The U.S. hotel industry sold more room nights than it ever has on the Friday and Saturday of Labor Day weekendsurpassing a record set in 2021.

It was a strong finish to a summer travel season that has benefited from robust leisure demand despite travel hassles, inflation and overall economic uncertainty.

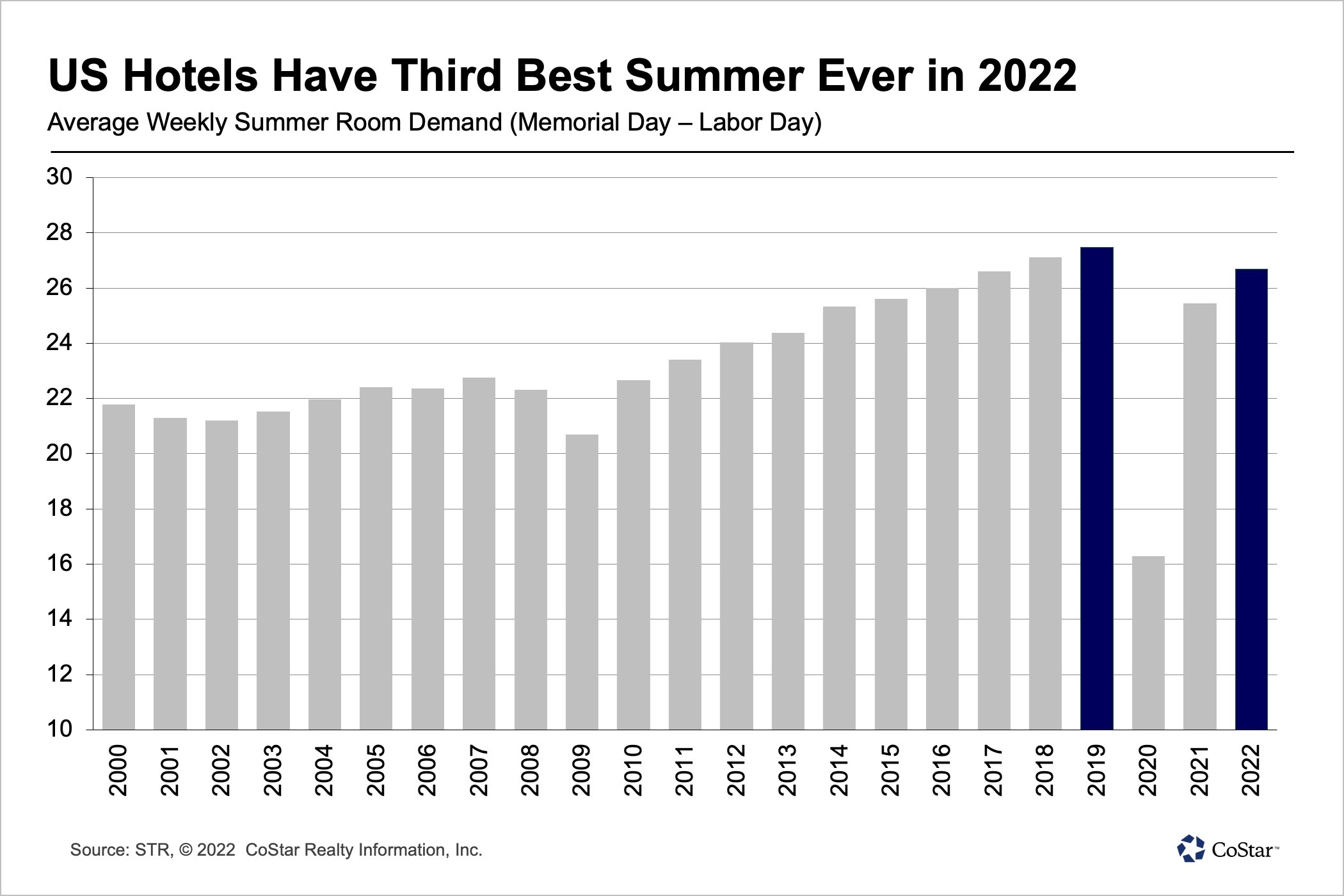

Over the 15-week summer travel season, weekly room demand in the U.S. was the third best since 2000 — behind 2019 and 2018. Compared to 2019, demand was 2.8% lower as U.S. hotels sold on average 777,500 fewer room nights each week. Summer occupancy averaged 68.3%, which was below the 72.3% achieved in 2019. Before the pandemic, summer occupancy averaged 69.5%.

The weekly performance also bodes well for the fall travel season, particularly as group demand for hotels continues to strengthen.

Airport screenings by the Transportation Security Administration show Americans are flying at close to pre-pandemic levels, with the seven-day average as of Sept. 9 remaining within 5% of what it was at this time in 2019.

U.S. hotel occupancy for the Friday and Saturday of Labor Day weekend was 76%, the highest of the past four weeks, and in line with weekend occupancies achieved over the summer. Room demand — the number of room nights sold — was 1.2% higher than in the comparable week of 2019 and the highest on record for the Labor Day weekend, according to data from STR, CoStar’s hospitality analytics firm. All comparisons account for calendar shifts for the holiday.

Week to week, however, room demand continued to trend down, falling 3.3% from the previous week. The weekly decline in demand is typical for this time of year, as summer gives way to fall, but in past years demand has fallen off more quickly — on average by 4.8% in the week ahead of the Labor Day holiday.

For the full week, U.S. hotel occupancy was 62.8%, down 2.1% week over week but 1.7% higher than a year ago.

Demand and occupancy fell sharply ahead of the holiday weekend. Sunday to Thursday, demand was down by more than 8% and occupancy was down 5% week over week. Occupancy for weekday and shoulder days combined was 57.6%, the weakest since the week of Memorial Day.

Nominal average daily rate was flat for the week and up 10% over the same week in 2021. Weekly nominal revenue per available room fell 3.4% week over week, but was up 13.2% compared to 2021.

On an inflation-adjusted basis and compared to the same week of the Labor Day weekend of 2019, real ADR and RevPAR were at a deficit, down 1% and 7%, respectively.

Weekend nominal ADR rose 5.6% week over week, the largest such gain in 27 weeks. Weekly nominal RevPAR was also strong with 94% of markets above 2019 levels, but that does not account for the shift of the Labor Day holiday. Doing so and adjusting for inflation, a third of markets had weekly RevPAR above 2019. Looking specifically at the holiday weekend, more than half of all hotels had real weekend RevPAR above Labor Day weekend 2019.

Twenty-five U.S. hotel markets had their highest summer demand on record. Those markets included Atlanta, Austin, Charlotte, Dallas, Miami and Nashville.

While demand was at a record level, occupancy was not. For example, Atlanta’s 2022 summer occupancy was the eighth best and Austin’s was its 12th best. New York had its sixth-best summer in terms of room demand, with occupancy ranked 18th out of the past 23 years. Not surprising, summer ADR and RevPAR were at their highest levels in 2022, but ranked fourth and sixth respectively when accounting for inflation.

Market weekend occupancy ranged from 93% in Colorado Springs to 53% in Louisiana South with the majority of the 166 STR-defined markets above 70%. A third of all markets reported occupancy above 80% over the Friday and Saturday of Labor Day weekend.

New York City led the top 25 markets with weekend occupancy of 92.6%, boosted by the U.S. Open. This was the city’s highest weekend occupancy since the start of the pandemic.

Twelve of the top 25 markets reported weekend occupancy above 80% including Boston, Chicago, Denver and Los Angeles. For Chicago, it was the second-highest weekend occupancy since March 2020. Another 11 of the top 25 markets reported weekend occupancy above 70% but under 80%. Among the top 25, only the Houston and Phoenix hotel markets reported occupancy under 70%. Overall, top 25 market weekend occupancy was 79%, its highest level since the end of July.

Sunday to Thursday, only seven markets reported occupancy above 70%, including Boston at 75% and New York City at 77%. Denver was also close to that level at 69%.

For the full week, Alaska had the highest occupancy at 82%, followed closely by New York City at 81%. Boston and Denver hotels also had a good week, averaging 79% and 75% occupancy respectively. While San Francisco was not on the top of the list, occupancy was solid at 68%.

Ten of the top 25 markets reported weekly occupancy above 65% for the week with New Orleans an outlier at 46%. However, New Orleans’ weekend occupancy did improve significantly to 72%, its highest of the past nine weeks but well below the 84% achieved during Labor Day weekend 2019.

Nominal weekend ADR increased by more than 20% in 17 U.S. hotel markets, led by New Orleans where rates were up 55% week over week. The New York City and Atlanta markets also reported strong week-over-week gains of more than 25% in nominal ADR.

At the property level, 103 hotels reported weekend nominal ADR above $1,000 — up from 29 in the 2019 Labor Day weekend. Of hotels that were open during the Labor Day weekend in 2019 and were still open this Labor Day weekend, 59% reported real weekend ADR levels above 2019.

Isaac Collazo is VP Analytics at STR.

This article represents an interpretation of data collected by CoStar’s hospitality analytics firm, STR. Please feel free to contact an editor with any questions or concerns. For more analysis of STR data, visit the data insights blog on STR.com.

Return to the Hotel News Now homepage.