[ad_1]

Key events

Filters BETA

If key benefits are uprated by earnings instead of inflation next year – something the Government is reportedly considering as a way to cut public spending – then nine million households will face an income loss, with low-income families with children hit the hardest. pic.twitter.com/vx6gppRCIf

— Resolution Foundation (@resfoundation) October 19, 2022

Here’s a breakdown of the factors that drove UK inflation back to a 40-year high of 10.1% in September:

-

Food and non-alcoholic beverages: 14.5% – up from 13.1% a month earlier

-

Alcoholic beverages and tobacco: 5.5%

-

Clothing and footwear: 8.5%

-

Housing, water, electricity, gas and other fuels: 20.2%

-

Furniture, household equipment and maintenance: 10.7%

-

Health: 3.5%

-

Transport: 10.6%

-

Communication: 2.4%

-

Recreation and culture: 5.2%

-

Education: 4.3%

-

Restaurants and hotels: 9.7% – up from 8.7% a month earlier

-

Miscellaneous goods and services: 5.0%

Resolution: crucial to lift benefits in line with inflation

It’s crucial that the government uses September’s inflation figure to update benefits next April, rather than pulling another u-turn, the Resolution Foundation says.

Resolution says a 10.1% increase to benefits next April would help 10 million working-age families through the deepening cost-of-living crisis.

September’s inflation data is usually used to set the next year’s benefits increase – and Jack Leslie, Senior Economist at the Resolution Foundation, says households need the support:

“Surging food prices have driven a return to double-digit inflation across Britain and high inflation looks set to stay with us for some time too, with accelerating services producer price inflation and the early end of the Energy Price Guarantee likely to put upward pressure on consumer prices next year.

“This bleak outlook means that family incomes will continue to fall sharply again next year, especially as support with energy bills is withdrawn.

“That is the context of debates within Government about whether previous commitments to uprate benefits or pensions in line with prices should be the next U-turn to be announced. While the significant Treasury savings may look tempting in the context of its attempts to fill its fiscal hole, the cost to ten million working age families and almost every pensioner would be huge amid the deepest cost of living crisis for half a century.”

How much would the Treasury save if it uprated benefits by earnings rather than prices next year?

– £6.2bn if applied to State Pension and Pension Credit

– £5.2bn working-age benefits

– £3bn unprotected working-age

The cost? A significant income cut amidst a cost-of-living crisis— Resolution Foundation (@resfoundation) October 18, 2022

The RPI measure of inflation has risen to its highest level in four decades too.

The Retail Price Index jumped to 12.6% in the year to September, up from 12.3% in August.

Although the RPI is no longer a ‘national statistic’, it is still used in wage bargaining, and to uprate some maintenance payments and housing rents.

Unite general secretary Sharon Graham says:

“With RPI now up to 12.6%, workers and communities must not pay for a crisis they did not create.

“We will not stand by and watch the country take a pay cut while corporations profit and the government pours petrol on the fire.”

“With RPI now up to 12.6%, workers & communities must not pay for a crisis they did not create.

“We will not stand by & watch the country take a pay cut while corporations profit & the government pours petrol on the fire.” @UniteSharon https://t.co/2RD2eUUrxP— Unite the union: join a union (@unitetheunion) October 19, 2022

UK businesses are still facing historically high cost increases, although falling crude oil prices have helped ease inflationary pressures.

The cost of inputs, such as raw materials, rose by 20.0% in the year to September, down from 20.9% a month ago.

The costs charged ‘at the factory gate’ also eased – output inflation rose by 15.9% over the last year, down from 16.4% in the year to August.

In the year to Sept 2022:

▪️ cost of raw materials rose 20.0%, down from 20.9% in the year to Aug – the third consecutive time we’ve seen a slowing in the annual rate

▪️ cost of goods leaving factories rose 15.9%, down from 16.4% in the year to Aug➡️ https://t.co/bXni08fmaW pic.twitter.com/qPXa6IrWip

— Office for National Statistics (ONS) (@ONS) October 19, 2022

Shadow chancellor Rachel Reeves says:

“Inflation figures this morning will bring more anxiety to families worried about the Tories’ lack of grip on an economic crisis of their own making.

“It’s clear that the damage has been done. This is a Tory crisis, made in Downing Street and paid for by working people.

“The facts speak for themselves: mortgage costs are soaring, borrowing costs are up, living standards down and we are forecast to have the lowest growth in the G7 over the next two years.

“What we need now is to restore financial credibility and a serious plan for growth that puts working people first. That is what Labour will bring.”

Hunt: we’ll prioritise “help for most vulnerable”

Chancellor Jeremy Hunt has said the government will prioritise help for the most vulnerable, after inflation rose to 10.1%.

In a statement, Hunt says:

I understand that families across the country are struggling with rising prices and higher energy bills.

“This Government will prioritise help for the most vulnerable while delivering wider economic stability and driving long-term growth that will help everyone.

“We have acted decisively to protect households and businesses from significant rises in their energy bills this winter, with the Government’s energy price guarantee holding down peak inflation.”

However, Hunt has just limited the goverment’s energy price freeze to just six months, from two years. That means average annual energy bills could rise to more than £4,000 from April.

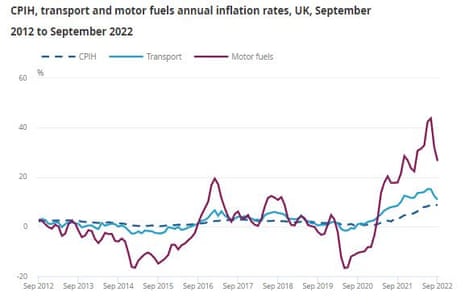

After soaring earlier this year, petrol and diesel prices dropped in September.

Petrol prices fell by 8.7 pence per litre on average on the month to 166.5p, while diesel prices fell by 5.0p to 181.6p per litre.

That’s still around 25% higher than a year ago, but a slowdown on August when fuel inflation was 32.1%.

However, motoring groups have reported that fuel prices are climbing again this month:

Here’s ONS director of economic statistics Darren Morgan explaining the rise in inflation:

“After last month’s small fall, headline inflation returned to its high seen earlier in the summer.

The rise was driven by further increases across food, which saw its largest annual rise in over 40 years, while hotel prices also increased after falling this time last year.

“These rises were partially offset by continuing falls in the costs of petrol, with airline prices falling by more than usual for this time of year and second-hand car prices also rising less steeply than the large increases seen last year.

Inflation: the key charts

This chart shows how consumer price inflation has surged dramatically over the last 18 months – from just 0.7% in March 2021.

Electricity, gas and other fuels, food and non-alcoholic beverages, and transport, have been the biggest factors pushing up inflation:

Food inflation hits 42-year high

Food and drink price inflation has hit its highest level since April 1980.

Food and non-alcoholic beverage prices rose by 14.5% over the last year, up from 13.1% in August.

Food inflation has now risen for the last 14 months, up from negative 0.6% in July 2021.

The largest upward effects came from bread and cereals, meat products, and milk, cheese and eggs in September.

NEW:

Rate of inflation back up to 10.1% in September on target Consumer Prices Index measure… 5 times target.

Normally used as basis for uprating rises in pensions under triple lock, and benefits and tax credits, for April, but that is unclear right now. pic.twitter.com/nESDdkHAgI

— Faisal Islam (@faisalislam) October 19, 2022

Inflation was driven up by the surge in gas and electricity bills over the last year, and the jump in food and drink costs.

The ONS says:

The largest contribution to the annual rate in September 2022 is from housing and household services. The second largest contribution came from food and non-alcoholic beverages, which has overtaken that from transport.

UK inflation jumps back to 10.1%

Newsflash: Inflation in the UK has risen to 10.1% as the cost of living crisis continued to hit households.

That matches July’s 40-year high.

Here’s Paul Kelso of Sky News on the implications of today’s inflation report:

At 0700 latest inflation figure from @ONS. September CPI forecast to nudge up from 9.9%, anything above 10.1% is a 40-year high. And whatever it is it matters because September CPI is the figure on which future benefit & pension payments are based, both now in doubt @SkyNews

— Paul Kelso (@pkelso) October 19, 2022

One in 7 Britons skipping meals in cost of living crisis, says TUC

Rowena Mason

One in seven people in the UK are skipping meals or going without food, according to new polling data released by the Trades Union Congress (TUC).

The data from an MRP poll by Opinium reveals that more than half of British people are cutting back on heating, hot water and electricity in the cost of living squeeze, and one in 12 have missed the payment of a household bill.

The polling found that one in seven people are skipping meals but that rises to one in five people in nearly 50 constituencies across the country.

It reveals that Birmingham Ladywood is the constituency with the highest number of people going without food, at 29%, followed by Dundee West at 27%, Glasgow at 24% and Rhondda at 24%.

Here’s the full story:

Introduction: UK inflation expected to remain painfully high

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

The scale of Britain’s cost of living crisis will be exposed again today when September’s inflation report is released, at 7am.

Economists predict that consumer prices rose by a painful 10% over the last year. That would push inflation back into double-digit levels, having dipped slightly to 9.9% in August.

Soaring food prices and the energy crisis have been squeezing household budgets all year, with inflation running sharply ahead of wage growth. Back in July, inflation hit 10.1% for the first time in 40 years.

Michael Hewson of CMC Markets explains:

UK inflation got a bit of a respite in August falling back to 9.9% from 10.1% in July, with the fall in petrol prices helping to pull the headline number back below double figures.

While welcome news on a headline level, food prices are still acting as a tailwind rising by 13.1% and up from 12.7% in July, with the price of staples like milk, eggs, and butter all up by over 20%. These increases are expected to filter into September with a move back above 10%.

September inflation figure has implications for pensioners and those on benefits, as it’s used in the Work and Pensions Secretary’s annual benefits uprating review.

If the government decides to uprate benefits by inflation, this is the percentage they will be increased by, and will come into effect from next April.

But yesterday, Liz Truss’s official spokesperson refused four times to commit to keeping the state pension triple lock, under which pensions would rise by the highest of average earnings, CPI inflation based on September’s rate, or 2.5%.

Today’s inflation rate will also be a big factor in how sharply the Bank of England raises interest rates next month. The money markets currently suggest the Bank is likely to lift base rate by a full percentage point, from 2.25% to 3.25%.

Last night, the Bank confirmed it will push ahead with selling £80bn of UK government bonds from the start of next month, a day later than planned, despite fears over choppy conditions in financial markets after the mini-budget.

The agenda

-

7am BST: UK consumer inflation report for September

-

7am BST: UK producer price index of factory inflation for September

-

9.30am BST: UK house price index for August

-

10am BST: Eurozone inflation report for September

-

Noon BST: US weekly mortgage applications

-

3pm BST: Treasury Committee questions Bank of England deputy governor Sir Jon Cunliffe

[ad_2]

Source link