SoftBank Group’s investment vehicles posted losses of nearly $6 billion at the end of December as the Japanese technology investor continued to bleed through the market’s decline and backed new deals heavily.

It was the fourth straight quarter that SoftBank Group lost money, prompting many to challenge the giant’s fundamentals, which have deployed more capital in technology markets than anyone else in the past decade.

SoftBank said it lost $5.8 billion in the quarter on its Vision Fund and Latin America Fund. While the $5.8 billion loss is nothing to write home about, SoftBank can take comfort in the fact that it lost $10 billion last quarter.

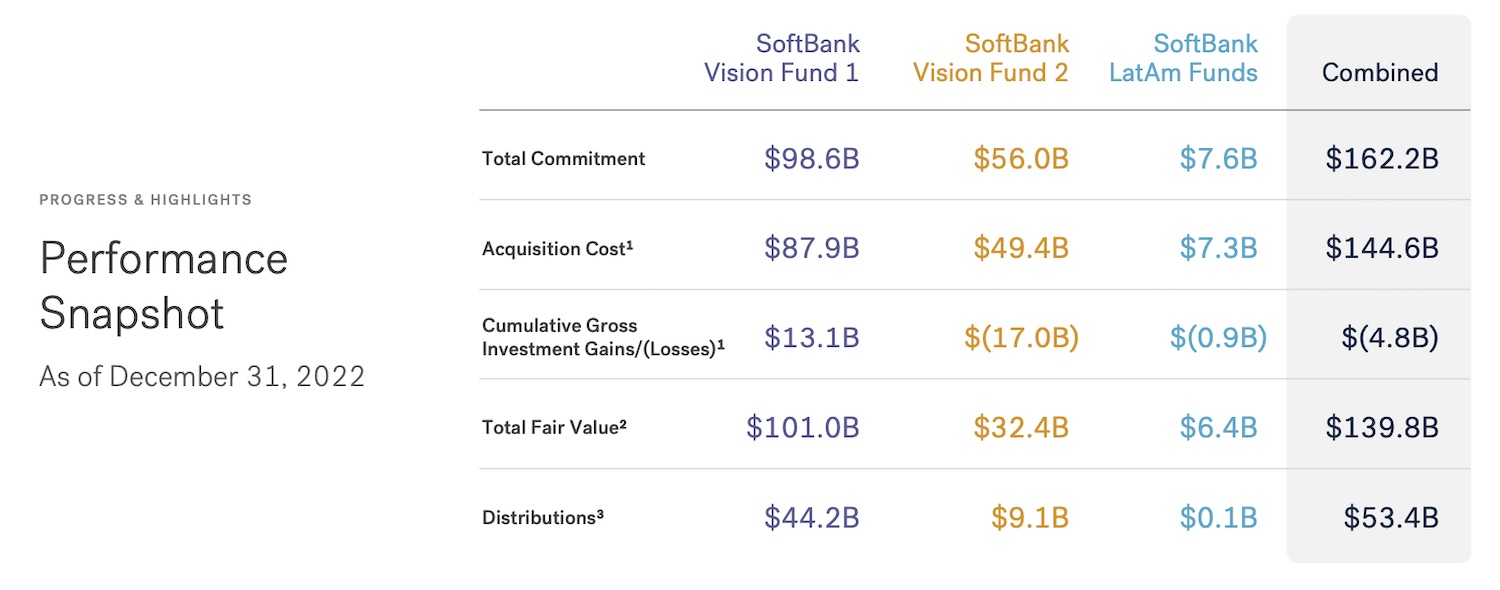

The company said the fair value of its current deferred portfolio is more than $37 billion.

In the year In 2021, SoftBank was one of the most successful investors globally, cutting more than $20 billion worth of checks in a single quarter as more investors scrambled to win big deals. When the market turned around early last year, many fans had to adjust their strategies drastically.

Softbank’s Vision Fund invested $300 million each in Q2 and Q3, he said. He said that 49% of all investments are in startups now earning more than $1 billion. Softbank-backed startups By 2022, it has raised more than $16 billion, the organization said.

Image credits: SoftBank Group

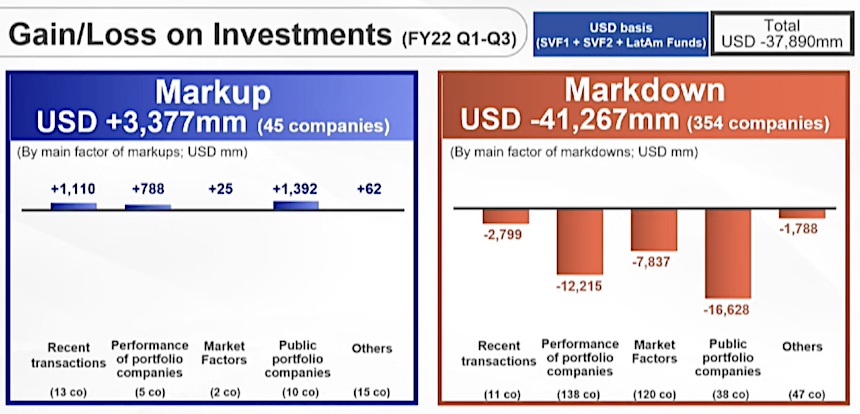

While the financial health of SoftBank’s private investments is unclear, how it has performed in the public markets is clear — and not well.

In total, SoftBank’s Vision Fund 1 has $19.9 billion in equity in publicly listed companies, compared to $31.4 billion invested by the giant. In Vision Fund 2, SoftBank invested $48.3 billion in companies and is currently seeing a loss of $17.6 billion.

While SoftBank shares gained $4.2 billion in Coupang, the Japanese company lost more than $9 billion in DD and $5.1 billion in WeWork.

On Tuesday’s earnings call, SoftBank said it was in “defensive mode” and was preparing for three different scenarios. The company estimates that the market could begin to recover this year or the second half of this year, or be disrupted until early 2024.

SoftBank has tried to bring more discipline to its portfolio companies over the past year as fundraising has become more difficult. Masayoshi Son, founder and CEO of SoftBank Group, warned that the funding winter for start-ups could drag on as some unicorn founders refuse to accept lower rates in new funding talks. Son skipped the earnings call on Tuesday.

SoftBank says it is taking a “cautious approach” to investing in the blockchain and crypto sector. He has made 26 investments in the category so far, with a current fair value of $1 billion. The company has divested its $97 million investment in collapsed cryptocurrency exchange FTX.

SoftBank said the company has a “high degree of guilt” in AI.