Retirement plans are usually made by people who feel they can stop working at a certain age and have enough money to maintain their lifestyle. But what about those who don’t?

A number of fintech startups are solving this problem, including Retirable, which believes that retirement planning should also be easy to access, even if you don’t have millions of dollars saved up. The New York-based startup describes itself as the “first comprehensive” retirement planning approach.

Building on a 2019 study by the TransAmerica Center, only one in five employees has a written retirement strategy, the company offers similar offerings to other retirement plan companies: dedicated consulting and products and services for investing, planning and withdrawals.

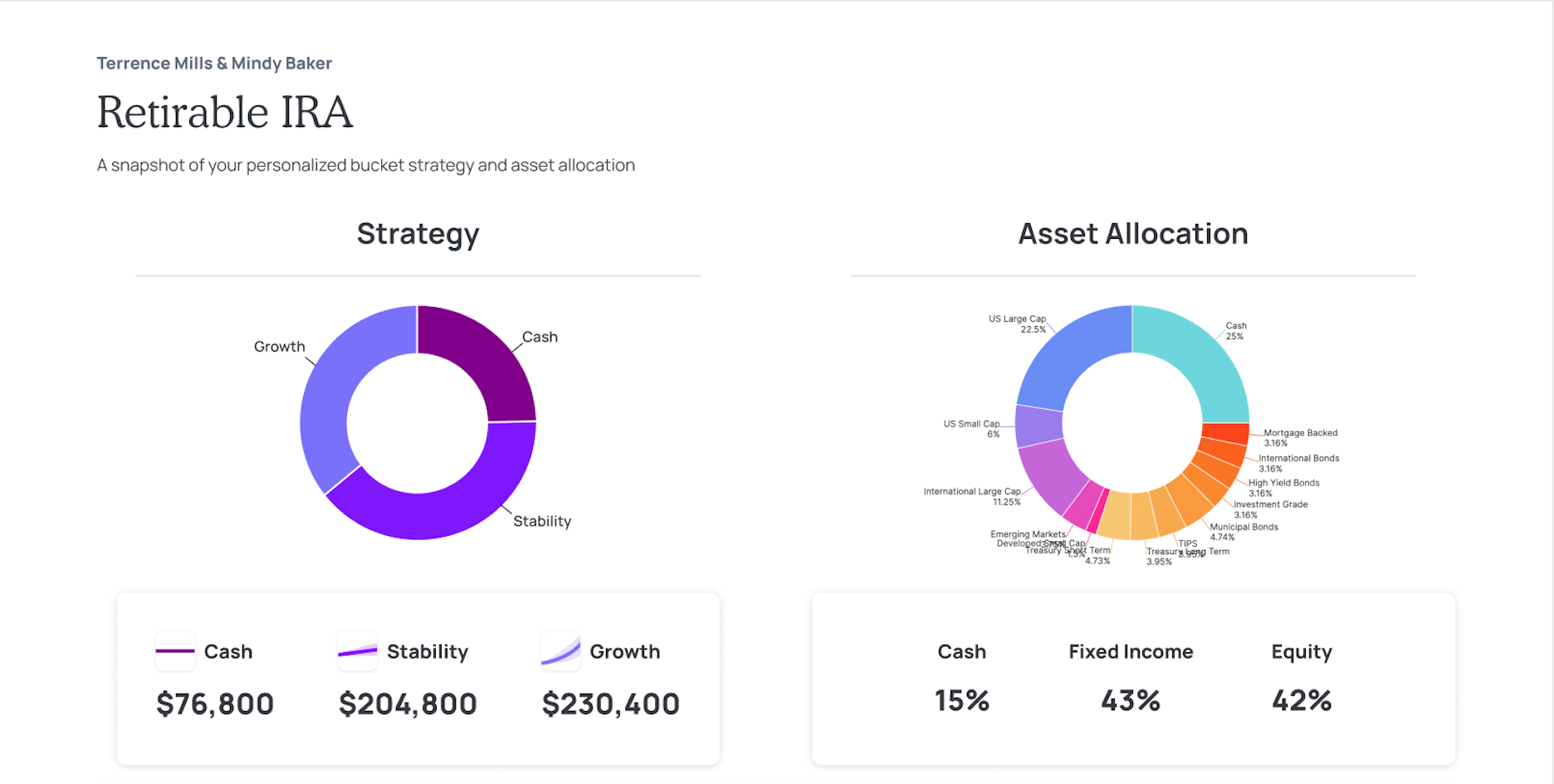

But co-founder and CEO Tyler Ende says that’s where the similarities end: Not only is it focused on low-net-worth individuals, it’s also all in on the retirement “distribution.” It does this by classifying individual assets into three buckets: cash, stability and growth. The client can see what the income is in real time and how safe it is every month. The same logic applies to investments and a debit card that puts money back into savings.

The company offers free consultations to Americans age 50 and older and charges 0.75% for the service on the first $500,000 in assets under management, and nothing after that. That translates to roughly 63 cents for every $1,000 managed, which is less than comparable consulting services.

Retirement Asset Allocation Dashboard. Image Credits: Removeable

“The big players may offer call centers to have someone help you with your account, but we’re the only one who will work with you on your plan, honest, no commissions,” he says. TechCrunch told him. “You see a lot of people start out with a mission similar to ours of helping everyone, but when people are encouraged to sell, they generally gravitate toward higher net worth.”

End founded the company in 2011. He co-founded with Ian Yami and Brian Ramirez in 2019 and created proprietary technology that has designed more than 50,000 retirement plans for retirees with 15 employees.

The company launched investment management and payroll products a month ago and started matching its clients with planners. A retiree grew his income by more than 25% per month.

Today, the company announced an additional $6 million in venture-backed seed funding for the company’s total investment of $10.7 million. The round was led by Prime and included Vestigo Ventures, Diagram, Portage and Primetime.

Finally, the new funding will be used to accelerate development of the debit card, grow its advisory team and add new distribution channels, such as working with Medicare agents, tax planners and estate planners.

“One of the interesting things about this demographic is that some people spend a lot early on,” he added. “When you’re very active in retirement, spending changes as you age. What this debit card does is to give both the user and the advisor an understanding of the amount of spending and where the money is being spent. We can then offer discounts on savings. It is a first-of-its-kind product.”