Key events

Filters Beta

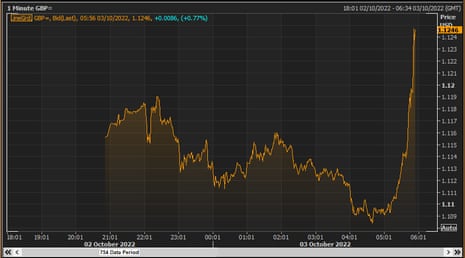

The pound jumped as UK PM Truss and Chancellor Quartet announced plans to scrap income tax for high earners in a dramatic U-turn. Kwarteng found the plan to pay 45% of income >£150,000 for activities financed by loans “disturbing”. pic.twitter.com/9hcxxL6FSz

— Holger Zeschepitz (@Schuldensuehner) October 3, 2022

Jan from courtBank Group Chief Analyst NordeaHe warns that the pound will likely remain under pressure.

From a market perspective, he said scrapping plans to increase the top tax rate to 45p was “a good step in the right direction”.

It will take time for markets to buy the message, but the pressure should ease.”

“Questions remain and sterling may remain under pressure.”

CBI: 45p tax rate U-turn is good development.

The CBI, which represents British businesses, welcomed the decision not to cut the 45p tax rate.

Tony DankerDirector General CBIHe told Radio 4’s Today program that scrapping the plan should help stabilize markets.

Danker says:

Businesses up and down the country want the market to stabilize.

That’s an absolute prerequisite for investment and growth, and it’s a prerequisite for ushering in these great improvements.

So yes, I think it’s good progress this morning.

If the markets stabilize, Danker hopes the investment climate will also stabilize.

Danker also said the 45p tax cut would be a distraction from the supply-side reforms in the government’s growth plan, which is in line with Kwasi Kwarteng.

He says it is “absolutely essential” that the “quite controversial” reforms are passed at the Conservative conference, which he believes will boost growth.

The pound has now pared all losses since the Karteng mini budget sent it to record lows a week ago.

Sterling

Quartet stopped the abolition of the top tax rate of 45p

It’s official: The UK government will not go ahead with its controversial plan to scrap the 45p top rate of tax paid by high earners.

Chancellor Kwasi Kwarteng announced the move on Twitter:

“We’re not going to scrap the 45p tax rate. We’ve got it, we’ve heard it.

Kwarteng said it was clear the plan was a ‘distraction’ from the government’s mission to address the challenges facing the UK.

By abandoning it, the government can focus on delivering the major components of the development package, he said.

He says the scrapping of the 45p top final tax rate is a ‘big deal’ for the pound Viraj Patel, Macro strategist b Wanda Research.

Kwasi Kwarteng predicts the pound will rise this week as the damage caused by the small budget remains unscathed.

My guess is that $GBPUSD It should trade around 1.13-1.14 if the overall ‘kami-quasi budget’ risk premium is unaffected. It seems reasonable that we will get there in the next few sessions… The nail in the coffin for the 45p tax cut was the pound last week. Getting this out is a big deal. pic.twitter.com/LXwfCp3PWD

— Viraj Patel (@VPatelFX) October 3, 2022

Introduction: Sterling collects on U-turn reports at a tax rate of 45p

Good morning, and welcome to our rolling coverage of business, the global economy and financial markets.

The pound rallied this morning on reports that the UK government is seriously preparing its plan to avoid a 45p top income tax.

Sterling jumped to more than $1.126 a penny – its highest level in a week – before falling to a record low of $1.035 a week later.

The recovery was triggered by reports that Chancellor Kwasi Kwarteng May. Reverse Abolition of the 45p income tax proposed 10 days after the minimum budget was announced.

The U-turn comes after strong opposition from several Tory MPs after last week’s mini-Budget, which saw Britain escalating borrowing to fund tax cuts for the wealthy, sent chaos into financial markets.

Last Friday, the ratings agency Normal and poor cIt downgraded the AA credit rating for British sovereign debt to “negative” with a “stable” rating, expecting the Prime Minister’s Leasing Trust’s tax cut plans to increase debt.

But it’s a wonderful twist; Yesterday Truss said she was absolutely committed to scrapping the 45% top tax rate.

Major U-turn at Truss and Kwarteng – smashing 45p top tax rate will not go ahead.

Markets react very positively; In half an hour after the announcement of the U-turn, the pound gained 1.17% against the dollar

— Jack Parker (@Jackparkr) October 3, 2022

Our political live blogger Andrew Sparrow Reports:

Just yesterday Liz Truss told the BBC’s Laura Kunsberg that she was committed to going ahead with the plan announced in the Budget to scrap the top tax rate of 45%. Now the government is poised to unleash it – after it became clear on the first day of the Conservative party conference that Truss would face a major backlash if she tried to force her MPs to vote.

The Sun’s political editor, Harry Cole, first broke the news of the U-Zur last night. He is co-authoring a biography of the trust, and is one of the journalists most closely associated with its administration.

🚨🚨🚨

NEW: Lease Trust set to drop 45p rate after late crisis talks with Chancellor

The humiliating relegation plan comes after a row at Broome.

The announcement that was expected in the morning was a blow to the new government

No refusal from No10 this evening https://t.co/He8qwMayou

— Harry Cole (@MrHarryCole) October 2, 2022

Andy covers all the action from the Conservative Party conference here:

He will come today.

European stock markets are set to start the new month with fresh losses as fears of a recession mount.

Earlier today, data showed that Japan’s manufacturing activity has grown at the slowest pace since early September last year.

Japanese factories have been hit by a slide in output and new orders due to weaker demand from China, the United States and other trading partners.

Joe Hayes, senior economist at S&P Global Market Intelligence, which compiled the survey, explained:

“Weakness in Japan’s manufacturing sector continued in September and turned even worse.

That’s a bad sign for global economic demand.

We also look at how factories in the UK, Eurozone and US fared last month, as fears of a global recession grew.

the agenda

-

9am BST: Eurozone manufacturing PMI report for September

-

9:30am BST: UK manufacturing PMI report for September

-

3pm BST: US manufacturing PMI report for September