[ad_1]

Tiger Global believes India will generate the highest return on equity globally going forward, partner Scott Shleifer said in an investor call on Tuesday, though the investment giant has made more money in China and the US and acknowledged the locale. The startup ecosystem is struggling with management and unit economics challenges.

“We think it’s going to be a very good place to invest,” said India’s Shleifer. “In 2010, we were able to buy 16 or 17% of Flipkart for $8 million,” he said of the investment in the e-commerce giant, which is currently valued at more than $36 billion. “We were able to buy 10% of Inframarket for $8 million. We bought a third of Upstox for $50 million.

Tiger Global is one of the most successful investors in India and backs more than one-third of the unicorn startups in the country. The New York-headquartered firm, which counts India among its top three markets globally, has invested more than $6.5 billion in India since its inception, TechCrunch reported last year.

India has attracted more than $75 billion in investment over the past decade from tech giants like Google, Meta, Microsoft and Amazon and investors including Sequoia, Tiger Global, Accel and Lightspeed. But the country’s burgeoning startup ecosystem has seen very few exits, with several consumer internet startups listed in the past two years trading well below their valuations.

Shleifer admits that his return to India has been nothing to write home about so far.

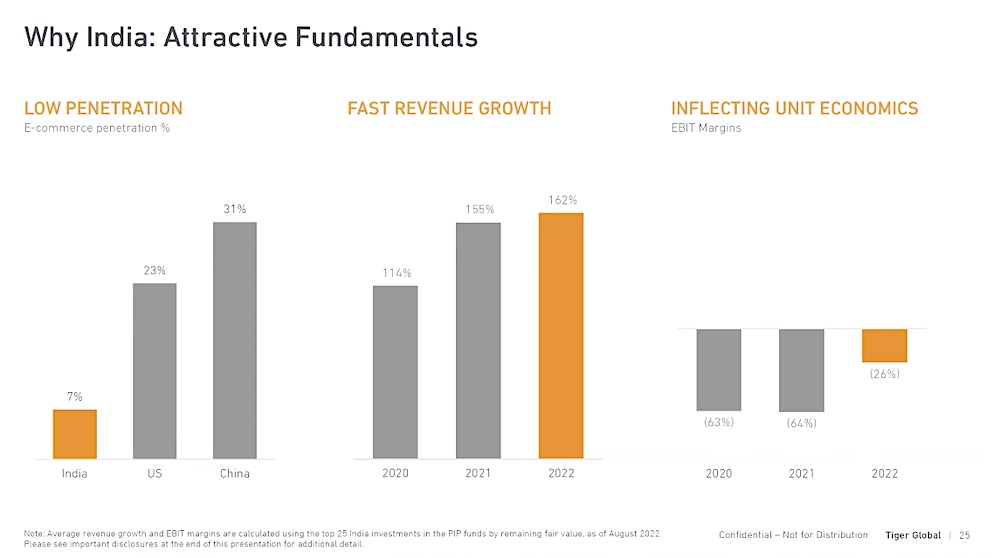

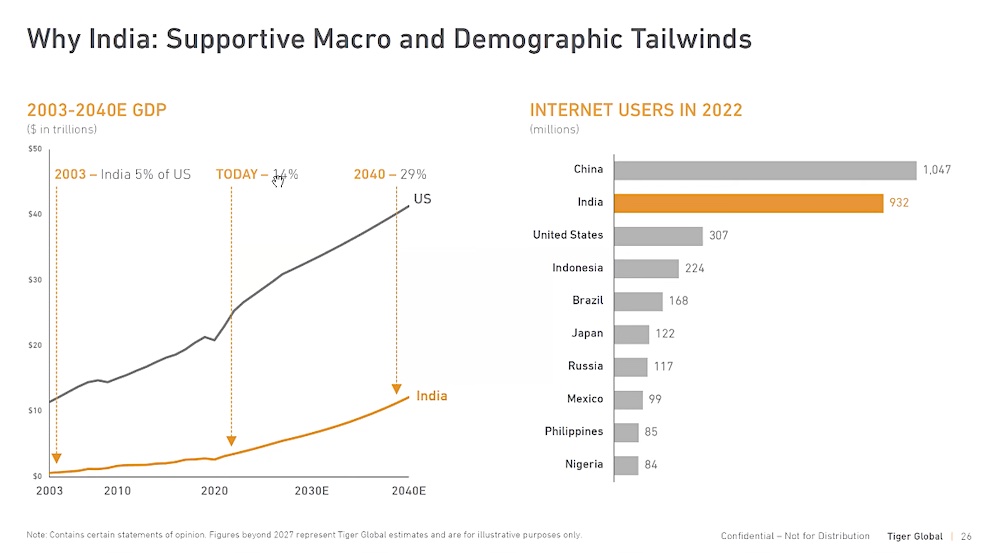

“Returns on capital in India have historically been low. If you look at the market leading internet companies like Google, Facebook, Alibaba and Tencent, their earnings exceeded their value a decade ago. Over the last 17-18 years, you’ve had a huge legacy of materially profitable internet companies. Therefore, the return on equity in the Internet is very high and it has also resulted in high profits for investors. But that has not happened in India,” he said on the call, which was also attended by Navroz Udwadia, co-founder and partner, Alpha Wave Global, and around 200 entrepreneurs, investors and bankers.

Until the last two or three years, India had almost zero profitable Internet startups, Shleifer said, even as banks and firms in other industries proliferated. “As a result, the return on capital for investors like us was below average…below. Our returns in India have been something like 20% gross since inception. This compares to the mid-30s on the private side in the United States and the low 50s in China. But that is in the past,” he said.

Shleifer sympathizes with India’s poor returnees, arguing that the country cannot deliver a ton with its $3 trillion economy. We have seen the increase in profit margins at market leaders is impressive. So this big concern is to have a great country that gets a share of the GDP, but we think the chances of that falling off the cliff, not just the profit pools that can have a sustainable competitive advantage.

Historically low returns in India allowed the country to weather the recession better than the US, he said.

Slides from Tiger Global’s presentation:

This is a developing story. More to follow.

[ad_2]

Source link