Has a venture fundraiser. Continued at a strong pace, but with much less money being invested.

Let’s start with a few topics:

- In September, Bessemer raised about $3.85 billion for an early-stage startup, the largest vehicle in the company’s 50-year history.

- Insight Partners raised more than $20.0 billion in February, double its previous fund (which closed at $9.5 billion in April 2020).

- Lightspeed raised more than $7 billion in four funds for seed Series B rounds in July.

- Battery Ventures raised more than $3.8 billion in July.

- Founders Fund raised more than $5 billion in venture ($1.9 billion) and growth ($3.4 billion) funding in March.

- In May, a16z raised about $4.5 billion in its fourth fund targeting blockchain, bringing the total amount raised for blockchain-related companies to more than $7.6 billion.

- a16z closed $9 billion in new capital in January, with $1.5 billion earmarked for biotech investments.

- Tiger Global is said to be raising PIIP 16, a vehicle worth around $10 billion and the second largest fund.

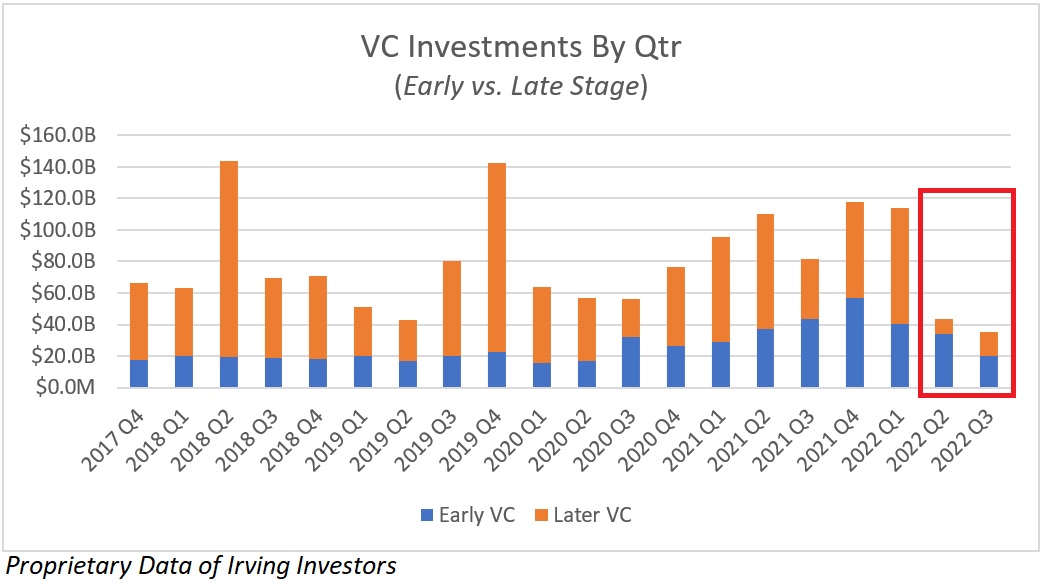

Public markets have seen tremendous price adjustment, and it is effectively trickling down to private markets. All the while, hedge funds and VCs have been watching from the sidelines – capital deployments have been in somewhat of a “wait and see” mode.

The Net/Net: The more dollars collected during the less time spent, the higher the cash balance materially.

Image Credits: Irving Investors

What does the number tell us?

Capital raising

Venture capital fundraising has remained somewhat steady this year. VC firms raised a total of $122 billion this year, and are on pace to end the year with $172 billion.

“Working around” a short-term assessment can be a huge long-term problem.

This is 20% less than in 2021 ($214 billion), a touch below 2020 ($180 billion) and 11% less than the average of $194 billion raised annually from 2019.

This strong level of fundraising is in stark contrast to the poor performance of high-growth names in the public markets. For example, our high-growth SaaS bucket experienced losses of 60% to 80% or more.

Image Credits:

Capital expansion

In Q2 2022 and Q3 2022, total capital deployed by VCs declined rapidly and now averages $39 billion per quarter. This is on track to be the lowest reading since we can pull the data from 2017.

Currently, capital employed in Q3 2022 (less than $40 billion) is on pace to be about 70% below Q4 2021 levels (about $118 billion).