the production equipment, which added leverage in upstream communications management. Each contract between InMode and suppliers is one year in length with an auto-renewal clause. The contract specifies the cost per unit of each product, allowing InMode to be pre-defined per unit COGS. In an inflationary environment, contract terms are important to InMode. In November 2019, InMode acquired 10.34% ownership of Medimor. As the business expands, I believe InMode will strengthen its suppliers and achieve vertical integration.

Price

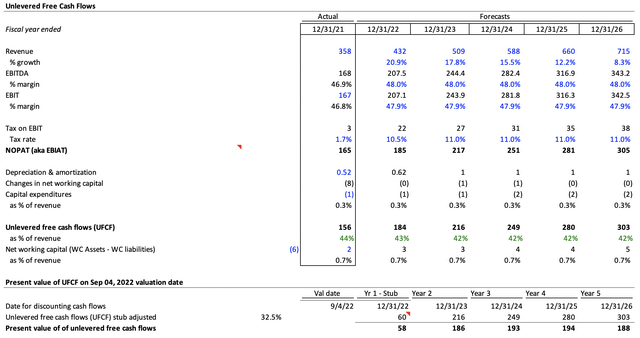

In revenue forecasting, I separate top-line growth into three channels: minimally invasive, hands-free, and non-invasive. Total revenue growth for FY22 and FY23 is pointed to the analyst consensus with slight adjustments from Thomson Econ. As mentioned in my investment research paper, the small invader is determined to be the most heavily weighted of the three channels, especially with the launch of Invision.

Income forecast (Produced by author, some information cited to Thomson Econ)

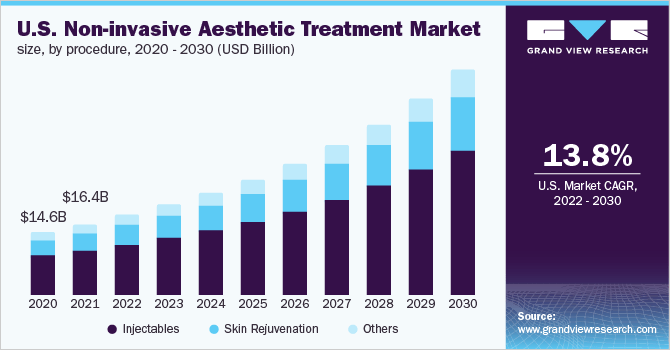

from Grandview ResearchThe US non-invasive aesthetic treatment market is predicted to grow at a rate of 13.8% from 2022 to 2030. In revenue forecasts, non-invasive growth is set at 13.8% from FY23 to FY26.

Minimally invasive CAGR (Grand View Study)

Hands-free revenue has declined over the years. With the EvolveX update coming towards the end of FY22, I think we will see sales rebound from FY23. However, there is insufficient information to accurately plan its development. Hence, a hands-free growth rate of 5% is set from FY23 onwards. EBITDA and EBIT margin forecasts are based on historical numbers and analyst consensus. Since InMode is headquartered in Israel, it enjoys a low tax rate and tax relief. Hence, the tax rates from FY22 are kept in the range of 10-11 percent. InMode has a small capex and D&A, which I have explained in the model. From the model, InMode will have a fixed FCF margin of 42%+.

DCF by INMD (made by author)

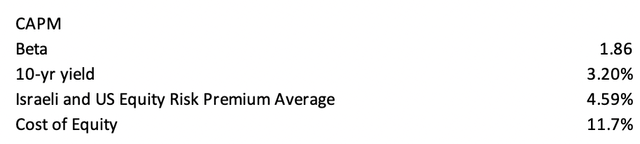

Since INMD has no long-term debt, the WACC is the pure cost of equity. A beta of 1.86 is the weekly beta over the past two years. The risk-free 10-year U.S. Treasury yield is 3.2 percent. I used average Israeli and US equity risk premium of 4.59% as IMND equity risk premium. CAPM results in a cost of equity of 11.7%

CPM (made by author)

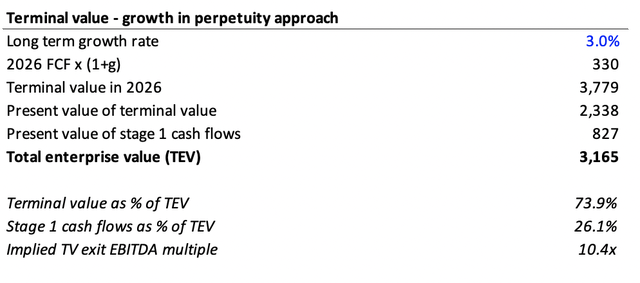

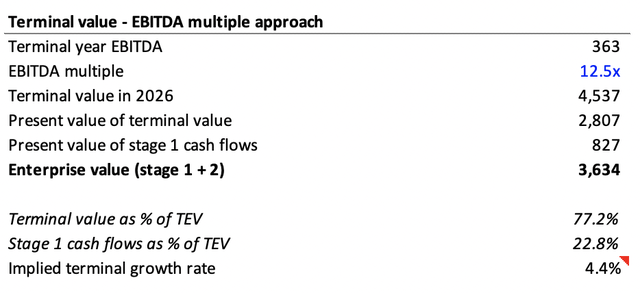

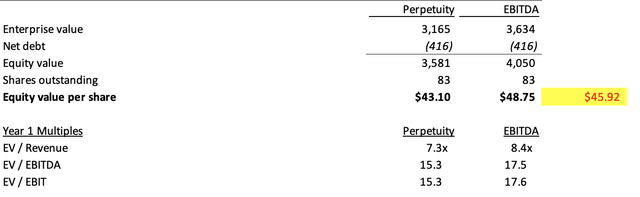

I used both perpetuity and EBITDA multiple methods for terminal value. And the two methods will result in an enterprise value between 3.2 and 3.6 billion dollars.

Sustainability method (made by author)

EBITDA multiple method (made by author)

After adjusting for net debt, the implied share price is $43 to $49. I used the average of both as my target price which is $46.

Implications of share price (made by author)

In the sensitivity analysis, it is clear that the various outputs from EBITDA multiples and terminal growth rates indicate that INMD’s stock price is undervalued.

Football field (made by author)

Accidents

As mentioned above, InMode outsources most of its production through three subcontractors in Israel. Geopolitical instability in the Middle East could pose a threat to InMode’s supply chain. If communication between InMode and suppliers is interrupted, production will be significantly impacted. InMode should consider multiplying the output.

InMode’s medical devices are subject to FDA approval. Any delay or rejection from the FDA for the pipeline will affect top line growth.

As mentioned in 20F, InMode has plans to expand globally. The increase in S&M costs associated with the expansion will have a short-term impact on INMD’s operating margin.

InMode faces competition from Allergan, Venus Concept, Candela Medicals and many others. InMode wants to invest more in R&D efforts to innovate different products.

Summary

InMode has a unique value chain that delivers a differentiated product, maintains high growth and maintains 80%+ gross margin. The minimally invasive beauty market is a blue ocean of huge potential for InMode. InMode is still a little-known company, with only five Wall Street firms currently covering its stock. As the Israeli company gains popularity, more and more investors start researching INMD. I believe InMode is a buy with a target price of $46, or 40% upside.